(Disclosure: Some of the links below may be affiliate links) Finpension just started their third pillar offer: Finpension 3a. And it is extremely interesting. Finpension is already behind valuepension, the best vested benefits (second pillar) account available in Switzerland. So, it is great that they now start to offer a third pillar account. So, let’s review Finpension 3a in detail. In this article, I will look at many things about Finpension 3a: their fees, their investment strategy, and its security. Finally, I am also going to compare it against other third pillar providers. Finpension 3a Finpension 3a is a pension foundation that is managed by finpension AG. Finpension 3a is related to the third pillar offer. But finpension has managed other kinds of pension assets, such as

Topics:

Mr. The Poor Swiss considers the following as important: Investing, Switzerland

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

(Disclosure: Some of the links below may be affiliate links)

Finpension just started their third pillar offer: Finpension 3a. And it is extremely interesting.

Finpension is already behind valuepension, the best vested benefits (second pillar) account available in Switzerland. So, it is great that they now start to offer a third pillar account.

So, let’s review Finpension 3a in detail.

In this article, I will look at many things about Finpension 3a: their fees, their investment strategy, and its security. Finally, I am also going to compare it against other third pillar providers.

Finpension 3a

Finpension 3a is a pension foundation that is managed by finpension AG. Finpension 3a is related to the third pillar offer. But finpension has managed other kinds of pension assets, such as vested benefits with their valuepension offering, since 2017.

Finpension started with the yourpension collective foundation that is a pension solution for the extra-mandatory part of the second pillar. Customers liked it so much they wanted to keep their account after they stopped working. So, finpension started their vested benefits offering (valuepension). And now, they have started their third pillar offering: finpension 3a, in 2020.

It is important to note the foundation itself is separated from the management company itself. Doing so allows for having a clear separation of books for the assets.

The third pillar account can be accessed via the mobile application available on the App Store and the Google Play Store. But they have plans to offer a web interface as well in the coming months.

Investment Strategies

Finpension 3a is heavily focused on investing in the stock market. For this goal, they offer access to 6 different strategies:

- Finpension Equity 0

- Finpension Equity 20

- Finpension Equity 40

- Finpension Equity 60

- Finpension Equity 80

- Finpension Equity 100

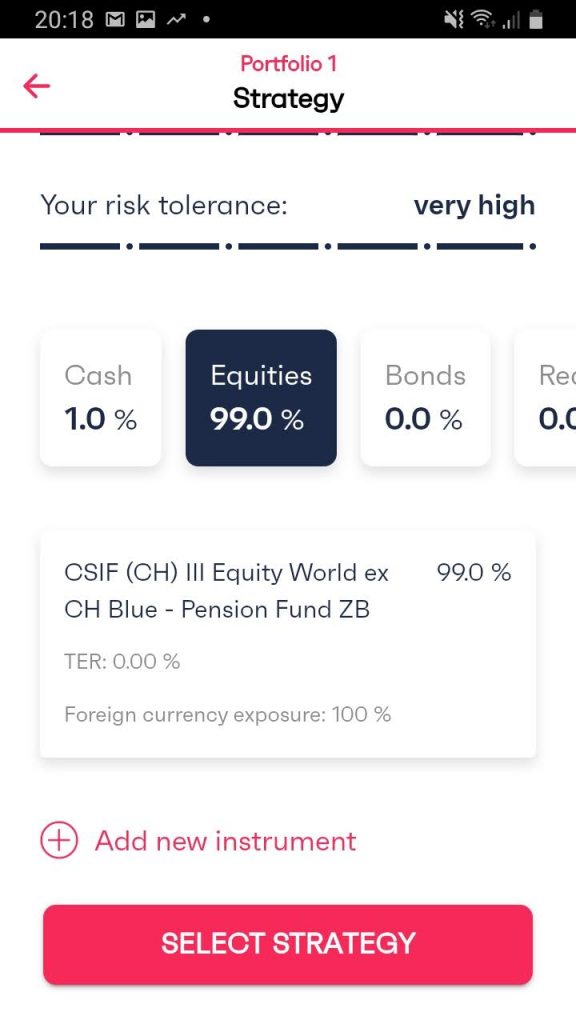

The number in the strategy is the allocation to stocks in the portfolio. The rest of the portfolio is allocated to bonds and 9% to real estate. But each strategy has 1% allocated to cash. For instance, Finpension Equity 100 is 99% of stocks, and 1% of cash. Finpension Equity 60 has 60% of stocks, 30% of bonds, 9% of real estate, and 1% cash. Finpension Equity 0 has 99% allocated to bonds and 1% in cash.

And on top of these strategies, you can choose three different investment focuses:

- Global: A globally-diversified portfolio.

- Switzerland: A portfolio with a focus on mostly Swiss equities.

- Sustainable: A portfolio investing only in sustainable companies, mostly with ESG principles.

