Investec Switzerland. The SMI is set to end the week modestly lower along with global stocks after earnings reports from pharmaceuticals heavyweights Roche and Novartis fell short of analyst’s estimates. Global markets experienced another volatile week amid ongoing speculation over whether central banks will come to the rescue of turbulent financial markets. A bad week for Novartis – © Lucaderoma | Dreamstime.com The slowdown in China and central remained central to investor sentiment this week. Chinese stocks lost further ground after data showed that capital outflows from the mainland reached a record trillion in 2015, more than seven times more than the whole of 2014. In the US, Federal Reserve Chair Janet Yellen and her colleagues opened the door to a change in their outlook for the economy this year and possibly a slower pace of interest- rate hikes that would make another upward move on rates in March less likely. The Fed acknowledged that recent economic data has been weak and that the current market turbulence may pose a risk to the US economy. Shares in US companies, along with the USD, fell after the statements release. On Friday stocks received a boost after the Bank of Japan unexpectedly stepped up monetary stimulus.

Topics:

Investec considers the following as important: Business & Economy, Investec Switzerland, Novartis, Swiss company news, Swiss franc outlook

This could be interesting, too:

investrends.ch writes Novartis erhöht seine Prognose zum 9. Mal in Folge

investrends.ch writes Novartis kündigt Milliarden-Investitionen in den USA an

investrends.ch writes Pharma-Aktien im freien Fall

investrends.ch writes Sandoz-Familienstiftung verkauft Paket an Novartis-Aktien

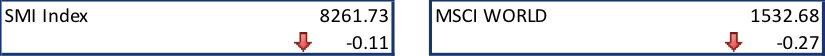

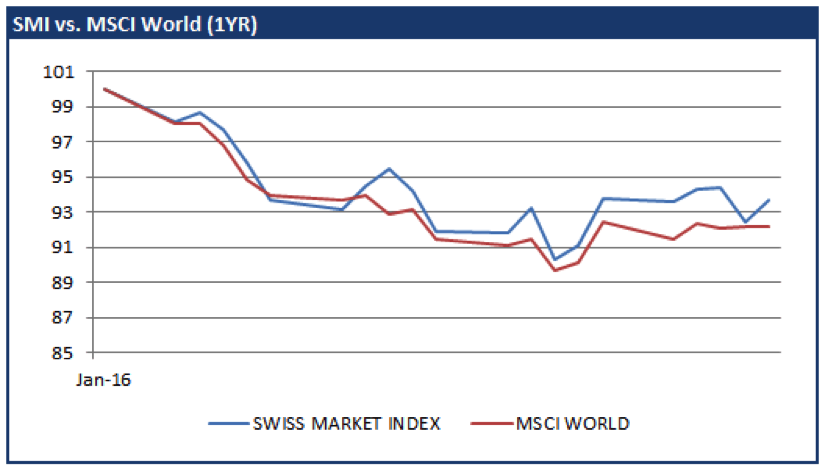

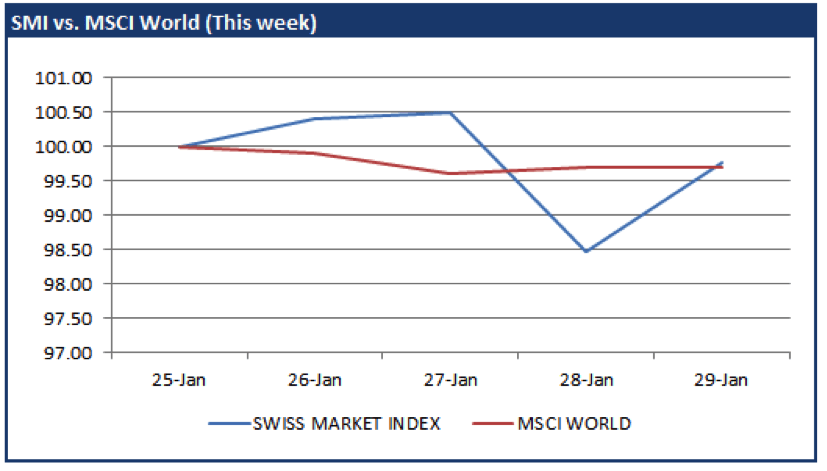

The SMI is set to end the week modestly lower along with global stocks after earnings reports from pharmaceuticals heavyweights Roche and Novartis fell short of analyst’s estimates. Global markets experienced another volatile week amid ongoing speculation over whether central banks will come to the rescue of turbulent financial markets.

A bad week for Novartis – © Lucaderoma | Dreamstime.com

The slowdown in China and central remained central to investor sentiment this week. Chinese stocks lost further ground after data showed that capital outflows from the mainland reached a record $1 trillion in 2015, more than seven times more than the whole of 2014. In the US, Federal Reserve Chair Janet Yellen and her colleagues opened the door to a change in their outlook for the economy this year and possibly a slower pace of interest- rate hikes that would make another upward move on rates in March less likely. The Fed acknowledged that recent economic data has been weak and that the current market turbulence may pose a risk to the US economy. Shares in US companies, along with the USD, fell after the statements release.

On Friday stocks received a boost after the Bank of Japan unexpectedly stepped up monetary stimulus. The BoJ announced a negative interest-rate strategy to spur banks to lend in the face of a weakening economy, surprising markets.

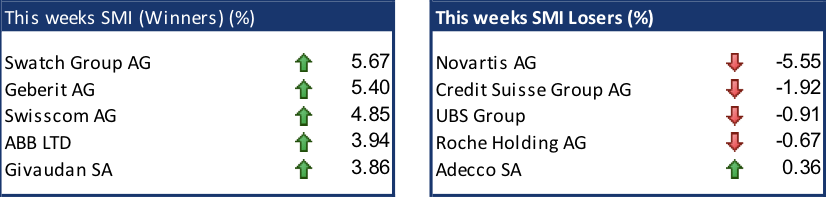

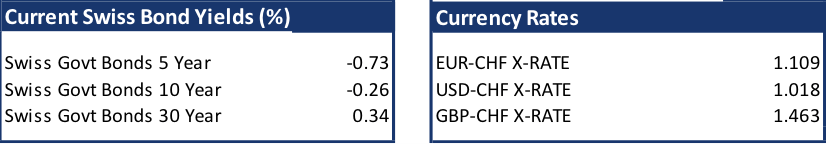

Swiss franc outlook

In Switzerland, the franc remains at its weakest level against the euro since the Swiss National Bank dropped its currency cap a year ago. However, potential new stimulus from the European Central Bank , suggested by ECB Head Mario Draghi last week, could reverse the single currency’s upward trend against the franc. For SNB president Thomas Jordan, that may mean cutting rates further below zero in response. Euro-area monetary policy has repeatedly forced an SNB response and further easing from the ECB could undermine Swiss efforts to weaken the franc. In economic data, Swiss watch exports posted their first annual drop in six years, hurt by slumping demand for less expensive timepieces that are competing with Apple and other smartwatch makers.

Swiss company news

In company news, Swiss pharmaceuticals made headlines this week after Roche Holding AG, Europe’s largest drug maker, reported that full year profits missed analyst estimates. The company blamed the strong Swiss franc and higher taxes for the disappointing performance. Novartis AG, Europe’s second-largest drug maker, also disappointed as its Alcon eye-care unit continued to plummet and the strength of the US dollar eroded the value of global sales. CEO Joe Jimenez stated that the golden days of unfettered price increases are over in the US as the soaring cost of some medicines has sparked a controversy that’s hampered drugmakers’ ability to raise prices in their biggest and most profitable market.