Swissinfo.ch/Delali Adogla-Bessa As the world’s second-largest cocoa producer continues to lose swathes of farmland to illegal gold mining, Switzerland’s chocolate makers are waking up to the threat to their raw material supply. SWI swissinfo.ch special series: An African perspective on cocoa Native to Central and South America, cocoa cultivation in West Africa was first recorded in 1868. The archives of the Royal Botanic Gardens in Kew refer to a few cocoa trees that were thriving on the property of the Swiss missionary charity Basel Mission in Akropong in what was then known as the British Crown colony of Gold Coast. Today, the West African countries of Ivory Coast and Ghana produce over 60% of the world’s cocoa beans and Switzerland has become synonymous with

Topics:

Swissinfo considers the following as important: 3.) Swissinfo Business and Economy, 3) Swiss Markets and News, Business, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

As the world’s second-largest cocoa producer continues to lose swathes of farmland to illegal gold mining, Switzerland’s chocolate makers are waking up to the threat to their raw material supply.

SWI swissinfo.ch special series: An African perspective on cocoa

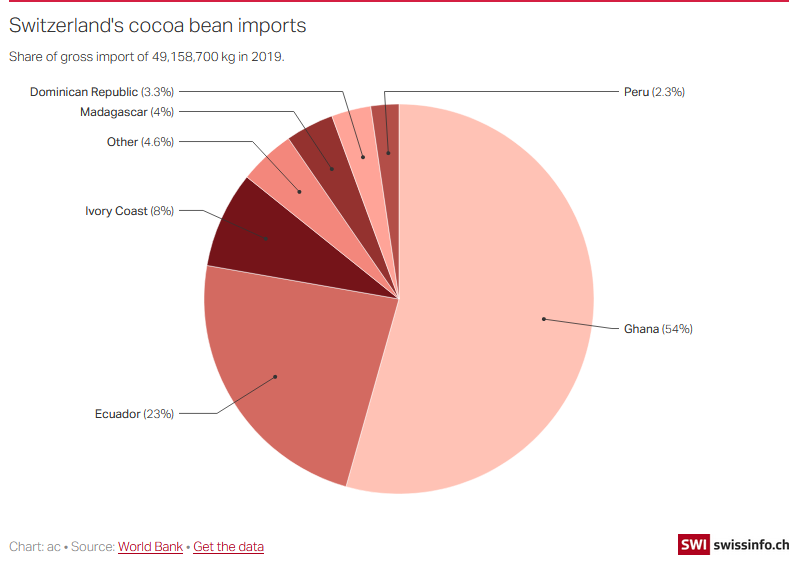

Native to Central and South America, cocoa cultivation in West Africa was first recorded in 1868. The archives of the Royal Botanic Gardens in Kew refer to a few cocoa trees that were thriving on the property of the Swiss missionary charity Basel Mission in Akropong in what was then known as the British Crown colony of Gold Coast. Today, the West African countries of Ivory Coast and Ghana produce over 60% of the world’s cocoa beans and Switzerland has become synonymous with chocolate.

This mutually beneficial relationship has come under strain in recent years. Ivory Coast and Ghana are no longer satisfied with their meagre slice of $6 billion of the $120 billion chocolate industry. Switzerland, along with the European Union and the US, is unhappy about deforestation and child labour in cocoa growing regions of West Africa. Both sides are applying pressure on each other to get what they want, but the power balance is still heavily skewed in favour of the cocoa consumers compared to the cocoa producers. The combined revenue earned by Swiss chocolate makers Nestlé (confectionery only), Lindt & Sprüngli and Barry Callebaut in 2021 was more than three times the combined value of cocoa beans exported by Ivory Coast and Ghana the year before. As major stakeholders these companies are also shaping what cocoa production will look like in the future.

This series of six articles will look at how West Africa is trying to renegotiate its role in the chocolate industry. From joining forces and adding value to investing in digitisation and sustainability. It is an uphill battle but a necessary one to avoid being held hostage by global cocoa prices and to ensure a livelihood for the five million cocoa farmers in the region.

The road leading to Yakubu Ousmane’s community in the Kunsu traditional area of central Ghana was once lined with cocoa, oil palm and orange plantations. But over the past four years, the land has been ravaged by the hunt for one of Ghana’s most precious natural resources — gold. Acres of fertile farmland that nurtured the country’s main cash crops have been turned into barren wasteland littered with piles of soft clay contaminated with mercury and deep pits that remain dangerously uncovered.

Ousmane, who is in his 60s, reminisces about the days when cocoa farming provided a good living. That was before 2018, when illegal mining (known locally as galamsey) really took hold in Kunsu. The drastic changes make him fearful of the future.

“The seedlings we nurse are just dying. The cocoa pods on the trees are also dying,” says the former cocoa farmer. “Illegal mining is destroying our land. It has made things really hard.”