So, together, you can choose between 18 strategies. There should be enough for everybody! If you are not satisfied with the strategies proposed, you can create your own individual strategy. For this, you will be able to pick in their large range of index funds.

finpension 3a does not invest in Exchange Traded Funds (ETFs) but in index funds. There are several advantages to doing that, from a pension foundation perspective:

- They can reclaim the withholding taxes on dividends on foreign stocks.

- There is no stamp duty to pay for these funds, compared to ETFs.

- They access extremely cheap funds that are normally reserved for institutional investors.

To be precise, they invest in Credit Suisse institutional funds, which are big, efficient, and cheap.

All the strategies are very well detailed on the website. You can see in which index funds each strategy is investing in. For instance, here is the finpension equity 100 strategy:

This strategy has a good mix of Swiss Stocks and Global Stocks. And it also has a good diversification between small caps and large caps. If I were doing it myself, I would use fewer funds, but this strategy should be a good fit for most people.

Keep in mind that you cannot be uninvested with Finpension 3a. You cannot have an account with 100% in cash. If you do not want to invest 99% in stocks, you will have to invest in bonds. The problem is that currently Swiss and European bonds have negative yields. As such, they are a poorer investment than cash. This may change in the future, but this is the case. So, strategies that invest in bonds are not that good.

Creating your custom strategy can be done from the mobile application. It is straightforward, and you have very few limits on what you are doing. You can invest 99% in a World index fund (minus CH), and you will have an extremely simple and well-diversified portfolio. And it will be an extremely cheap portfolio! One of the limits you have is that you cannot have too much invested in a single stock. You will have limits on Swiss Stock Market Indexes that are heavily weighted in three huge companies.

It is interesting to note that all of their strategies have only 1% cash. You cannot have a cash third pillar account. However, if you choose a custom strategy, you can use a money market fund. So, you will be able to invest mainly in stocks, bonds, real estate, and alternatives (currently only gold).

The cash in your account (after a deposit) is used to buy shares of the funds on the first banking day of the month. And if you want to change strategy (free of charge!), the change will be done on the first banking day.

Your portfolio will be rebalanced once a month, on the first banking day of the month. Rebalancing happens if the allocated deviates for more than one percentage point.

Overall, the investing strategies of the finpension 3a accounts are great! I do not have much to say about it. They offer a great allocation to stocks, a great diversification, and an excellent ability to customize the portfolio. And on top of that, they do not force currency hedging on you, which is another great thing.

However, if you do not want to invest 99% in stocks, you will be forced to invest in negative-yielding bonds. So, these accounts are great for 99% in stocks, but not that great for people with a smaller allocation to stocks.

Fees

Now that we have seen their investing strategies let’s look at the fees of investing with finpension 3a.

Finpension is using a flat rate for their fees. This flat rate is set at 0.39%, without VAT. With a VAT of 7.7%, this flat rate is 0.42%. Therefore, we will use 0.42% as the base fee. The 0.39% fee is the marketing number.

On top of that, you will pay the product costs. These costs depend on which strategy you are using. Fortunately, finpension is an institutional client of Credit Suisse. And institutional clients can get zero-fees on some of the index funds. So most of the funds will have zero fees. There are a few exceptions like Real Estate funds and Emerging Funds. But even these exceptions have very low fees.

For instance, the finpension Equity 100 strategy has 0.02% product costs. And even better, if you do a custom strategy, you can reach 0.00% product costs!

So, with the Equity 100 strategy (the best strategy for the long-term), you will have total costs of 0.44% per year! This fee is incredibly low, 10% cheaper than the cheapest alternative! And if you use a custom strategy, you can reach 0.42%!

And it is really it! Finpension does not charge any margin on foreign currency exchanges. But the bank they are using has a spread of 0.05% on currency conversion. Importantly, most of their funds are in CHF. They do not have any load or redemption fees. But some funds have small load and redemption fees (below 0.10%).

Overall, the fees of the Finpension 3a account are excellent! All of their fees are at least as good as the cheapest third pillar in Switzerland, and often better. Finpension 3a account is the cheapest third pillar account for people wanting to invest heavily in stocks!

Open a Finpension 3a account

Opening a Finpension 3a account is very easy and can be done in a few minutes. Open your phone, download the finpension app on your favorite app store, and follow the process as you go.

They will start by asking for your phone number and a password for your account. Then, they will compute your investment horizon based on your age.

After that, you will have to answer the common questions about your risk tolerance. And they will use that to choose an investment strategy for you. But if you do not like the suggested strategy, you can choose your own. And do not worry, you can change it later too.

After you have chosen the strategy, you will have to fill in your personal information, and that is it! Your account is ready to welcome a deposit already. It is very smooth.

A great thing is also that you can create up to five portfolios per person. It means that you can make staggered withdrawals to optimize your taxes. For more information on this optimization, read my article on the third pillar.

Security

If you want this money to last for a long time, it is important to consider the security of each institution.

Let’s start with the technical security of the Finpension 3a application. All the communications between the application and the servers are encrypted. And you will connect with a phone number and a password.

My main complaint here is that the application is not bound to your phone. It means that you can connect from any phone. I would have preferred a second-factor authentication. Now, it is not critical since you cannot withdraw money directly from the application. But you can access a lot of information and numbers on it. So extra security would be good.

