The sell-off in stocks last week showed a certain nervousness about the sharp run-up in tech stocks and the role of big option bets. Indeed, prices in some instances had risen too fast. But this was a technical correction. With the US tech titans generating free cash flow, we do not believe we are facing a repeat of the bursting of the dot-com bubble in 2000. And yet, it could be that Tesla’s ambition to raise USD5bn through occasional share sales will be seen as marking a kind of high-water point—especially as the approach of the November election increases market nervousness. A Biden win, plus seizure of both houses of Congress by the Democrats, could mean higher taxes and more regulation. Although we believe the probability for such a scenario is still low,

Topics:

Cesar Perez Ruiz considers the following as important: 2.) Pictet Macro Analysis, 2) Swiss and European Macro, Featured, Macroview, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The sell-off in stocks last week showed a certain nervousness about the sharp run-up in tech stocks and the role of big option bets. Indeed, prices in some instances had risen too fast. But this was a technical correction. With the US tech titans generating free cash flow, we do not believe we are facing a repeat of the bursting of the dot-com bubble in 2000. And yet, it could be that Tesla’s ambition to raise USD5bn through occasional share sales will be seen as marking a kind of high-water point—especially as the approach of the November election increases market nervousness. A Biden win, plus seizure of both houses of Congress by the Democrats, could mean higher taxes and more regulation. Although we believe the probability for such a scenario is still low, this would definitely be bad news for tech stocks. Just as challenging would be an inconclusive ‘result’ in November – an outcome maybe just as probable as a decisive win for either side.

The sell-off in stocks last week showed a certain nervousness about the sharp run-up in tech stocks and the role of big option bets. Indeed, prices in some instances had risen too fast. But this was a technical correction. With the US tech titans generating free cash flow, we do not believe we are facing a repeat of the bursting of the dot-com bubble in 2000. And yet, it could be that Tesla’s ambition to raise USD5bn through occasional share sales will be seen as marking a kind of high-water point—especially as the approach of the November election increases market nervousness. A Biden win, plus seizure of both houses of Congress by the Democrats, could mean higher taxes and more regulation. Although we believe the probability for such a scenario is still low, this would definitely be bad news for tech stocks. Just as challenging would be an inconclusive ‘result’ in November – an outcome maybe just as probable as a decisive win for either side.

The latest decline in unemployment may help quell fears the rebound in the US is topping out. Business surveys also show a solid improvement in sentiment and healthy order books. But job growth is showing signs of slowing and the overall impression of a fragile recovery remains. This can be attributed to fearful US consumers, whose eyes are fixed beyond emergency pandemic payments and onto their long-term employment prospects. Evidence that Americans are worried on this score can be seen in the sharp rise in the savings ratio. To preserve the recovery, Washington needs at the very least to agree quickly on an extended and meaningful fiscal package.

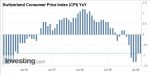

Weak inflation numbers last week increase the probability the ECB will trigger a new EUR500 bn round of quantitative easing by year’s end. Fiscal stimulus is also being rolled out, with the French unveiling a EUR100bn stimulus plan, of which EUR30bn will be allocated to the green transition – something set to be a prominent feature of the European investment landscape. The proposed merger of CaixaBank and Bankia in Spain may also be a sign of things to come. Banking sector rationalisation in Europe (outside Italy) never really happened after the global financial crisis. But with yield spreads likely to stay low, accelerated consolidation is the only route to survival for the European banking sector.

Tags: Featured,Macroview,newsletter