Scottsdale, AZ – September 3, 2024 – Monetary Metals® is proud to announce that it has achieved SOC 2 certification. This significant milestone demonstrates the company’s unwavering commitment to maintaining a secure environment for its innovative Gold Yield Marketplace® platform.

SOC 2 (Service Organization Control 2) certification is governed by the American Institute of CPAs (AICPA). Its rigorous framework assesses how well a company manages and protects customer data based on five Trust Service Criteria: Security, Availability, Processing Integrity, Confidentiality, and Privacy.

This certification underscores Monetary Metals’ dedication to safeguarding client information.

Jeffrey Crane, Director of Operations at Monetary Metals, talked about the significance:

Articles by Monetary Metals

Bryan Caplan: Why Housing Costs DOUBLED

June 11, 2024Best-selling author and economist Bryan Caplan joins the podcast to discuss why housing prices continue to rise, what we can do about it, and why everyone seems to hate markets.

Follow Bryan on Twitter @Bryan_Caplan

Connect with Monetary Metals on Twitter: @Monetary_Metals

[embedded content]

Additional Resources

Books by Bryan Caplan

Bryan Caplan’s Substack: Bet on It

Earn Passive Income in Gold

Gold Bonds to Avert Financial Armageddon

Arthur Jensen Book

Podcast Chapters

00:00:00 – Bryan Caplan

00:00:17 – Monetary Metals

00:00:43 – Build, Baby, Build!

00:01:23 – Housing deregulation

00:04:00 – Common objections

00:09:03 – Why people hate developers

00:17:36 – Investing in real estate

00:31:00 – The fiscal impact of open borders

00:38:58 – The Ideological

Is gold an inflation hedge?

April 12, 2024Jeff Deist and Ben Nadelstein discuss narratives surrounding the merits of gold ownership. Is gold an inflation hedge, store of value, or a safe haven asset? The episode ends with questions regarding gold’s monetary premium and the different types of inflation.

Connect with Jeff and Monetary Metals on X: @JeffDeist @Monetary_Metals

[embedded content]

Additional Resources

Start Earning Interest on Gold

The Case for Gold Yield in an Investment Portfolio

How NOT to Think About Gold

Podcast Chapters

00:00 – Gold’s changing landscape

03:01 – Decoupling from traditional metrics

05:35 – Impact of interest rates on gold

08:45 – Safe haven vs. inflation hedge

11:01 – Long-term trends in safe haven assets

14:14 – Dollar weakness

16:30 – Gold’s financial role

17:42 –

Gold Outlook 2024 Brief

March 12, 2024This is a brief preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market dynamics and drivers and finally, give our predictions for gold and silver prices over the coming year.

Click here to download a free copy of the full Gold Outlook Report 2024.

The talking heads are talking about recession, unemployment, and inflation. The same as they’ve always done, though now perhaps with a bit more urgency. Most people have a sense that hiking the Fed Funds Rate from 0 to 5% in 18 months has to have some consequences. The last time the Federal Reserve hiked like this—June 2004—it led to the global financial crisis in 2008. Then they hiked by one percentage point less, and they stretched it over 25 months.

But the problem is that

Monetary Metals Publishes Eighth Annual Gold Outlook Report

March 12, 2024Scottsdale, AZ – March 12, 2024 Monetary Metals has released its eighth annual Gold Outlook Report. The report features Monetary Metals’ award-winning economic analysis and their price forecasts for gold and silver in 2024.

The report makes a case against the mainstream notion that inflation continues to be the primary driver of the Federal Reserve’s interest rate policy. Instead, they provide mechanical analysis supported by decades of data that suggest the Federal Reserve must cut rates eventually. The only question is “when,” not “if.”

You can download a free copy of the Gold Outlook report here.

A central theme of the research revolves around the likely impact of interest rate cuts on precious metals prices. The report includes price forecasts for both

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

January 24, 2023Jeff Snider, Headmaster of Eurodollar University, joins the podcast to talk about the perverse complexities of the Eurodollar system. What even is a Eurodollar? Why was the system created?

Keith and Jeff discuss the Eurodollar market and then give their hot takes in a hilarious lightning round. We hope you enjoy this insightful, whirlwind of an episode!

Follow Jeff on Twitter and his website.

Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner @Monetary_Metals

[embedded content]

Additional Resources

Eurodollar University

BIS 80 Trillion Eurdollar Crisis

Why Can’t We All Just Net Along

Theory of Interest and Prices

The Myth of Paul Volcker

Heat Death of the Economic Universe

Podcast Chapters

00:00–00:41 Intro

00:41–01:21 Jeff Snider

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

December 17, 2022Bryan Caplan, Professor of Economics at George Mason University, joins the podcast to talk about his latest book, the minimum wage, betting, and much more! Is nature or nurture more important? Why should a Keynesian be against the minimum wage? What is the trillion dollar tab waiting for us to pick up? Watch this whirlwind episode, and let us know what you think in the comments!

Follow Bryan on Twitter and his Substack.

Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner @Monetary_Metals

[embedded content]

Additional Resources

Don’t Be a Feminist

Selfish Reasons To Have More Kids

The Case Against Education

Peter Singer Debate

The Problem of Political Authority

Labor Econ vs the World

Economics in One Lesson

Capitalism: The Unknown Ideal

The

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

December 6, 2022Is the dollar heading to new heights or new lows? Brent Johnson of Santiago Capital joins the Gold Exchange Podcast LIVE in New Orleans! Listen to Brent discuss the historic rise of the DXY, the effects on (d)emerging markets, and how he sees a currency and sovereign debt crisis playing out. Will Powell be able to solve Triffin’s Dilemma? Can foreign central banks escape the zugzwang position? Will the financial justice warriors finally be vindicated? Watch the full episode to find out!

Connect with Brent on Twitter and his website.

Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner @Monetary_Metals

[embedded content]

Additional Resources

Brent’s Speech on Being a Financial Psycho

Fed Zugzwang Position

The UK Pension System

The Dollar

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

November 18, 2022Scottsdale, AZ–Nov 15, 2022 Monetary Metals is pleased to announce it has closed a Gold Bond for Akobo Minerals AB (AKOBO.OL), a publicly traded company, headquartered in Oslo, Norway. The term of the bond is two years, and investors are earning an annual interest rate of 19% on gold, paid in gold.

The proceeds will be used to develop the mine entrance to Akobo’s Segele gold deposit, in addition to building and installing a processing plant on site.

The bond was oversubscribed, with high net-worth investors from the US and abroad leading the charge.

“There is strong and growing demand for ‘inflation-proof’ investments. Our clients can earn an attractive yield in gold, which is impervious to currency debasement,” said Keith Weiner, the Founder and CEO of Monetary

Sam Bankman-Fried FTX’ed Up

November 17, 2022You can listen to the audio version of this article here.

Last week the cryptocurrency exchange FTX, which was recently valued at $32 billion, imploded.

While the tragedy continues to play out, let’s summarize what has happened so far:

FTX is a cryptocurrency exchange, co-founded by Sam “SBF” Bankman-Fried. FTX enables customers to make leveraged bets (as high as 20 to 1) on cryptocurrencies.

More often than not, it takes loans to make loans. FTX would make these loans to customers with borrowed money from various counterparties, one of them was a sister company, Alameda Research, which was purportedly created for the purpose of “arbitrage and market making” activities.

When you lend money out, you want to have good collateral. The best collateral is cash (USD),

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

October 28, 2022In this latest installment of our Zombie Month series, we welcome Daniel Lacalle onto the Gold Exchange Podcast. Daniel is an economist, fund manager and professor of Global Economics. Daniel discusses the recent fallout in the UK, the pressures building up in the global economy, and the central banks’ creation of zombie firms. Listen to Ben, Keith and Daniel get into everything from quantitative easing to zombie slaying.

Connect with Daniel on twitter @dlacalle and on his website

Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner @Monetary_Metals

[embedded content]

Additional Resources

Zombie Research

How to Make and Break A Pension in 22 Easy Steps

Earn Interest on Gold and Silver

Pension Fund Time Bomb

How To Make and Break A Pension

How to Build and Destroy a Pension Fund System in 22 Easy Steps

October 26, 2022CEO of Monetary Metals Keith Weiner gave a talk at the New Orleans Investment Conference on how to build and destroy a pension fund system in 22 easy steps. If you’d like to see an excellent case study of these steps in action, see the United Kingdom. This is a summary of Keith’s talk published with his permission.

