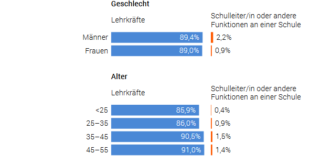

14.10.2022 – The number of teachers in compulsory education is expected to rise by around 6% up until 2031 due to population growth. Between 43 000 and 47 000 new primary teachers will have to be recruited by then. For the lower secondary level, between 26 000 and 29 000 new teachers will be needed. Furthermore, 90% of those teaching in compulsory education in 2015 who were aged under 55 at that time were still working in a school five years later, according to two...

Read More »Credit-default swaps: the case for the defence

Vultures, rats and maggots are often the focus of disgust, less because of anything for which they can be blamed, and more because of the conditions with which they are associated. Death, disease and squalor carry a stigma that is hard to shake. Something similar is true of credit-default swaps, financial instruments that make headlines during market turmoil and economic misery. When charts of credit-default swap prices begin to crop up in financial research it is...

Read More »Bitcoin Indikator deutet auf Bounce Back hin

Der „Crypto-Winter“ ist noch in vollem Gange, doch der tatsächliche Winter könnte für den BTC richtig heiß werden. Einer der aussagekräftigsten Indikatoren ist diese Woche grün geworden. Analysten prognostizieren daher einen Bounce Back des Kurses noch in diesem Winter. Bitcoin News: Bitcoin Indikator deutet auf Bounce Back hin Es handelt sich beim Indikator um das Handelsvolumen. Dieser Wert stieg im wöchentlichen und täglichen Durchschnitt zuletzt klar an, so dass...

Read More »“The British people are politically homeless – Part I”

Interview with Godfrey Bloom: Part I of II A lot has been said and written about Britain’s political and economic woes since Brexit, and even more so over the last two years. Overwhelmingly, mainstream media coverage has been negative and many of the nation’s problems have been blamed on Brexit itself. The role of the lockdowns, the forced business closures and especially of the extreme fiscal and monetary interventions during the Covid crisis has been downplayed,...

Read More »Can We Look Past US CPI ?

Overview: There seems to be a nervous calm today ahead of the US CPI. The dollar is hovering near JPY147 but the risk of BOJ intervention in the North American session seems slim. The BOE’s emergency Gilt buying operation ends tomorrow and UK bonds yields have tumbled. While equities in the Asia Pacific region lost ground, Europe’s Stoxx 600 is trying to snap a six-day decline. US equity futures are firm. Yields in Europe are mostly 3-6 bp lower, and despite...

Read More »Physical Gold & Why I Hold it – Bubba Horwitz

Founder and CEO Todd Bubba Horwitz joins GoldCore TV’s Dave Russell to discuss the Great Reset, physical gold investment forthcoming stagflation . This is Bubba’s first appearance on GoldCore TV , and we’re delighted to welcome him. When Dave spoke to Bubba, they covered a lot of ground: from the rock and a hard place that the Fed finds itself in, to the impact on the housing market, the Green New Deal, the oil price and, of course, the price of both gold and...

Read More »College as an Economic and Social Problem: Dealing with the Culture

Jeff Deist recently posed the question “Is College Worth It?” My first thought when I opened the article was that he could have reduced the entire piece to a single word: “no.” This cynicism might seem odd coming from somebody who is nearing the end of a PhD program in history, which takes an average of eight years to complete, not including the years spent acquiring a BA and, for many students, an MA before even starting on the doctorate. But this experience has...

Read More »New World Stage calls for overhaul of UN Security Council

The United Nations’ Security Council goal was to ensure the collective security of humanity. Seventy years after its creation the five-member council needs a massive shakeup if it is to address today’s challenges argues Hassan Nafaa, professor of Political Science at Cairo University. More than seven decades have passed since the United Nations was established to maintain international peace and security. Since then, the world’s political and social landscapes have...

Read More »Everything’s Fixed–Except What’s Broken

Everything's fixed except what's no longer profitable to plunder. Underfunded, ignored, mismanaged by incompetents, it breaks. Everything's fixed--except what's broken. Hmm. Maybe we need to read that again. Everything's fixed means it's been "fixed" like a game or match has been fixed--rigged to benefit insiders while the unwary onlookers and punters have been led to believe that it's "fair and open." That con job is the critical cover to...

Read More »Thomas Jordan: Current challenges to central banks’ independence

In the recent past, the political and economic backdrop has changed dramatically. Inflation is far too high almost everywhere, and central banks are raising their policy interest rates at a time when stocks of government debt are large. In some places, central bank independence is being publicly called into question. Threats to central banks’ independence, and thus to their ability to fulfil their monetary policy mandates, are particularly acute in the current...

Read More » SNB & CHF

SNB & CHF