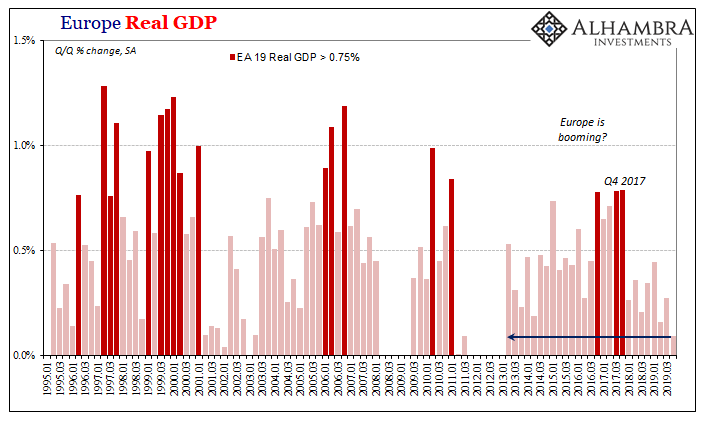

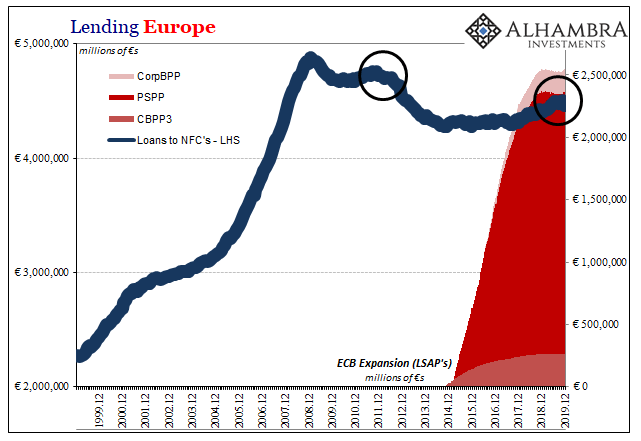

Rolling over in credit stats, particularly business debt, is never a good thing for an economy. As noted yesterday, in Europe it’s not definite yet but sure is pronounced. The pattern is pretty clear even if we don’t ultimately know how it will play out from here. The process of reversing is at least already happening and so we are left to hope that there is some powerful enough positive force (a real force rather than imaginary, therefore disqualifying the ECB) to counteract the negative tendencies in order to set them straight before it becomes too late. Europe Real GDP, 1995-2019 - Click to enlarge The European economy is right now skirting that fine line, as far as GDP is concerned. European Economy, 2004-2019 - Click to enlarge Lending Europe,

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, business credit, C&I loans, C&I loans, Commercial and Industrial Loans, Construction Spending, credit standards, currencies, disinflationary pressures, economy, eurodollar system, Featured, Federal Reserve/Monetary Policy, global headwinds, jay powell, Markets, newsletter, non-residential fixed investment, rate cuts, richard clarida, sloos, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

Rolling over in credit stats, particularly business debt, is never a good thing for an economy. As noted yesterday, in Europe it’s not definite yet but sure is pronounced. The pattern is pretty clear even if we don’t ultimately know how it will play out from here. The process of reversing is at least already happening and so we are left to hope that there is some powerful enough positive force (a real force rather than imaginary, therefore disqualifying the ECB) to counteract the negative tendencies in order to set them straight before it becomes too late. |

Europe Real GDP, 1995-2019 |

| The European economy is right now skirting that fine line, as far as GDP is concerned. |

