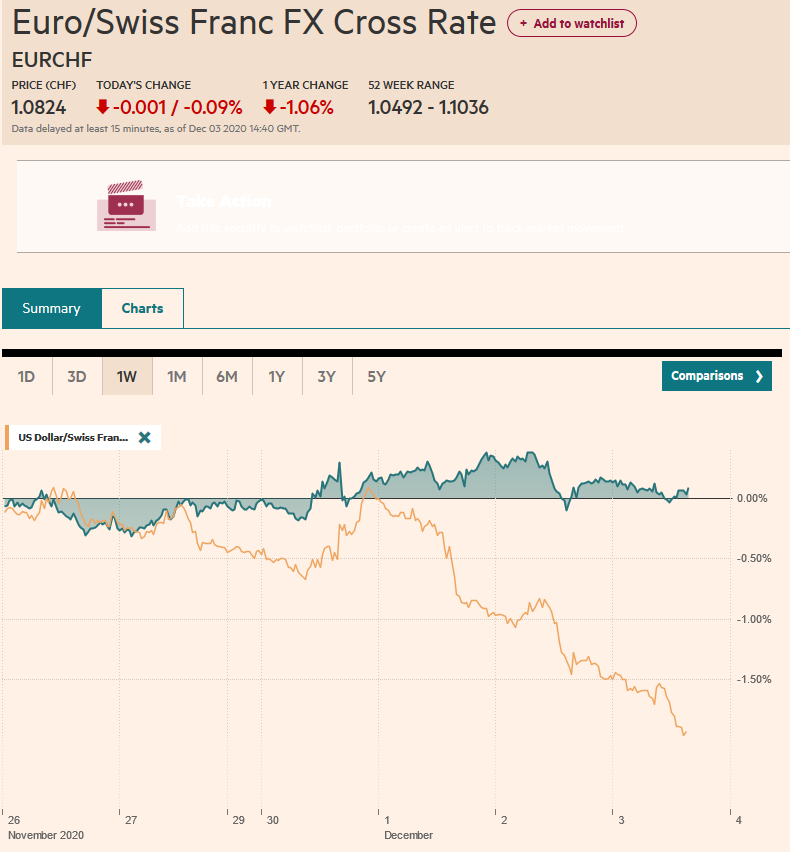

Swiss Franc The Euro has fallen by 0.09% to 1.0824 EUR/CHF and USD/CHF, December 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Selling pressure on the dollar and US Treasuries intensified in North America yesterday. The dollar fell to new lows against the dollar-bloc, euro, and Swiss franc yesterday. The US 10-year yield rose to new three-week highs. The S&P 500 set a new closing record high. While Asia Pacific equities are mostly advanced, mild profit-taking is seen in Europe, and the Dow Jones Stoxx 600 is lower for the second consecutive session. US shares are also trading a little lower. Australia’s 10-year yield rose above 1% for the first time in more than three months, while European yields

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, EUR/CHF, Featured, Feed, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.09% to 1.0824 |

EUR/CHF and USD/CHF, December 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