The lure of gold

Kunsu has all the hallmarks of a typical illegal mining operation: foreign nationals, in this case Chinese, work with the locals; young men armed with metal detectors prospect for gold; and excavators — in Kunsu they bear the logo of Chinese heavy-equipment manufacturing Zoomlion — are everywhere, moving earth and uprooting vegetation.

The illegal miners have priced cocoa farmers out of the market. Ghanaian media reports indicate that they pay anywhere between GH¢6,000 to GH¢40,000 ($640 to $1,064) per acre of farmland. The price depends on the value of the crop on the land but also on the proximity of the farmland to an existing gold mine. This is between ten to fifty times the profit a cocoa farmer makes annually per acre from selling cocoa beans (GH¢548 to GH¢837 per acre according to the Crop Research Institute in Kumasi).

Chinese footprint

While unregulated gold mining has always existed in Ghana, it began drawing the interest of Chinese and other foreign prospectors around 2006, according to a 2015 report by the International Growth Centre. A jump in gold prices in early 2008 triggered a gold rush and the arrival of a large number of foreign miners, mostly Chinese from Shanglin county in Guangxi province, which is known for gold mining.

“Chinese miners introduced a higher level of mechanisation, notably the use of excavators and wash plants, which led to larger areas of land being turned over to mining, with increased environmental degradation,” the report said.

The biggest crackdown on Chinese miners took place in 2013. A total of 884 Chinese were arrested for illegal mining (93% share of foreigners arrested) and 713 were deported (67% share of deportees) by the Ghanaian immigration service for not having a work permit.

However, the Chinese are only a part of illegal gold mining network. A 2014 British-Ghanaian study blamed a nexus of Chinese businessmen and companies, gold dealers, traditional chiefs and local entrepreneurs for the rapid spread of galamsey, as illegal mining is known. Gold prices have increased by 30% in the last five years ensuring illegal mining remains an attractive proposition.

The money from gold has trickled down to others in the community, especially women, who have limited income-generating opportunities in rural areas. They wash the leftover soil to extract what little gold remains (a practice known locally as kolikoli).

“If I say illegal mining hasn’t helped me, I would be lying,” says Hawa Yakubu, a single mother of five, who has been panning for gold for around five years in Kunsu. She now spends her spare time scavenging for gold rather than scraping a living selling petty goods from a kiosk.

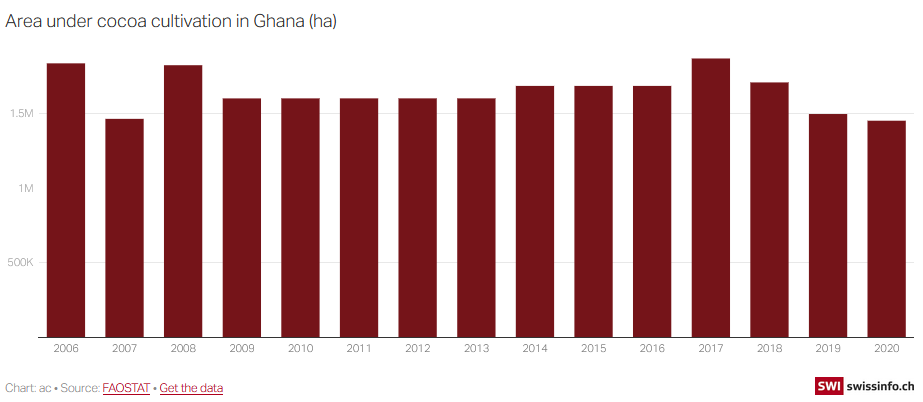

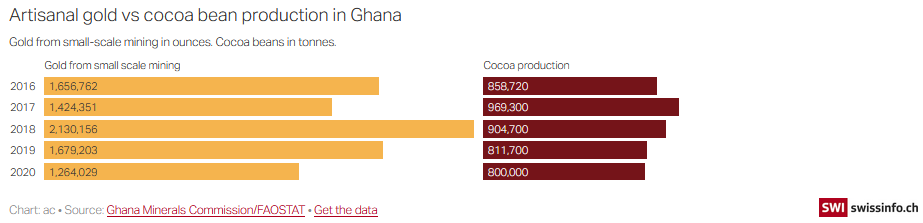

Gold vs cocoaIn April, the first large-scale galamsey survey by Ghana’s cocoa board (COCOBOD) revealed that around 19,000 hectares of cocoa plantations were taken over or damaged by illegal gold mining from 2019 to 2020, an area more than twice the size of Zurich. Satellite images show that in 2013 a total of 27,839 hectares (extrapolated to 43,879 hectares in 2015) of prime cocoa cultivation land was taken over completely by illegal gold mining, a 2017 analysis by the University of Cranfield found. Thus, COCOBOD’s estimates and satellite data suggest Ghana has lost anywhere between 0.8% to 2% of its cocoa farmland to galamsey since 2013, with around 23% of the cultivated area affected by mining-related pollution. |

The cost for Ghana is significant. It will take around $250 million to reclaim land and water polluted by gold mining in western Ghana alone, according to the International Growth Centre, a London-based research centre that promotes sustainable growth. This is on top of the significant loss in tax revenue for the country (estimated at $2.2 billion in 2016) based on estimates by Ghana’s natural resources ministry.

