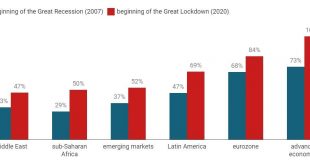

The 2020 recession, which many countries are still going through, now has an “official” name: the Great Lockdown. In economic terms, the public sector’s response in practically all countries has been very swift and bold (which is not necessarily a good thing).1 This has caused the global public debt to skyrocket as never before. As a result, now more than ever, it is necessary to emphasize the dangers of public debt. In this article, we will highlight the contrasts...

Read More »Fed to Treasury Dealers and Congress: We Can’t Count On You, We’re Taking Charge

The Fed sees itself as trapped by the incompetence and greed of the other players and by its own policy extremes that were little more than expedient “saves” of a system that is unraveling due to its fragility and brittleness. There are two standard-issue narratives about the Federal Reserve’s agenda: the Fed’s official narrative is that the Fed’s mandate is to keep inflation under control while promoting full employment. The unofficial mandate that’s obvious to...

Read More »77: Four Reasons Why Inflation is Transitory

"Inflation" is a generalized, sustained increase in consumer prices. A spike in consumer prices is just that - a transitory spike. Watch as Jeff gives four reasons and examples (2000, 2008, 2021 bond yields and auctions) why the probabilities favor a rise in CPI, not "inflation". ---------SEE IT----------- Twitter: https://twitter.com/JeffSnider_AIP Twitter: https://twitter.com/EmilKalinowski Alhambra YouTube: https://bit.ly/2Xp3roy Emil YouTube: https://bit.ly/310yisL...

Read More »FX Daily, May 24: China Action on Commodities and Crypto Featured

FX Rates Overview: The US dollar is firmer in the European morning after starting out with a softer bias in Asia Pacific turnover. The dollar-bloc currencies, sterling, and the Swiss franc are heavy, but ranges are narrow, and consolidation seems to be the flavor of the day. Central and Eastern European currencies are faring best among emerging markets, but the JP Morgan Emerging Market Currency Index is little changed. Benchmark 10-year yields are also hovering...

Read More »Charles Hugh Smith on the Era of Accelerating Expropriations

http://financialrepressionauthority.com/2021/05/20/the-roundtable-insight-charles-hugh-smith-on-the-era-of-accelerating-expropriations/

Read More »FX Daily, May 20: Market Stabilize after Yesterday’s Tumultuous Session

Swiss Franc The Euro has fallen by 0.18% to 1.0981 EUR/CHF and USD/CHF, May 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: US equity indices finished lower, but the real story was their recovery. Asia Pacific equities were mixed, with Australia’s 1.5% rally leading the recovery in some markets, including Tokyo and Singapore. Europe’s Dow Jones Stoxx 600 is up a little more than 0.5% near mid-session, led...

Read More »“Everything Is On Fire”

Authored by Egon von Greyerz via GoldSwitzerland.com, “Everything is on fire” – Heraclitus (535-475 BC) What Heraclitus meant was that the world is in a constant state of flux. But the big problem in the next few years is that the world will experience a fire of a magnitude never seen before in history. I have in many articles and interviews pointed out how predictable events are (and people). This is particularly true in the world economy. Empires come and go,...

Read More »UBS International Pension Gap Index: Swiss pensions – an international comparison

Pension schemes are as diverse as the cultures of the countries whose working population they insure. Nevertheless, they all aim to guarantee a certain level of income in retirement. The UBS International Pension Gap Index, first released in 2017, analyses the sustainability and adequacy of the pension promises across 24 jurisdictions. This is done on the basis of the private savings rate required by an average person of 50 today to maintain their standard of living...

Read More »Where Europeans Get To Work From Home

The social distancing measures introduced in response to the Covid-19 pandemic has forced many people to work from home and accelerated the trend of remote working. Eurostat have released some interesting new data showing the share of employed people aged between 15 and 64 in Europe who usually do home office. As Statista’s Miall McCarthy notes, over the past decade, that has been hovering at around five percent and the pandemic has seen it rise to 12.3 percent....

Read More »Public trust in Swiss banks soars amid pandemic

A Covid credit programme has helped boost the reputation of Swiss banks, despite some of them being the target of climate protests. © Keystone / Christian Beutler Swiss people’s trust in their country’s banks is at its highest in 20 years, boosted by Covid credits and a commitment to sustainability, according to a new survey. People from almost all political camps have a positive perception, with 75% describing their attitude towards Swiss banks as positive or very...

Read More » SNB & CHF

SNB & CHF