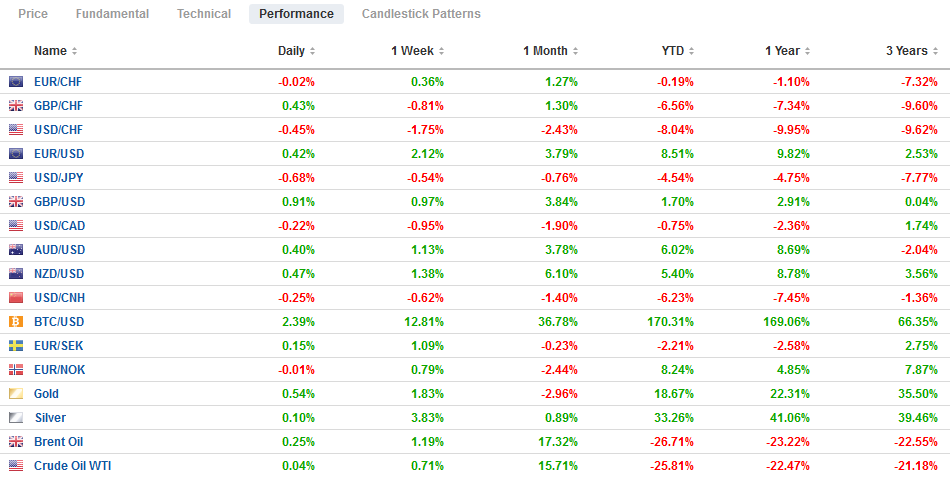

FX RatesOverview: Selling pressure on the dollar and US Treasuries intensified in North America yesterday. The dollar fell to new lows against the dollar-bloc, euro, and Swiss franc yesterday. The US 10-year yield rose to new three-week highs. The S&P 500 set a new closing record high. While Asia Pacific equities are mostly advanced, mild profit-taking is seen in Europe, and the Dow Jones Stoxx 600 is lower for the second consecutive session. US shares are also trading a little lower. Australia’s 10-year yield rose above 1% for the first time in more than three months, while European yields are benchmark yields are a little softer. The US 10-year yield is flat near 0.94%. The dollars mixed. Sterling has joined the yen and Swiss franc in a move higher, while the other majors are mostly little changed. Emerging market currencies are also mixed. Of note, the dollar fell below KRW1100 for the first time in two years, and despite higher than expected inflation, the Turkish lira has come back bid. The JP Morgan Emerging Market Currency Index is little changed. Gold continues to recover. It is higher for the third consecutive session, the longest advance in nearly a month. January WTI is a little heavier after rebounding smartly from around $44 to almost $46. It is straddling the $45 area today. |

FX Performance, December 03 |

Asia Pacific

China’s Caixin PMI was stronger than expected. The service PMI rose to 57.8 from 56.8. Economists had mostly looked for a small pullback. The composite rose to 57.5 from 55.7.

Japan’s preliminary PMI was revised higher. The service PMI rose to 47.8 from the 46.7 preliminary reports and 47.7 in October. The composite PMI stands at 48.1 rather than 47.0 as the initial estimate suggested and 48.0 in October.

Australia’s service and composite PMIs are were revised higher from the flash readings that already had shown improvement over October. The service PMI is at 55.3 from 53.7 in October, and the composite PMI is at 55.1 after 53.5. However, the more interesting news, given the tensions with China, is that its October trade surplus was larger than expected at A$7.45 bln. The September surplus was revised higher to A$5.81 bln from A$5.56 bln. Exports were stronger than expected, rising by 5% in the month, September’s increase was revised to 3% from 4%. Imports had fallen by 6% in September and were expected to have grown by 4% in October but increased by 1%.

Yesterday, we noted the apparent US silence in the face of China’s trade war with Australia primarily stemming from Canberra’s foreign policy that is often in lockstep with the US. Unrelated and several hours later, President-elect Biden’s national security adviser offered support for Australia, noting its sacrifices for “freedom and democracy” and pledging that the US “stood shoulder-to-shoulder” with Australia. China was not explicitly mentioned, but the message was clear.

The dollar met resistance near JPY104.55 and has slipped to almost JPY104.20. Around $1.6 bln in options in the JPY104.45-JPY104.50 area expires today, and there is an option for $3.5 bln at JPY104. that also expires today. We suspect the exchange rate is not going anywhere quickly today. The Australian dollar extended its gains to a new 2020 high of a little more than $0.7435 today, where an option for nearly A$675 mln expires. The upside momentum has stalled in Europe. The $0.7400-area should offer initial support. The PBOC set the dollar’s reference rate at CNY6.5592, slightly firmer than expected. Its open market operation drained liquidity (CNY70 bln), bringing the amount withdrawn over the past three sessions to about CNY230 bln, and short-term rates jumped.

Europe

The eurozone’s service and composite PMIs were revised a little higher but do nothing to assuage fears that it is contracting here in Q4. The service PMI rose to 41.7 from the flash reading of 41.3 and 46.9 in October. The composite stands at 45.3, slightly better than the 45.1 initially estimated, but below the 50 boom/bust level seen in October. By country, Germany was revised lower and France higher. Italy was worse than expected and Spain slightly better, but both declined deeper below the 50-level.