Also, I would actually prefer having a proper identification check when creating an account.

Your cash will be held in the custodian bank of the finpension 3a foundation. The current custodian bank is Credit Suisse. This cash is protected by Swiss law, up to 100’000 CHF. Since strategies at Finpension 3a have very little cash, this should not be an issue.

As for your securities, they are invested in Credit Suisse’s institutional funds. Credit Suisse is managing more than 100 billion CHF in pension assets. It is a good point to have a large manager, not a small unknown bank.

All the funds are set on the balance sheet of the foundation. And this foundation only has client assets on its balance sheet. So, even if finpension (the asset managers) goes bankrupt, the funds are safe in the foundation. And the foundation will have to find a new manager.

Overall, I think that the security of the Finpension 3a is sufficient but could be better. The fact that the foundation is separated from the asset management company is a great thing for safety. I wish for extra authentication and identification on the app. But it should not put your assets at risk.

Finpension 3a vs VIAC

Until now, I have always recommended VIAC as the best third pillar in Switzerland. So, let’s see how Finpension 3a compares to VIAC. Is it the new best third pillar account of Switzerland?

Let’s start with the fees. Finpension 3a is significantly cheaper, with 0.44% (0.42% with custom strategy) than VIAC at 0.51%. It may not seem much, but this is more than 10% lower fees!

On top of that, Finpension has a very low spread (0.05%) for currency conversion, while VIAC has a large one (0.75%). Now, it is true that VIAC is using netting to reduce that fee. In practice, it cost less than 0.25% with netting. Also, a lot of funds are in CHF, which makes it cheaper. And it is a one-time cost. But it is still cheaper at Finpension 3a.

With Finpension 3a, you can invest up to 99% in stocks while you are limited to 97% with VIAC. Again, it is not a huge difference, but it will add up in the long-term.

You also have more freedom when creating a custom strategy with finpension 3a than with VIAC. For instance, you can create a portfolio with a 99% foreign currency exposure with Finpension 3a while VIAC limits you to 60%! This feature is great for investors with particular needs!

If you do not want to have 99% invested in stocks, VIAC may be better than Finpension 3a. Indeed, they let you invest in cash. With finpension 3a, you will have to invest in negative-yielding bonds which may not be great. So, for low allocation to stocks, VIAC may be better.

VIAC can be a little more practical since they have a mobile application and a web application, while Finpension only has a mobile application. But Finpension indicated that they would introduce a web application in the future.

Both services are quite transparent and look very honest. And they both have a good level of security and safety for your assets. They both have a great reputation as well.

Given that higher allocation to stocks and the lower fees, Finpension 3a is a better third pillar than VIAC. This makes Finpension 3a the new best third pillar in Switzerland!

For people that do not want to be fully invested in stocks, VIAC is probably still better. It does not make much sense currently to invest in negatively-yielding bonds. But if you have a long investing horizon in front of you, you should consider investing fully in stocks.

In the future, I will make a detailed comparison of these two third pillar accounts. Let me know if you would be interested in such an article.

Finpension 3a Pros

Let’s quickly summarize the advantages of Finpension 3a:

- Extremely low fees!

- You can invest up to 99% in stocks.

- No currency hedging is forced on the investors.

- Straightforward registration process.

- You can create a custom investing strategy with a lot of freedom.

- No foreign equity limit

- No foreign currency limit

- Excellent transparency on all the funds and fees on their website.

- You can create up to five portfolios.

Finpension 3a Cons

Let’s quickly summarize the disadvantages of Finpension 3a:

- Invest in negative-yielding bonds.

- Only a mobile application, no web interface.

- No second-factor authentication on the mobile application.

- No referral program to reduce fees even further.

Conclusion

I was expecting a good third pillar account by finpension, and I am not disappointed. The finpension 3a offer is a great third pillar account. It is even actually the new best third pillar in Switzerland (for people investing fully in stocks).

The fees are very low, with a minimum of 0.44% with the proposed strategies. And you can even go to 0.42% with a custom strategy. The overall pricing system is very advantageous, as well.

On top of that, you can invest up to 99% in stocks. And with a custom strategy, you can have an extremely well-diversified portfolio with only one or two funds.

All this makes Finpension 3a better than VIAC! I do not plan on moving my funds directly, but it is something I am going to consider in the future. We will see if VIAC makes any changes in reaction to this announcement or not. But if you do not have one already, Finpension 3a is a great third pillar to get started!

Now, there is one area where Finpension is better than VIAC. If you do not invest fully in stocks, VIAC may be cheaper. Indeed, with Finpension you will have to invest in negative-yielding bonds. At VIAC, you will be able to invest in cash (with a 0.1% return), which is currently better than bonds. And at VIAC, you will only pay the fees on the invested part.

But for aggressive investors like me, Finpension 3a is currently better than VIAC.

If you liked this review, you will like my review of finpension vested benefits offer – valuepension.

What do you think of this new Finpension 3a account?