Our interest rate system is like a wrecking ball. It swings to one side of the street and destroys one side of town (the falling interest rate). Then when it swings to the other side of the street, it destroys the other side of town (the rising interest rate), without repairing any of the infrastructure it previously destroyed.

With that as background, let’s go through How to Build and Destroy a Pension Fund System in 22 Easy Steps:

Step 1: Divine the

Read More »Ep 40 – Dan Oliver Jr: Markets Will Force the Fed to Balance

September 8, 2022Dan Oliver of Myrmikan Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the history of credit bubbles, the inevitability of central bank failings, and what history can tell us about the Fed’s current trajectory.

Connect with Dan on Twitter: @Myrmikan and at Myrmikan.com

Connect with Keith Weiner and Monetary Metals on Twitter:

@RealKeithWeiner@Monetary_Metals

[embedded content]

Additional Resources

CMRE.org

Myrmikan.com

Gold Backwardation

Swiss GDP article

Laffer Maxima

Penny in the Fusebox Forbes

Podcast Chapters

00:00–02:00 Intro

02:00–08:38 Modernity vs Antiquity

08:38–13:38 Dan Oliver Jr.

13:38–22:10 Tulip Mania and the Bank of Amsterdam

22:10–36:44 End Game of Central Banks and Gold Backwardation

36:44–41:46 Economics Trumps

Keith Weiner on the VoiceAmerica Business Channel

September 7, 2022CEO Keith Weiner returns to popular radio show Turning Hard Times into Good Times hosted by Jay Taylor. Jay argues that the U.S. government hates gold because its rising price shines the light on the destruction of the dollar caused by the Federal Reserve’s printing press used to finance massive government deficits.

The detractors of gold have long suggested that owning gold doesn’t make sense because it doesn’t pay interest. Keith and Jay discuss why critics can’t say that any longer because Monetary Metals now pays interest rates to small and large investors alike at rates that compete with U.S. Treasury rates. With interest paid in gold, not increasingly worthless dollars, a Gold Fixed Income now competes with dollar fixed income returns.

Keith explains

Read More »Ep 38 – Jp Cortez: Fighting for Sound Money

August 10, 2022Jp Cortez of the Sound Money Defense League joins Keith and Ben on the Gold Exchange Podcast to talk about problems with central planning, the morality of sound money, which states are topping the Sound Money Index and why, and what you can do to support grass roots initiatives in the fight for sound money.

To connect with Jp and the Sound Money Defense League click here.

Connect with Jp on Twitter: @JpCortez27

Connect with Keith Weiner and Monetary Metals on Twitter:

@RealKeithWeiner@Monetary_Metals

[embedded content]

Additional Resources

Mises Theory of Money and Credit

Stephanie Kelton and the People’s Economy

Gold Bonds

Zombie Ship of Theseus

The Sound Money Index

James Blanchard III

Soho Forum Debate

Podcast Chapters

00:00-01:03 Intro

01:03-1:57 Jp Cortez and

Soho Forum Debate: Gold vs Bitcoin

July 19, 2022The Soho Forum is a monthly debate series held in Soho/Noho, Manhattan. A project of the Reason Foundation, the series features topics of special interest to libertarians and aims to enhance social and professional ties within the NYC libertarian community.

Moderated by Gene Epstein, former economics editor of Barron’s, The Soho Forum features some of the most highly regarded speakers across varied fields. At each event, the audience actively engages with the speakers, votes on the resolution, and there is a social reception that follows.

After hosting a debate up north at PorcFest in New Hampshire, the Soho Forum is headed down south — to Auburn, Alabama.

On Tuesday, July 26, 7:00 PM ET at the Mises Institute in Auburn, Alabama, Soho Forum Director Gene

Read More »Unit of Account and Current Valuations by Paul Belanger

June 27, 2022We’re pleased to republish this guest post by Paul Belanger. Paul is the author and owner of the website, Evidence Based Wealth, and the YouTube channel belangp, where he’s published over 10 years of research and analysis of gold. He’s also the author of Evidence Based Wealth: How to Engineer Your Early Retirement, available for purchase at Amazon.com. This post does not necessarily reflect the views of Monetary Metals.