Before leaving the PMI story, note that the UK’s reading was also revised higher from the preliminary estimates, but its reading also reflects an economy whose recovery has been stalled. The service PMI stands at 47.6. The flash reading was 45.8 after October’s 51.4. The composite is at 49.0. It is better than 47.4 initially estimated but compares unfavorably to October’s 52.1 reading.

Brexit developments are mixed. On the one hand, Ireland’s foreign minister Coveney said there was a “good chance” of striking a deal in the next few days, though it seemed mostly an expression of hope than concrete developments. On the other hand, the French warning that it could veto a trade deal seemed to warn against EC negotiator Barnier making new concessions. The French position reportedly was backed by Belgium, the Netherlands, and Denmark. It is not clear if Barnier will make a draft version available for examination, which several officials have sought.

The euro reached almost $1.2140 late in the Asian session before a bit of selling pressure was seen in early European turnover that took it back toward $1.21. We note that the euro buying/dollar selling has been most acute in the North American session this week, and the intraday technicals appear to be bottoming. Another attempt higher today cannot be ruled out. Although we thought ahead of next week’s ECB meeting, the deflationary forces that are still evident, and the growth divergence here in Q4 favoring the US that the euro would not sustain a break of its four-month trading range. However, we recognized a convincing break could spur a two-cent move. Sterling is firm, and for the third consecutive session, is flirting with the $1.34 area. It peaked over the past two sessions near $1.3440 but could not sustain a foothold above $1.34. It recovered from below $1.33 yesterday, the week’s low, to reach $1.3420 today. The intraday momentum readings are stretched. Meanwhile, the euro is seeing its recent strong gains against sterling pared. It had reached almost GBP0.9085 and has fallen back to almost GBP0.9020 today. Below there, support is seen near GBP0.9000.

America

The possibility of a last-minute stimulus deal has improved after the Democratic leadership (Biden, Pelosi, and Schumer) backed the bipartisan proposal for a $908 bln package. It is the first significant retreat from the $2.4 trillion effort, though reports suggest they had unveiled a $1.3 trillion package this week. The bipartisan proposal includes $180 bln for a $300-a-week, extended unemployment insurance, $300 bln for a new Payroll Protection Program (loans that can turn into grants), and $240 bln for state and local governments. Biden suggested that while the bipartisan proposal was not the answer, it did offer immediate assistance.

Note that the House of Representatives approved a bill that the Senate did a few months ago that would force companies (Chinese) to be denied listing on US exchanges if the accounts could not be audited by US officials. Unlike some other measures that the US has implemented, which seem at least partly aimed at reducing the options for the next administration, this bill provides a three-year phase-in period and draws bipartisan support. As we have argued, the shift in US policy from trying to curb China’s expansion through trade to its integration of the capital markets appears to have begun.

US data today include the weekly jobless claims, where a new problem has been identified. Apparently, the statistical method has used the number of weeks of claims as a proxy for the number of individuals receiving assistance. The national November figures will be released tomorrow. The Markit final services and composite PMI may not be quite as good as the initial readings, and the ISM services index is also on tap. Canada’s economic release calendar is light ahead of tomorrow’s employment report. Mexico reported a continued recovery in its domestic auto sales yesterday (November) and today reports vehicle production and export figures. Brazil sees Q3 GDP (Bloomberg survey median forecast is for 8.7% growth after a 9.7% contraction in Q2). The Markit service and composite PMIs are also due, and the recovery looks to be carrying into Q4.

The US dollar extended its slump to a new 2020 low against the Canadian dollar today to just above CAD1.29. It recovered to CAD1.2940 in the European morning, where new offers lurked. It may take a move above CAD1.2960 to stabilize the tone. On the downside, there may be mild support in the CAD1.2860-CAD1.2880 area, but the next big chart point is the low from October 2018 near CAD1.2785. The greenback is pinned near its trough against the Mexican peso that extends a little below MXN20.00. It has found support this week (yesterday and today) near MXN19.96 and last week’s lows were nearer MXN19.94.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: EUR/CHF,Featured,newsletter,USD/CHF