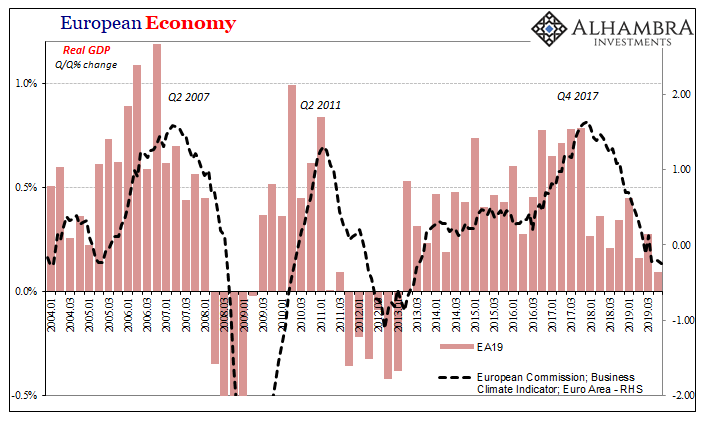

European Economy, 2004-2019 |

Lending Europe, 1999-2019 |

|

| As I’ve been writing since early 2018, though, Europe’s problems aren’t European alone. They are shades of our own future, that side of the Atlantic merely ahead in time of the American economy in this downturn process.

These global headwinds and disinflationary pressures; the “dollar”, more or less. Even when suggesting that things are now going right, officials over here have to concede it is in these crucial places like capex where they hadn’t been. Federal Reserve Vice Chairman Richard Clarida had proposed in early January:

If these headwinds are indeed abating, we should be able to see that in investment or at least factors related to it. |

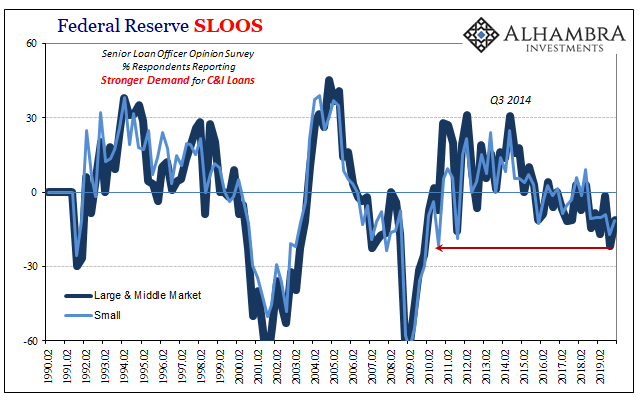

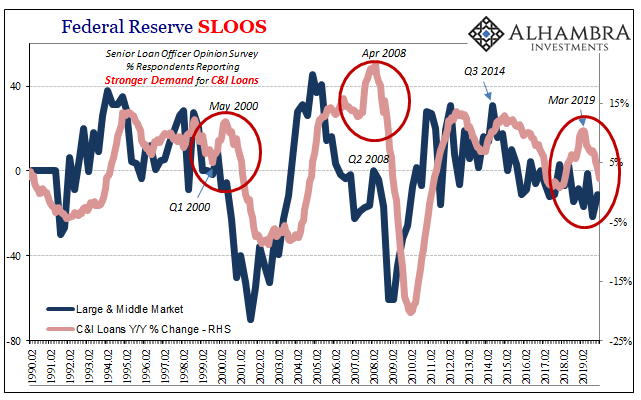

Federal Reserve SLOOS, 1990-2019 |

| The crucial financial influences like debt and demand for lending.