The Ghanaian cocoa industry can ill afford to lose more cocoa farms. In the last two years, COCOBOD has spent $230 million of a $600 million loan from the African Development Bank to rehabilitate of some 156,400 hectares of cocoa plantations. The cocoa trees on these lands were too old or infected with the Cocoa Swollen Shoot Virus and had to be uprooted and new trees planted. Hence, the last thing COCOBOD wants is for these rehabilitated farms to fall to illegal gold mining.

Swiss concern

Swiss chocolate producers, heavily reliant on cocoa from Ghana, have tried to dissuade farmers from abandoning cocoa cultivation by offering various incentives to ensure a steady supply of good quality cocoa.

Four years ago, Swiss food giant Nestlé paid the cocoa farmers of Kunsu a 14% premium on the market selling price in return for participating in the company’s Cocoa Plan. The goal was improve the yield and quality of their cocoa crop by providing them better quality plants and training in improved farming practices.

However, Nestlé’s intervention was not able to keep gold mining at bay. On a reporting trip to Kunsu, SWI swissinfo.ch observed that many cocoa trees in an area invested in by the company had been ravaged by mining.

When contacted, Nestlé did not want to comment on the situation in Kunsu. Company reports show that more than 18,000 Ghanaian farmers benefited from Nestlé’s training in good agricultural practices. Other Swiss chocolate heavyweights also have similar schemes: Barry Callebaut’s Forever Chocolate scheme benefited 17,000 farmers and Lindt & Sprüngli’s Farming Program reached 69,000 farmers last year. Thus, Swiss companies have invested in around 7% of Ghana’s 1.5 million cocoa farmers to ensure they keep producing quality raw material.

“We can confirm that Illegal gold mining is adversely affecting the cocoa farming communities,” a spokesperson for Barry Callebaut told SWI swissinfo.ch.

The company’s Ghanian buying subsidiary Nyonkopa Cocoa Buying Ltd. publicly stated last year that “illegal mining is affecting the cocoa sector, and by extension adversely affecting cocoa buying and chocolate production”.

The impact is difficult to quantify, however, as other factors including weather, disease, and prices also affect cocoa production.

“To date, the impact of illegal gold mining on our supply chain cannot be assessed in detail,” a spokesperson for Swiss chocolate firm Lindt & Sprüngli told SWI swissinfo.ch by email. “However – especially when assuming those illegal activities will continue – we might expect negative impact on cocoa farming, e.g. in terms of environmental impact.”

Decreasing demand due to closure of retailers and restaurants due to the Covid-19 pandemic meant that there was a surplus of cocoa on the global market in 2020/2021. However, the International Cocoa Organization forecasts a deficit in 2021/2022 as demand picks up which would strain the supply of quality cocoa for Swiss chocolate makers.

Providing alternatives

The Ghana government too is trying to weed out illegal gold mining. The issue moved to the top of the political agenda in 2017, when Ghana’s President Nana Akufo-Addo said the fight against galamsey was so critical he was willing to put his presidency on the line to fight it. A temporary ban was imposed on small-scale mining operations (both legal and illegal) in 2017 and 2018, while military operations were launched against illegal miners and even Chinese nationals involved in the business were arrested. Mining laws were amended in 2019 which imposed minimum jail sentences of 15 years on those found guilty of illegal mining.

Despite these measures, illegal mining continues to thrive due to corruption and the lack of law enforcement. The harsh reality is that cocoa cannot compete with gold.

In June, SWI swissinfo.ch went out with Hawa Yakubu while she scavenged for gold on the fringes of illegal mines in Kunsu.

She worked for about two hours before finding a small nugget of gold that could be worth GH¢ 300 ($37). With an average daily wage of a little over $1 a day, it would take a cocoa farmer in Ghana a month to make that kind of money.

“It is galamsey I have used to build a house and take care of my five children and their schooling as well,” says Yakubu.

Change on the way?

Change could be on the way as the government shifts its strategy to cope with the reality on the ground. In 2019, Ghana’s Minerals Commission, which regulates the mining sector, introduced a Community Mining Scheme (CMS). This is designed to turn illegal miners into formal small-scale miners by allowing them to mine in specifically designated areas under government supervision provided they meet certain safety and environmental criteria.

Kunsu will be one of the beneficiaries of this scheme. In February, the government announced that five mining concessions in the region would be awarded to a Community Mining Scheme (CMS) that authorities claim will create 5,000 jobs. The government aims to approve 100 such CMS projects across Ghana by the end of 2022, with a goal of creating 220,000 new jobs.

To ensure that Community Mining Schemes do not add to the problem of arable land disappearing to gold mines, Ghana’s Minerals Commission also agreed at a meeting with COCOBOD in April to share data on the location of cocoa farmlands. This would allow the commission to block those areas from being made available for mining.

Tags: Business,Featured,newsletter