Swiss Franc EUR/CHF - Euro Swiss Franc, March 09(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP / CHF The cost of hedging against major currency fluctuations between the Swiss Franc and the Euro hit it’s highest level in 2 months yesterday, as fears over impending French elections have investors worried. The far-right political parties in France are seeing their highest levels of popularity in 30 years and just 2 weeks ago a French opinion poll put Marine Le Pen in the lead and this created enough Euro weakness to push the Pound to Euro rate to its highest level in 2017. The reason behind investors fears is that Marine Le Pen have previously outlined her plans to remove France from the European Union and stop using the Euro. Such a shock to the Eurozone would inevitably result in volatility within the foreign exchange markets and would likely lead to CHF strength as investors run for safe-haven currencies such as CHF and the Japanese Yen. Moving forward I’m predicting to see the Swiss Franc gain further on the Pound if there are political upsets within the Eurozone, there is also the chance of Brexit negotiations beginning badly and should this become public I would also expect to see the Pound lose value.

Topics:

Marc Chandler considers the following as important: AUD, CAD, China Consumer Price Index, China Producer Price Index, Crude Oil, EUR, Featured, FX Trends, GBP, JPY, newslettersent, U.S. Initial Jobless Claims, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 09(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

GBP / CHFThe cost of hedging against major currency fluctuations between the Swiss Franc and the Euro hit it’s highest level in 2 months yesterday, as fears over impending French elections have investors worried. The far-right political parties in France are seeing their highest levels of popularity in 30 years and just 2 weeks ago a French opinion poll put Marine Le Pen in the lead and this created enough Euro weakness to push the Pound to Euro rate to its highest level in 2017. The reason behind investors fears is that Marine Le Pen have previously outlined her plans to remove France from the European Union and stop using the Euro. Such a shock to the Eurozone would inevitably result in volatility within the foreign exchange markets and would likely lead to CHF strength as investors run for safe-haven currencies such as CHF and the Japanese Yen. Moving forward I’m predicting to see the Swiss Franc gain further on the Pound if there are political upsets within the Eurozone, there is also the chance of Brexit negotiations beginning badly and should this become public I would also expect to see the Pound lose value. Yesterdays Spring Budget was uneventful and it’s likely that the Pound will remain around current levels until we have more insight into when the Brexit will begin, although those hoping for further Sterling strength should be aware the currency has been softening over the past couple of weeks. |

GBP/CHF - British Pound Swiss Franc, March 09(see more posts on gbp-chf, ) Source: Investing.com - Click to enlarge |

FX RatesThe euro tested the lower of its range near $1.05 in Asia before short covering in Europe lifted back toward yesterday’s highs near $1.0575. However, buoyed by the upside surprise in the ADP estimate of private sector jobs growth, the dollar is firmer against most other currencies today. The US 10-year yield is up 20 bp this week. Including today’s move, the US 10-year yield is up for the ninth consecutive session, and new 2.57% it had convincingly broken the downtrend in place since the middle of last December when the yield peaked near 2.64%. Sandwiched in between the ADP estimate and the US government’s report, the ECB meets today. With the euro near the lower end of its range, falling for four of the past five weeks, the pain trade is the ECB to be somewhat less dovish. The signal could be a change in the forward guidance about rates remain at current levels or lower. The or lower could be dropped, some believe, in recognition of the solid growth (above trend) and rising price pressures. Speculators in the futures market had shifted and taken a net long Aussie position, and the loss of $0.7500-$0.7520 warns that not only will longs have to be cut but momentum players may look to establish shorts. The next target is near $0.7450, and then $0.7380. The note of caution is that the Aussie is through the lower Bollinger Band (~$0.7525 today) Sterling’s downside momentum appears to be stalling in front of $1.21. Sterling is marginally lower today, for the fourth consecutive session. It fell in the first four sessions of last week as well. It has had only one advancing session in the past 10. The Brexit drama over amendments to the bill allowing May to trigger Article 50 has weighed on sentiment, but it is likely a short-lived factor. Interest rate differentials are also taking a toll. |

FX Daily Rates, March 09 |

| However, this does not appear to us to be the more likely scenario. The fact that core inflation is stable in the trough (now 0.9%, after bottoming at 0.6%), the ECB cannot be confident that energy prices, and to a lesser extent some weather-related increase in some fresh vegetable prices, will fade in the coming months, leaving a return to disinflation in its wake. This idea may deter the ECB’s staff from lifting their inflation forecasts very much.

Also, the ECB will be loath to take measures in the presently charged environment that could be destabilizing. Comments from officials show no strong urgency. The market is doing some of that work already in the sense that outside of a few exceptions, like Germany and the Netherlands, have seen short-term interest rates over the past month. Falling commodity prices and rising US rates have helped take the shine off the Australian dollar, which is the strongest of the major currencies so far this year (up 4% even after this week’s 1% drop). The Australian dollar broke out of the $0.7600-$0.7700 range last week. It whipsawed back to into the range on Tuesday, but the slide resumed yesterday, and further losses are seen today. The objective of the range breakout was $0.7500, and that has been taken out today. The yuan was weaker, falling to its lowest level since mid-January but recovered late. The offshore yuan (CNH) fell below the onshore yuan (CNY), and the PBOC might have helped spur the recovery of both. The offshore yuan has been stronger than the onshore yuan most of the year so far. It was seen as a sign that the PBOC was trying to break the bearish speculation that helped create a troubling cycle of a weaker currency and capital outflows. |