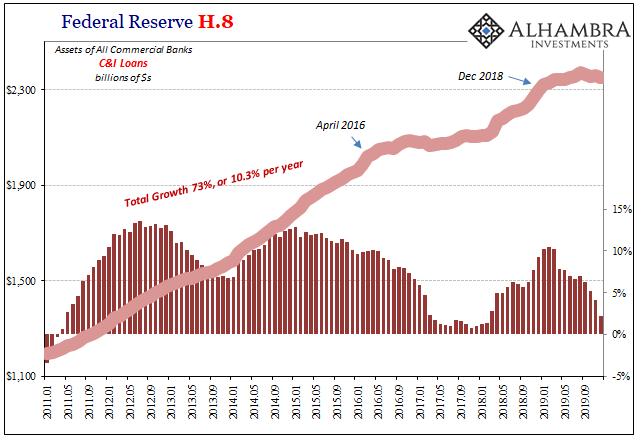

Along those lines the Federal Reserve has more bad news for Federal Reserve Chairman Clarida. According to the latest results of its Senior Loan Officer Opinion Survey (SLOOS), demand for Commercial and Industrial (C&I) loans remained very weak in January 2020. Conducted quarterly, the current stats are statistically the same as they had been in the previous one. Respondents, who are, as the name states, senior loan officers inside the banking system, have told the Fed that demand for C&I debt continues to linger at extremely low levels. Maybe not recession-type conditions, but not all that different from them, either. As you might expect, what these loan officers say to the central bank about credit conditions on the commercial side does correlate with ultimate credit conditions on the commercial side. In more data compiled by the Federal Reserve, release H.8, we see that the balance for total loans in the C&I sector are threatening to rollover in much the same way (and match much the same timing) as in Europe. |

Federal Reserve H.8, 2011-2019 |

Federal Reserve SLOOS, 1990-2019 |

|

| An increase of just 2.2% year-over-year in December 2019 was the lowest since early 2018, and if the SLOOS indications are right about demand going forward there’s a good chance over the next few months we’ll see the first negative in C&I since 2011– making a complete US rollover in business credit that much more of a real possibility.

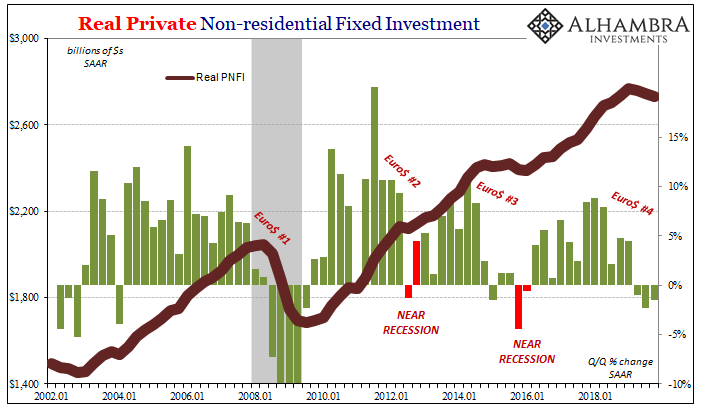

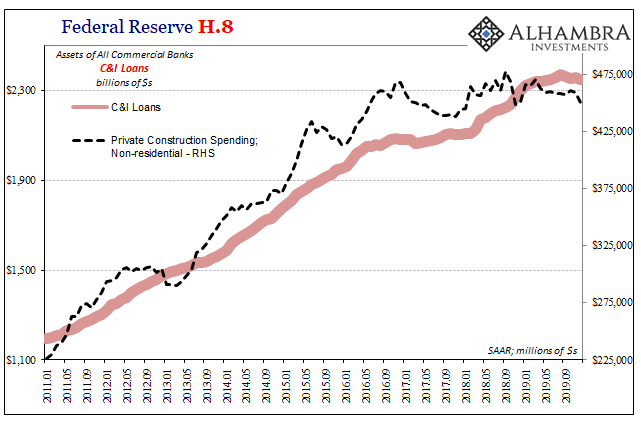

And that, of course, carries very real economic consequences. Reduced borrowing means (the possibility of reduced share buybacks!!) a reduced appetite for productive capital investment. That much we already know from the latest GDP report, as well as having kept track of the Census Bureau’s data on non-residential construction spending. Among the former class of estimates, GDP, Real Private Non-residential Fixed Investment was down in Q4 2019, the third quarterly negative in a row. |

Real Private Non-residential Fixed Investment, 2002-2018 |

| In terms of construction spending, an accelerating downside to end last year. |

Federal Reserve H.8 2011-2019 |

| Surprisingly, then, Richard Clarida has got it mostly right: global headwinds and disinflationary pressures (“dollar”) that in 2019 led to a worldwide manufacturing recession which has hit the US economy in that place leading to so far slightly lower productive investment.