In my last article and video I discussed the nature of investment. As Benjamin Graham has stated “An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.” Hopefully I successfully convinced you that because of repeated changes to

Investments, Speculations and Money by Paul Belanger

June 24, 2022We’re pleased to republish this guest post by Paul Belanger. Paul is the author and owner of the website, Evidence Based Wealth, and the YouTube channel belangp, where he’s published over 10 years of research and analysis of gold. He’s also the author of Evidence Based Wealth: How to Engineer Your Early Retirement, available for purchase at Amazon.com. This post does not necessarily reflect the views of Monetary Metals.

In light of the recent rise in interest rates, I started preparing to write an article discussing the conditions that need to prevail to make a US Government bond a reasonable investment. In the process it dawned on me that in order to do the subject justice I needed to lay some groundwork, specifically exploring the definition of investment. So

Analysis Featured In Gold We Trust Report 2022

June 11, 2022For well over a decade, Ronnie Stoeferle has written the annual In Gold We Trust Report. Since 2013 it has been co-authored by his partner Mark Valek and has provided a holistic assessment of the gold sector and the most important factors influencing it, including interest rates, debt, central bank policy and fundamental analysis.

This years report undertakes a comprehensive macroeconomic analysis and examines the fundamental workings of the financial and economic system with a contribution from Monetary Metals CEO Keith Weiner on “How to Understand Gold’s Supply and Demand Fundamentals”.

“The economic and interest rate situation is not likely to improve. Therefore, people will keep turning to gold.”

You can read the full In Gold We Trust Report here and our

Monetary Metals CEO Keith Weiner Interviewed on RealVision

June 3, 2022CEO of Monetary Metals Keith Weiner sat down with Michael Green of RealVision to discuss how Monetary Metals increases gold’s value proposition by paying interest on gold and silver holdings and the inevitable debasement of fiat currencies. Keith and Mike discuss the inherent volatility of Bitcoin, Costco’s ability to maintain its price point, and the colossal meltdown of the Terra stablecoin.

In addition to exploring all things gold, Keith and Mike get into the Federal Reserve’s interest rate hikes and their effect on the broader economy. Last but certainly not least, they discuss the dynamics of the dollar’s endgame.

“The dollar is only good so long as the Fed is solvent, but if that condition fails to be true, the U.S. dollar could one day go the way of the

Monetary Metals is Hiring an Associate Account Manager

May 15, 2022Monetary Metals is growing, and we’re looking for our next key hire: Associate Account Manager. We’re giving an ounce of gold to whoever refers the successful candidate. If you know the perfect candidate for this role, please follow these instructions:

Email [email protected] with “I have a Golden Candidate” in the subject line

In the body of the email include:

Your name, email address, and phone number

Applicant’s name, email address, and phone number

A brief description of why this person is perfect for Monetary Metals

Associate Account Manager Job Description

We are a high growth, disruptive company combining gold and technology. Our vision is to help the world rediscover honest money. The successful candidate brings significant skills to help

Monetary Metals Completes Latest Capital Raise

May 5, 2022Scottsdale, Ariz –May 5, 2022 Monetary Metals® has recently closed a $4.5 million equity capital raise, bringing the total funds raised to over $8.5 million. The goal of the capital raise is to support the company to scale up.

This round was oversubscribed, like all previous rounds. The company aimed to raise $3 million.

The founder and CEO of Monetary Metals, Keith Weiner commented, “We had strong investor interest in our company during this equity raise, because we have created a new market, demonstrated traction, and anticipate continued exponential growth.”

Monetary Metals offers investors the ability to earn interest on their gold holdings, increasing their total ounces over time. The company does not charge storage fees, thus maximizing returns for

Ask Keith Anything, Part III

May 5, 2022Welcome to the third installment of our Ask Keith Anything video series. We published the call for questions far and wide to our readership, and the response was overwhelming! We received questions from all over the world. Now we’ve published the results! In this episode, Keith answers your questions on Bitcoin, supply chain bottlenecks, banking, book recommendations, the gold and silver markets and so much more![embedded content]

Additional Resources

Ask Keith Anything Part I

Ask Keith Anything Part II

Yield Purchasing Power

Monetary Metals Gold Lease

Monetary Metals Gold Bond

Useless Ingredients

Russia, Oil, Gold, Ruble Article Series

Monetary Metals Gold Basis

Real vs Nominal Interest

Podcast with Stefan Gleason

Usury and Speculation article

Unadulterated

AKA Part I

April 23, 2022Thanks for all of those great questions you submitted! Make sure you follow us on Twitter, Facebook and LinkedIn and are subscribed to our YouTube Channel so you can submit question and check out all of our audio articles, media appearances, podcasts episodes and more.

