Comments from the SNB policymaker Declines to comment on further interest rate moves We see a weakening in the Swiss economy but no recession Acting now to make sure inflation doesn’t become entrenched Recent rise in franc helped dampen inflation The SNB is expected to rise 50 or 75 bps at the next meeting. [embedded content]...

Read More »Swiss Balance of Payments and International Investment Position: Q2 2022

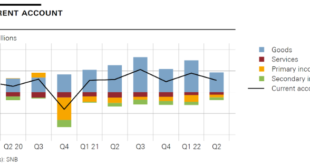

Overview In the second quarter of 2022, the current account surplus was CHF 11 billion, almost CHF 1 billion lower than in the same quarter of 2021. The receipts surplus in goods trade, especially merchanting and traditional goods trade (foreign trade total 1), declined. The expenses surpluses in services trade, primary income and secondary income were each lower than in the same quarter of 2021. . In the financial account, reported transactions recorded a net...

Read More »Thomas Jordan: Sixth Karl Brunner Distinguished Lecture – Introduction of Benjamin M. Friedman

Ladies and Gentlemen I am very pleased to welcome you all to the sixth Karl Brunner Distinguished Lecture. The Swiss National Bank established this annual lecture series in honour of the Swiss economist Karl Brunner, one of the leading monetary economists of the last century. Our aim with these lectures is to reach a broad audience, and to contribute to the public debate on issues related to central banking and economics more broadly. This year’s Karl Brunner...

Read More »+++Märkte+++ – Börsen-Ticker: Schweizer Aktienmarkt sinkt – 13 anstehende Zinsentscheide machen Anleger nervös – Bitcoin auf Drei-Monate-Tief

11:40 Der SMI notiert um 0,53 Prozent tiefer bei 10’554,85 Punkten. Laut Ansicht von BNP Paribas hat sich das Chartbild weiter eingetrübt. Bis zum Korrekturtief vom Juni bei 10’350 Punkten stelle sich nur noch das Zwischentief vom März 2021 bei 10’513 Punkten in den Weg. In der vergangenen Woche hatte der SMI mit rund 2,7 Prozent so viel verloren wie seit rund drei Monaten nicht. Die Marktteilnehmer verhielten sich vor den mit Spannung erwarteten Zinsentscheidungen...

Read More »Thomas Jordan: Carl Menger Award Ceremony 2022: Introductory remarks on Ricardo Reis

Ladies and Gentlemen I welcome you all to the ceremony of the Carl Menger Award, given by the Verein für Socialpolitik. I do so in the name of the sponsors of the award, namely the Deutsche Bundesbank, the Oesterreichische Nationalbank and the Swiss National Bank, as well as on behalf of the selection committee. This important award is given in recognition of outstanding research work relating to monetary economics and monetary policy. The city selected as the venue...

Read More »BOC’s Rogers: We are not where we were in July, but a long way from where we need to be

Bank of Canada’s Senior Deputy Gov. Carolyn Rogers: We are not where we were in July, but we are a long way from where we need to be Bank has seen early signs monetary policy is working the bank still sees a path to a stop to soft landing, that’s still our objective neutral territory is a range, it’s an estimate, there is no magic formula There has been a lot of central banks speak from the Swiss National Bank to the Federal Reserve to the ECB, and now additional...

Read More »SNB-Chef Jordan begrüsst Zinsschritt der EZB

SNB-Präsident Thomas Jordan: Der Schritt der EZB war wichtig. (Bild: PD)Die Forward Guidance – die Leitlinien für die zukünftige Geldpolitik, auf welche die US-Notenbank und die Europäische Zentralbank achten, um die Finanzmärkte auf ihre Entscheide vorzubereiten und dem ihnen einen Schock zu ersparen – ist für die Schweizerische Nationalbank unbedeutend. Man sei sehr zurückhaltend mit Ankündigungen betreffend einem Zinsentscheid. Damit wäre die Diskussion an der...

Read More »More from SNB’s Jordan: No comment on currency invention. We don’t rule anything out

Looks at series of models to gauge Swiss francs value; market has to live with some volatility no comment on currency intervention. We don’t rule anything out monetary policy cannot influence explosion and prices in case of a severe shortage the longer inflation last, the greater the risk of a 2nd round of facts having a negative impact central banks need to watch out that fiscal policy does not dictate monetary policy Meanwhile SNB’s Maechler is now joining in...

Read More »Börse – Zinsen, Dividenden, Wachstum: Diese Schweizer Bank-Aktien ziehen starkes Interesse auf sich

Als Dividendenzahlerin weiterhin beliebt: Die Waadtländer Kantonalbank. Die beste Jahresperformance der Schweizer Banken hat die Waadtländer Kantonalbank. Vor allem hohe Dividendenrenditen machen auch andere Schweizer Banken interessant – solange man bereit ist, auch Risiken zu tragen. Die Chefs von Schweizer Banken dürften am 16. Juni aufgeatmet haben. Was auch immer über die Pros und Cons von Zinserhöhungen gesagt wird, der Zinsschritt der Schweizerischen...

Read More »Swiss National Bank President Jordan warned of persistently higher inflationary pressure

Swiss National Bank President Thomas Jordan spoke at the Federal Reserve’s annual Jackson Hole symposium on Saturday. “Structural factors such as the transition to a greener economy, rising sovereign debt worldwide, the demographic transition and ultimately also the fact that globalization appears to have peaked — at least temporarily — could lead to persistently higher inflationary pressure in the coming years” “There are signs that inflation is increasingly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org