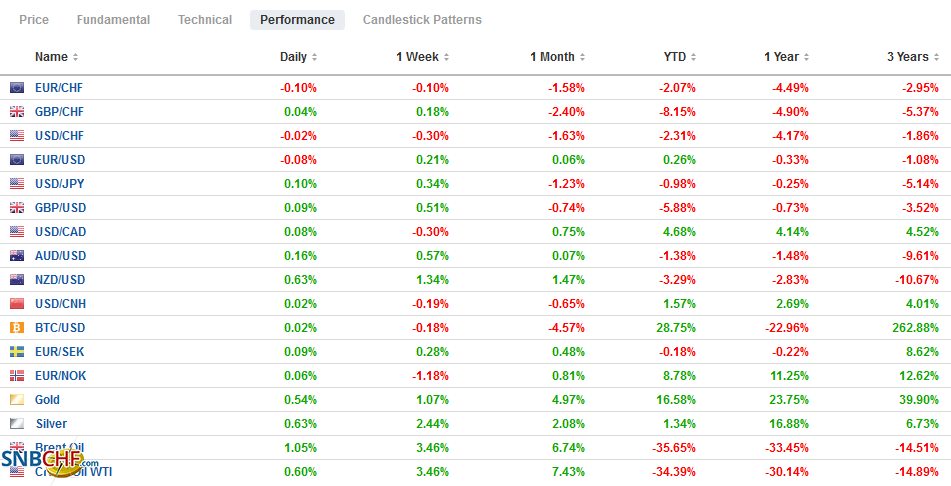

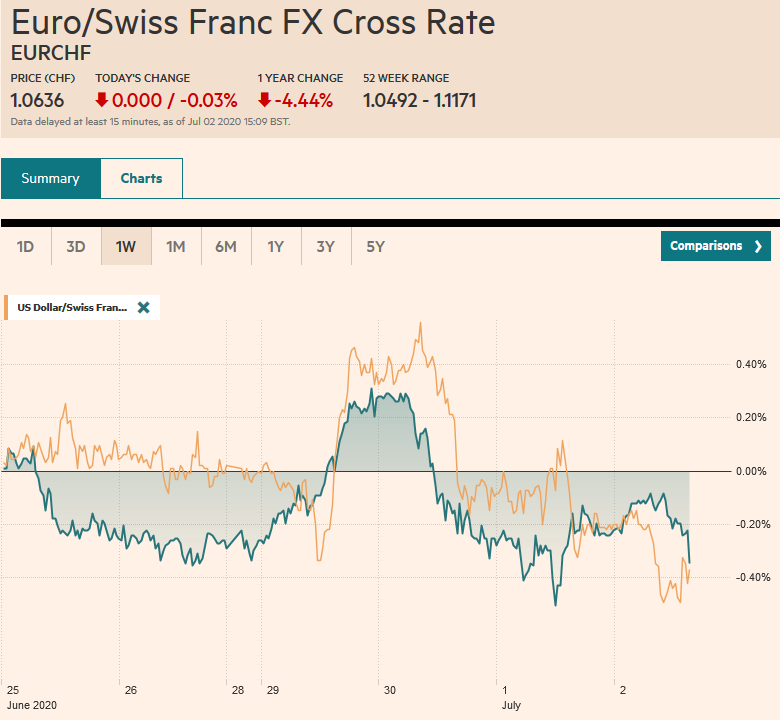

Swiss Franc The Euro has fallen by 0.03% to 1.0636 EUR/CHF and USD/CHF, July 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Market optimism over the possibility of a vaccine in early 2021 overshadowed the continued surge in US cases, where the 50k-a-day threshold of new cases has been breached. Following the NASDAQ close yesterday at record highs, global equities have advanced. Led by Hong Kong returning from yesterday’s holiday, Asia Pacific equities rallied. Most local markets rose by more than 1%, though Tokyo and Taiwan lagged. Europe’s Dow Jones Stoxx 600 is up over 1% to extend its rally for the fourth consecutive session. The S&P 500 is trading more than 0.5% higher in electronic trade, which is

