Run On The Pound ? Jeremy Corbyn Says Should Plan For – Right to plan for ‘run on pound’ if Labour wins says Corbyn and Labour party – British pound already down 20% since Brexit, collapse already in play– Run on the pound likely due to Labour’s ‘command economy’ approach– Collapse in Sterling would undermine UK financial system– Portfolios holding sterling and related assets would be significantly affected– Pension funds and property the most likely to get hit by run on the pound– Gold to benefit as sterling collapse picks up pace - Click to enlarge Last week Labour Shadow Chancellor John McDonnell said the party was carrying out “war-game-type scenario-planning” for events such as “a run on the pound”. A run

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GBP, global macro, gold price, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Run On The Pound ? Jeremy Corbyn Says Should Plan For

– Right to plan for ‘run on pound’ if Labour wins says Corbyn and Labour party |

|

| Last week Labour Shadow Chancellor John McDonnell said the party was carrying out “war-game-type scenario-planning” for events such as “a run on the pound”.

A run on the pound would see the value of the currency plummet, increase inflation and increase the value of those age old stores of value – namely gold and silver. McDonnell’s reasons for war-gaming were because of expectations that a ‘radical’ Labour government would face a range of challenges. He said was seeking to “answer the question about what happens when, or if, they come for us”. When asked what McDonnell meant by ‘they’, party leader Jeremy Corbyn said he was likely referring to outside forces who have previously punished Labour governments in such a way. |

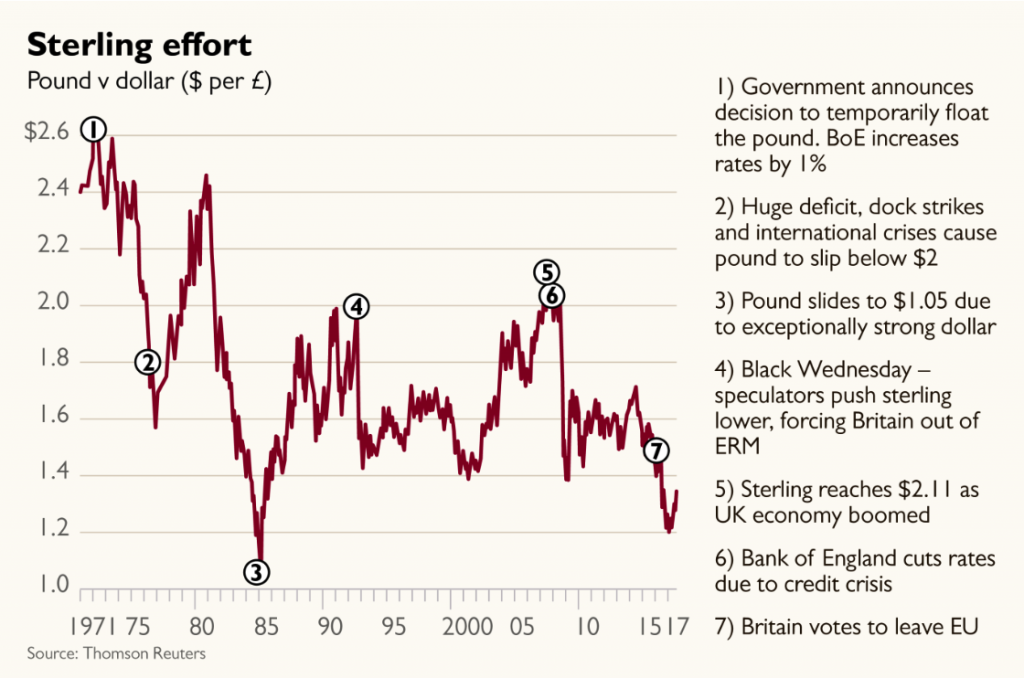

Pound v dollar, 1971 - 2017 |

| Of course the most famous run on the pound in living memory happened in 1992 but for Labour it was nearly 50 years ago that still haunts them.

In November 1967 Harold Wilson’s government announced it was lowering the exchange rate. The pound fell to $2.40, down from $2.80, a fall of just over 14%. Wilson is now much ridiculed for his statement made on national radio and television in which he ‘reassured’ citizens that:

Wilson’s comments, whilst derided at the time, seem to still ring true for our own government who do not appreciate that ongoing policies have resulted in a ongoing devaluation in the pound. Labour’s adverse effect on the pound It is not a ridiculous thought that ‘they’ might come for us should Labour be victorious. If one takes a look at Labour’s policies then we would come about as close to a command economy as one can get in peacetime. McDonnell has pledged to ‘take back’ rail, water, energy and the Royal Mail. Both the CBI the British Chambers of Commerce have denounced the shadow chancellor’s plans as “forced nationalisation” Europe has seen this before, writes Alex Rankine:

Labour are prepared for this and almost seem to be relishing the idea. Mark Serwotka, from the PCS union representing civil servants, said Labour would face “huge” opposition should it win. Serwotka predicted “all the usual arms of the ruling class will be brought to bear”. The union leader included using financial markets to bring “economic pressures” such as “the flight of capital” and trying to destabilise the economy. |

GBP & USD, Jan 2016 - Sep 2017(see more posts on #GBP, #USD, ) |

| For the Conservatives, “Labour’s plans would go too far, and ordinary working people will end up footing the bill,” Chancellor Philip Hammond said.