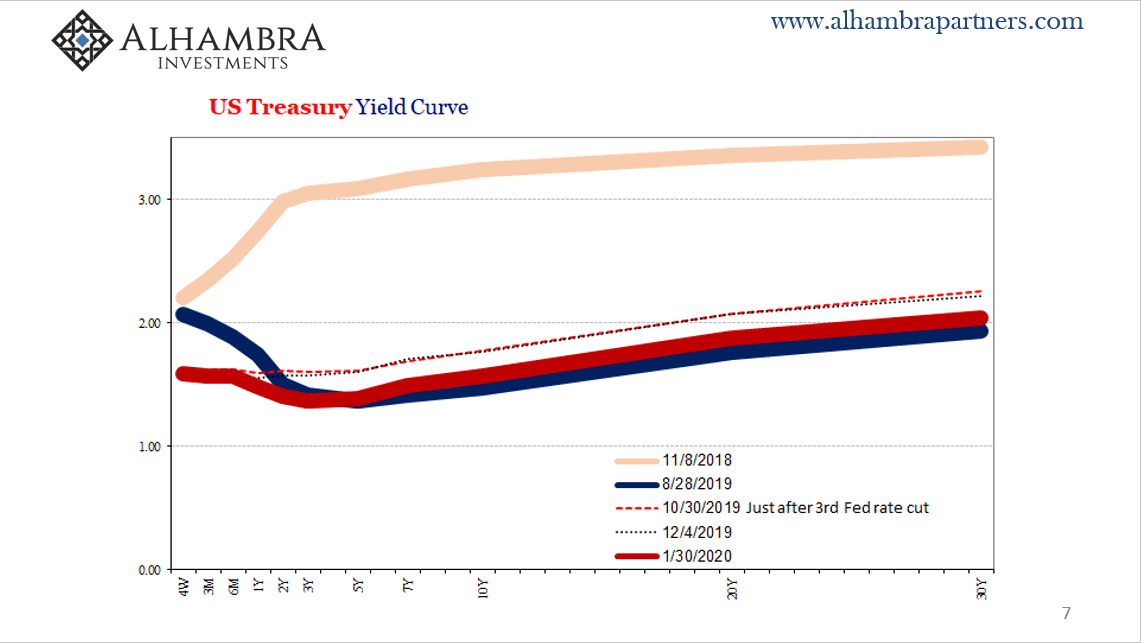

Except, now Clarida like Jay Powell contends that these pressures have abated or are in the process of abating. Based on what, though? There’s more evidence that these are, in terms of credit, continuing to roll over. And if credit falls the chances of “abating” are essentially zero. We also should keep in mind how the markets throughout 2018 had warned people like Richard Clarida (and Jay Powell) that this was going to happen. Today, in hindsight, he agrees but only long after he ignored all the warnings and childishly dismissed them as “mispriced” bond yields. Since bond yields (globally) haven’t actually moved all that much since August, when the recession fears were at their mainstream highest, again, on what basis are we meant to be seeing “abating?” He thought interest rates were wrong two years ago, and he implies today (more than a hundred basis points lower) they must be wrong again. What the bond market was warning everyone about in 2018 was that the boom wasn’t actually booming, thus the (liquidity) risks of something going wrong before it did (assuming it ever could have) were getting too high. By November 2018, it was too late; the landmine. Curve collapse and inversions (plural) were the signals. |

US Treasury Yield Curve |

What the bond market has been warning everyone about late in 2019 is that the turnaround had better actually turn the economy around at some point. In actual fact, not just in opinionated descriptions reprinted in the media as weighty fact. Even those sentiment numbers that suggest the possibility can’t manage to do so without serious questions.

In data and evidence, Q4 struck out.

Maybe Q1 will get it done, but one-third of the way through it’s not looking so hot; not enough, or any, different for curves or data.

Tags: Bonds,business credit,C&I loans,Commercial and Industrial Loans,Construction Spending,credit standards,currencies,disinflationary pressures,economy,eurodollar system,Featured,Federal Reserve/Monetary Policy,global headwinds,jay powell,Markets,newsletter,non-residential fixed investment,rate cuts,richard clarida,sloos,U.S. Treasuries,Yield Curve