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, Featured, jobs, newsletter, South Korea, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.03% to 1.0636 |

EUR/CHF and USD/CHF, July 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Market optimism over the possibility of a vaccine in early 2021 overshadowed the continued surge in US cases, where the 50k-a-day threshold of new cases has been breached. Following the NASDAQ close yesterday at record highs, global equities have advanced. Led by Hong Kong returning from yesterday’s holiday, Asia Pacific equities rallied. Most local markets rose by more than 1%, though Tokyo and Taiwan lagged. Europe’s Dow Jones Stoxx 600 is up over 1% to extend its rally for the fourth consecutive session. The S&P 500 is trading more than 0.5% higher in electronic trade, which is sufficient to take out a month-old downtrend line. The equity rally has not sapped demand for government bonds, and peripheral European yields are off 3-5 bp. The US 10-year is little changed around 67 bp. The dollar has been sold against nearly all the world’s currencies. Among the majors, the Canadian dollar is struggling to join the party, while among emerging market currencies, Indonesia, Thailand, and Turkey are the notable exceptions. Gold is firm above $1770, while August WTI continues to straddle the $40 a barrel level. Note that some US markets close early today ahead of tomorrow’s holiday and liquidity will suffer for it after the flurry of US data. |

Asia Pacific

Australia’s May trade figures were better than expected. Exports fell by 4% year-over-year. This compares with an 11% decline in April and expectations for a 7% drop in May. Imports were off 10% in April and were off only 6% in May. This, too, was better than economists expected. The result was the trade surplus came in at A$8 bln after a revised A$7.8 bln in April. Goods exports to China rose in May, but to most other countries, except New Zealand and Hong Kong.

South Korea emerged from deflation in May. The headline CPI rose 0.2% in May for a flat year-over-year performance. In April, consumer prices had fallen by 0.3% year-over-year. Core prices ticked up to 0.6% year-over-year from 0.5% in April.

The dollar posted a potential key downside reversal yesterday, but new selling has been limited. Yesterday the dollar rose above recent high but met a wall of sellers near JPY108.15 that drove it through the previous session’s low (~JPY107.50) and closed below there. Today’s low is near JPY107.30. There is an option for $950 mln at JPY107.50 and another for about $475 mln at JPY107.00. Both expire today. The Australian dollar is firm in the upper end of yesterday’s range. It is trading through a downtrend line drawn off the June 10 high. The next target is near $0.6950, where an option for about A$505 mln is struck that rolls off today. The PBOC set the reference rate for the dollar a little softer than the models suggested at CNY7.0566. The yuan has risen its highest level in about a month against its basket.

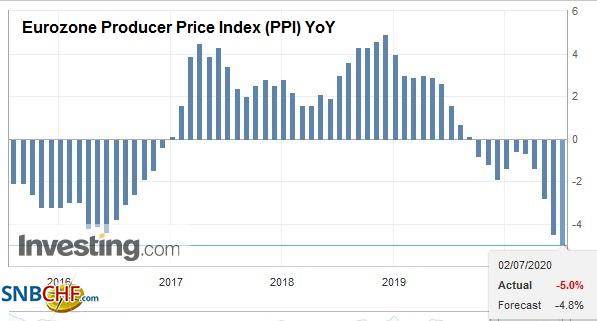

EuropeThe eurozone wholesale deflation intensified in May. Producer prices fell 5.0% year-over-year in May after a 4.5% decline in April. In May alone, they fell by 0.6%, a bit more than expected. Energy and construction accounted for about half of the monthly decline. Non-durable consumer goods prices fell 0.6% in May and were up less than 1% for the year. Durable consumer goods prices were unchanged and up 1.3% year-over-year. Capital goods prices were also stable in May but were 0.9% higher from a year ago. |

Eurozone Producer Price Index (PPI) YoY, May 2020(see more posts on Eurozone Producer Price Index, ) Source: investing.com - Click to enlarge |

| Eurozone unemployment ticked up to 7.4% in May from 7.3% in April. This was not as bad as economists feared. It stood at 7.3% at the end of last year. Many countries have moved to support workers furloughed rather than dismissed, and several governments have subsidized most of the cost.