The problem is, ordinary working people are already footing the bill. Without the help of Labour’s socialist policies. What is a “run on the pound” and the consequences A run on a currency usually happens when markets feel it is overvalued or is likely to drop quickly. Both international investors and speculators sell the currency and assets denominated in that currency en masse, forcing its value down. The UK’s most recent, famous example is from 1992. That September, a day now known as Black Wednesday, the falling value of sterling forced the Conservative government exit the European Exchange Rate Mechanism after its attempts to support the currency failed. In the most recent threat of a run on Sterling Labour’s opposition seized on McDonnell’s comments. Current Chancellor of the Exchequer Philip Hammond said Labour’s economic policies would trigger “a collapse in business investment and a crash in the value of the pound, causing a shock wave of inflation”. When there is a panic sell of a currency, the value drops and we see a rise in price of imported goods and raw materials. There is of course major capital flight. A sudden exodus of large sums of money out of the country which would undermine the stability of the financial system in the UK. Altogether financial shocks such as these could push up inflation. It sounds awful but the truth is Labour’s success may only mean an acceleration of what is already in place. The value of the pound has been in decline for many decades now. This is thanks to stealth inflation caused by loose monetary policies and little focus on preserving the value of the pound in our pockets. Between 2007 and 2008 the British Pound fell 21% (peak to trough). Whilst the rest of the world was on the verge of deflationary collapse we experienced an inflationary recession. GDP contracted at a top rate of 6.1% annually and inflation touched 5.1%. We still haven’t recovered. Previously we would have hauled ourselves out of such a fall thanks to manufacturing. Generally manufacturing has higher returns to scale than services. Today we don’t have that option. As a result we are extremely reliant on capital inflows into the City of London to limit a fall in sterling. But, as 2007 -2008 showed, this is an extremely unstable source of foreign demand for our currency. No right for Tory smugness Of course one thing that in all of their criticism the Conservative Party appears to have forgotten is that for the past year the United Kingdom has been experiencing a collapse in the Pound, whilst under their rule. Since the Brexit vote on June 23rd 2016 the value of Sterling has fallen by over 20% against the U.S. Dollar. Many point to Brexit as the leading cause, it is most certainly the catalyst. However Conservative policies have done little to boost confidence in the currency in the last two years. Concerns are so serious regarding Brexit and Mrs May’s ability to keep her government on side that not even a speech in Florence could give the pound a much needed boost. |

British Pound Spot Currency, 22 Sep 2017 |

| Conclusion – no need for war-gaming, we’re already at war

Labour’s practice runs should perhaps be closer observed by those already in power. They should see it as a reflection of what is already happening. The only difference is the Labour scenario would be at a faster pace. As demonstrated, the British Pound is already in free-fall. Just because we haven’t seen major capital flight since the 1970s does not mean that it isn’t happening. Just because inflation measures suggest there is little inflation in the economy does not mean it isn’t there. Currency devaluation is very much a part of every-day financial life. We all witness it, as prices increase and our paper and electronic fiat currencies no longer goes as far. Already pension funds and the housing market are in a state of disarray. Few really know how pension funds are going to manage their major deficits and the housing market is on the brink of collapse. A run on the pound would merely be the final spark in a highly combustible environment. With or without a Labour victory savers’ personal wealth is already at great risk. In all previous collapses in currencies, gold and silver have acted as hedges and safe havens. We only need to look at situations such as the stagflation that afflicted most western economies in the 1970s to see this. Or indeed the more extreme versions as seen in the Weimar Republic historically and Zimbabwe and Venezuela today. Investors would be well advised to line their portfolios with gold bullion before the UK economy or electorate throws up yet another fuse for the international markets to take a dislike to. UK investors have the great benefit of being able to invest in gold capital gains tax (CGT) free when they buy Gold Sovereigns or Gold Britannias for insured delivery or stored in the safest vaults in Switzerland, Singapore and Hong Kong. The best time to get insurance is before the event you need to protect against happens … whether that be car insurance, health insurance or the financial insurance of gold coins and bars. |

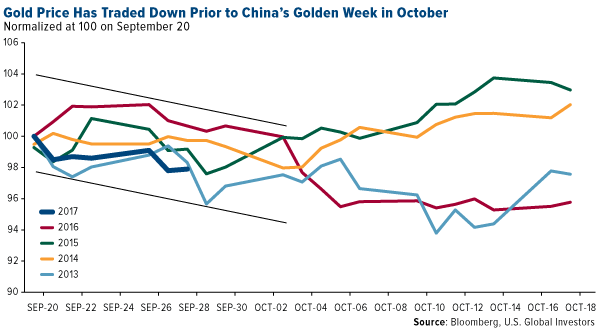

Gold Price, Sep - Oct 2017(see more posts on gold price, ) |

Tags: #GBP,#USD,Daily Market Update,Featured,gold price,newsletter