Gold falls from seven year high weekly close◆ Gold prices fell 0.6% today after reaching a seven year weekly high close at 87.90/oz on Friday, gold’s highest weekly price settlement since March 2013, a 4% gain in January and its second straight monthly climb. ◆ Chinese stocks crashed over 7.7% overnight as investors got a chance to react to the worsening coronavirus outbreak which also saw European equities seeing some selling and economically sensitive commodities like oil fall in value ◆ The Shanghai Composite (SHCOMP) fell 7.7% and the Shenzhen Component Index collapsed nearly 8.4% on their first day of trading after an extended Lunar New Year holiday which had seen them closed since January 24. Spot Gold Price - Click to enlarge ◆ Chinese authorities

Topics:

Mark O'Byrne considers the following as important: 6a.) GoldCore, 6a) Gold & Bitcoin, Daily Market Update, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

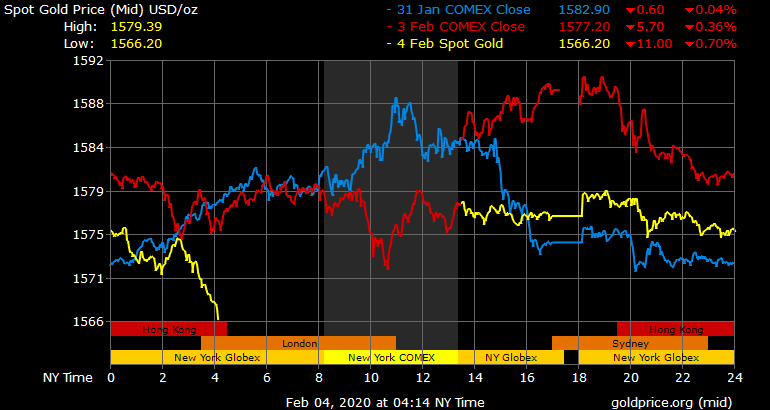

| Gold falls from seven year high weekly close◆ Gold prices fell 0.6% today after reaching a seven year weekly high close at $1587.90/oz on Friday, gold’s highest weekly price settlement since March 2013, a 4% gain in January and its second straight monthly climb.

◆ Chinese stocks crashed over 7.7% overnight as investors got a chance to react to the worsening coronavirus outbreak which also saw European equities seeing some selling and economically sensitive commodities like oil fall in value ◆ The Shanghai Composite (SHCOMP) fell 7.7% and the Shenzhen Component Index collapsed nearly 8.4% on their first day of trading after an extended Lunar New Year holiday which had seen them closed since January 24. |

Spot Gold Price |

| ◆ Chinese authorities pledged to use all monetary policy tools to ensure liquidity remains ample and prevent contagion amid the virus outbreak in Wuhan, which has so far claimed 361 lives.

◆ China’s central bank cut reverse repo rates and injected massive liquidity worth a hefty 1.2 trillion yuan into markets to help support them and to support an economy beginning to be impacted by the coronavirus outbreak. ◆ The risk of a deepening slowdown of the Chinese economy and then the global economy is high and the virus looks like it may be the straw that breaks the camel’s back. This will likely force other central banks to move to ultra loose monetary policies again in the coming weeks which will be bullish for gold. ◆ Gold prices may see support at $1,573 per ounce, prior to resuming their uptrend according to Reuters technical analyst Wang Tao. |

10 Year Gold Price in USD/oz, 2011-2020 |

In this special podcast to celebrate GoldCore’s appointment as an Approved Distributor of The Royal Mint, the GoldCore team discuss the ‘3 Key Things to Protect Your Finances in the 2020s’ |

Tags: Daily Market Update,Featured,newsletter