A Gold Mine of Show Notes

Ukraine and inflation

Famous Buyer and Seller Fallacy

Monetary Metals fundamental gold price

World Gold Council estimates on amount of gold mined

The Dawn of Gold by Philip Barton

Nixon closing the gold window

Central Bank Digital Currency

FedCoin Articles

Keith takes down the Central Banks Digital Currency Paper

The Perversion of the Dollar System

TRANSCRIPT

Dickson: Hello, everyone, and welcome to the Gold Exchange Podcast. My name is Dickson Buchanan. I am the VP of

Monetary Metals Completes Gold Lease to European Refiner L’Orfebre

January 14, 2022Scottsdale, Ariz – January 11, 2022 – Monetary Metals has leased gold to L’Orfebre, a European precious metals refiner.

The lease expands Monetary Metals’ gold and silver lease portfolio to include five industry verticals: bullion, jewelry, manufacturers, miners, and now refiners, on four continents.

Investor demand for the lease was substantial, resulting in an oversubscription of the offering. Investors earn a return on their gold, paid in gold instead of incurring vault costs. L’Orfebre benefits from the user-friendly lease structure. The interest rate paid to investors is 2.5%, in gold. The CEO of Monetary Metals, Keith Weiner, commented on the transaction:

“In this age of rampant speculation, gold offers stability. Investments that pay interest in gold

Episode 25: The Origins and Machinations of the Federal Reserve

December 10, 2021This week’s episode of the Gold Exchange Podcast explores the topic of Central Banks, most notably the US Federal Reserve. Monetary Metals’ CEO Keith Weiner explores why the Fed was created and what deleterious effects it has on our economy including inflation, boom bust cycles and monetary debasement in this recorded talk given to investment bankers.

In this talk Keith discusses:[embedded content]

Additional Resources

Episode Transcript

John Flaherty:

Hello, again, and welcome to the Gold Exchange Podcast. Today’s episode is a presentation Keith gave on the Federal Reserve and its impact on financial markets. His audience was an investment banking firm who requested this presentation. Keith covered a wide range of topics including how the Federal Reserve

Mickey Fulp Interview: Investing in Interest-Bearing Gold Bonds

December 3, 2021Mickey Fulp, aka the Mercenary Geologist, interviewed Monetary Metals’ CEO Keith Weiner to discuss the maturity of Monetary Metals’ recent gold bond. Gold bonds are denominated in gold, with principal and interest payable in gold.

Mickey and Keith have a wide ranging discussion which covers the history of gold as money in the United States, including the history of gold bonds, which were commonplace until 1933. Listen to their conversation below.

[embedded content]

Highlights of the Interview

– How Monetary Metals is making an old idea new again

– What happened to gold as money in the US?

– How exactly does a gold bond work?

– What companies would borrow in gold

– The benefits of gold bonds to investors

– Who can invest in gold bonds

– How to invest in gold bonds

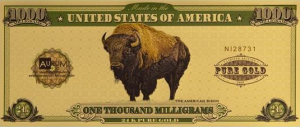

Monetary Metals Proves Marketplace for Gold Yield with Valaurum Gold Lease

November 17, 2021Scottsdale, Ariz – November 16, 2021 – Monetary Metals is pleased to announce a new gold lease to Valaurum to expand production of the Aurum®, their physical gold currency product. The lease size has grown by 800%.

Example of the Aurum®. Investors in the Monetary Metals gold lease are earning 2.25% interest on gold to finance production of the Aurum®, Valaurum’s physical gold currency product.

“We’re thrilled to get a new gold lease with Monetary Metals to scale up our operations, and at a significantly lower rate than we were expecting. We’re very pleased with the results,” said Adam Trexler, Founder and CEO of Valaurum. Valaurum has been leasing gold from Monetary Metals since 2016.

Monetary Metals’ investors were also pleased with the interest rate in the gold