FX Performance, March 09 |

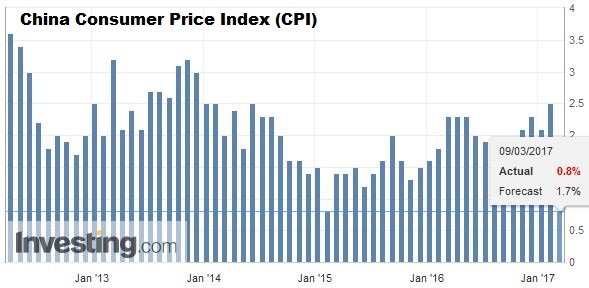

ChinaWhile Chinese producer prices jumped, consumer price inflation slowed markedly. Economists had expected a slowing from the 2.5% year-over-year pace seen in January, but the 0.8% pace what they anticipated. It is the slowest pace since January 2015. It appears to be skewed by an early spring and good vegetable crop. The Lunar New Year may have also distorted. Separately, China reported stronger bank lending in February than expected, but still a market slowing from January. The broader measures of aggregate financing, which also picks up the shadow banking activity, rose less than expected. The CNY1.15 trillion increased compares with a median expectation of CNY1.45 trillion and the CNY3.737 trillion rise in January. |

China Consumer Price Index (CPI) YoY, February 2017(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

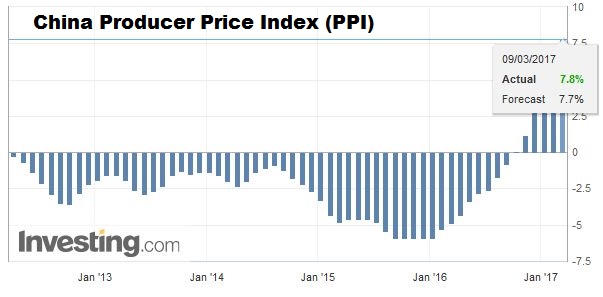

| Moreover, it seems that the pressures spurred by higher commodity prices may be peaking. It is true that China’s PPI jumped to 7.8% year-over-year, which is the fastest pace since 2008 and is seen reflecting commodity prices. However, this is partly a base effect as in the month of February producer prices actually fell (by 0.6%). |

China Producer Price Index (PPI) YoY, February 2017(see more posts on China Producer Price Index, ) Source: investing.com - Click to enlarge |

Crude OilOil prices have fallen, and today, the US WTI is below $50 a barrel for the first time this year. Copper prices are lower for the sixth session and iron ore prices, off over 1% today, also appear to have rolled over. Gold is falling as its down draft enters its fourth session (it has fallen in seven of the past nine sessions). Falling oil prices and rising US yields has taken a toll on the Canadian dollar. Recall the US dollar was testing support near CAD1.30 last month and is above CAD1.35 now, and looks poised to test the nemesis from the end of last year near CAD1.3600. |

Oil Price, February 2017(see more posts on Crude Oil, ) Source: bloomberg.com - Click to enlarge |

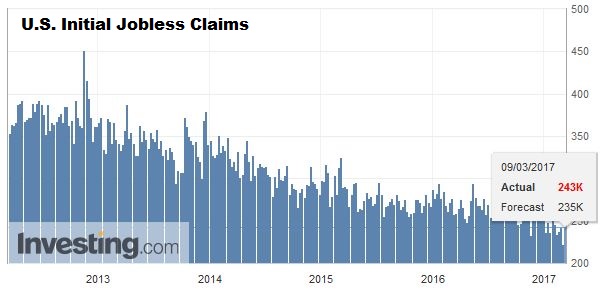

United StatesThe main focus is on the ECB and Draghi’s press conference. Tomorrow’s US jobs data may deter aggressive profit-taking on the dollar today. The US reports import/export prices, and weekly jobless claims. Claims may bounce after falling to new cyclical lows. |

U.S. Initial Jobless Claims, February 2017(see more posts on U.S. Initial Jobless Claims, ) Source: investing.com - Click to enlarge |

Japan

Rising yields appeared to have forced the Bank of Japan’s hands as well. The 10-year yield almost reached the BOJ 10 bp threshold after a poor reception to the MOF’s five-year bond auction. The US 10-year yield premium over Japan reached 2.48% yesterday, the most in nearly three months. This helped the greenback to test the JPY115 level that has largely capped the dollar since mid-January.

We note that the BOJ tweaked its negative deposit rate regime today. It made a small change in the portion of the current account balances at the BOJ to which are exempt from negative rates (“macro add-on balances”) to 17% from 13%.

The softer yen helped Japanese equities edge higher and buck the regional trend that saw the MSCI Asia Pacific Index fall 0.5%, which is now at its lowest level in a month. European stocks are also heavy. The Dow Jones Stoxx 600 rose yesterday and snapped a four-day losing streak, but it is back on the downside today. A close today below 371.80 would be the first below the 20-day moving average since February 7. As one might expect, energy and materials are leading the push lower. On the other hand, rising interest rates is seen as favorable for financials, which coupled with the real estate sector are leading the winners.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,China Consumer Price Index,China Producer Price Index,Crude Oil,Featured,newslettersent,U.S. Initial Jobless Claims