The euro poked above $1.13 for the first time in six sessions but met sellers in the European morning ahead of the US jobs data. Note that the downtrend line from last month’s high comes in today just above $1.1290. The overnight unsecured rate (ESTR) fell to a record low yesterday and is hovering near there today (~-0.55%). Expiring options may be playing a role as well. There is an option at $1.13 for 1.9 bln euros. Another is struck at $1.1275 (~508 mln euros) and $1.1250 (2.4 bln euros). Sterling is near a seven-day high (~$1.2525). It is overextended on an intraday basis and a push back toward $1.2450, where a roughly GBP610 mln option will expire today. Initial support may be encounters closer to $1.2475. |

Eurozone Unemployment Rate, May 2020(see more posts on Eurozone Unemployment Rate, ) Source: investing.com - Click to enlarge |

AmericaMarket participants will not be bitten by the same dog twice. Last month, expecting a loss of 7.5 mln jobs, investors were shocked by the reported 2.5 mln increase. The median forecast in the Bloomberg survey anticipates a 3 million increase in non-farm payrolls. The average is a bit higher, a little above 3.3 mln. However, the wide range of 500k to 9 mln underscores the great uncertainty. The Bloomberg survey also shows the manufacturing sector growing almost 440k jobs, nearly twice the 225k reported for May. The ADP report is not particularly helpful. It projected an increase of 2.37 mln jobs (~600k less than the median forecast), but the real story was the incredible revision to the May series. Instead of a loss of 2.76 mln jobs that were initially reported, ADP says that 3.065 mln private-sector jobs were created. The data, including the unemployment rate, are likely to be skewed by self-reporting and composition issues. Weekly jobless claims for the week ending June 27 will be reported at the same time. Another 1.3 mln American are expected to have filed for unemployment insurance for the first time, which is staggering. |

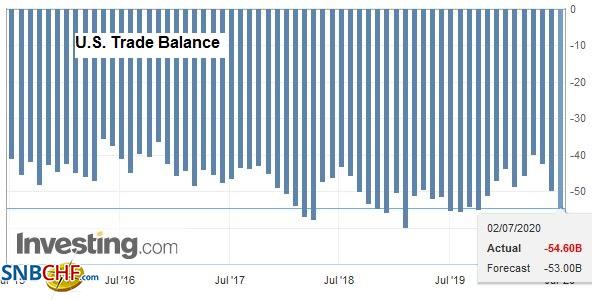

U.S. Trade Balance, May 2020(see more posts on U.S. Trade Balance, ) Source: investing.com - Click to enlarge |

The May trade balance will be lost in the wake of the employment data. Improvement that had been seen late last year and earlier this year is being unwound quickly. Preliminary figures showed the goods deficit widening by $3.6 bln. Goods exports were off almost 35%. Imported goods were off about 23%. Besides, the value-added issue, for which there now an OECD database, another element that perplexes many are the terms of trade or an index of export prices to import prices. Imagine two countries trade two goods–raw materials and finished goods. The change in the terms of trade, or relative prices, can and have historically had a significant impact on trade balances. Separately, May factory orders contain a little new information since a preliminary estimate of durable goods orders has already been released. A solid rebound after April’s 13% drop is anticipated. Note that yesterday’s auto sales report was a little stronger than expected, but it still left June sales off about 24.6% from last June. Japan reports its figures yesterday too. Auto sales in Japan were off about 26% year-over-year.

The Canadian dollar is unable to take advantage of the weaker US dollar tone today. Initial resistance for the greenback is seen near CAD1.3620. Above there, an option for around $535 mln at CAD1.3650 expires today. Support for the US dollar is now seen around CAD1.3560. The greenback peaked at the end of June near MXN23.23, which was the high for the month. It reversed lower and has seen follow-through selling that has pushed it to almost MXN22.53 today. Initial support may be near the 20-day moving average (~MXN22.45). A break would lend credence to the ideas that the nearly month-long upside correction is indeed over.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Currency Movement,Featured,jobs,newsletter,South Korea,Trade