Zero Hedge published an article on Canadian Bullion Services (CBS) last week. Other sites ran similar articles. The common thread through these articles, and in the user comments section, is that CBS is committing criminal fraud. Or, if not, then it’s a conspiracy by the Canadian government to confiscate gold. Terms like fractional reserve and re-hypothecation were dusted off for the occasion. I don’t know anything about this company other than what I read that day. I am writing today to...

Read More »Great Graphic: Surplus Capacity is not the Same as Insufficient Aggregate Demand

Many economists argue that the key challenge is that of insufficient aggregate demand. That is why world growth is slow. Hobbled with debt, households have pulled back. Business investment is weak. Government dissavings has been offset by household and business savings. The solution offered by some economists is a large public investment program. The G20 encouraged members not to rely on monetary policy, which even some central bankers are concerned, has reached a point of...

Read More »Great Graphic: Gold Triangle–Continuation or Reversal Pattern?

During a period in which the zero bound no longer is the floor of interest rates, and many central banks continue to ease policy, we have been watching gold a bit closer. In early January, we noted that the technical pattern warned of breakout. Our first objective was $1110-$1135. In early February, we updated our view with gold trading near $1150. The charts still looked constructive; we suggested a new target near $1200. The increasingly precious metal rose to almost $1263.5o on...

Read More »Markets Find Steadier Footing

It could have been a disaster. US faltered yesterday, with the S&P 500 again struggling in the 1945-1950 area, and China's PMIs were weaker than expected. However, after initial weakness Asian shares turned higher. The nearly 0.9% rise allowed the MSCI Asia Pacific Index to close at its best level in five sessions. European bourses are firmer, led by the 1.2% rise in the German DAX. The Dow Jones Stoxx 600 is up 0.6% near midway through the session. Consumer discretionary,...

Read More »Retail trade turnover in January 2016: Swiss retail trade turnover falls by 1.3%

01.03.2016 09:15 - FSO, Economic Surveys (0353-1602-20) Retail trade turnover in January 2016 Swiss retail trade turnover falls by 1.3% Neuchâtel, 01.03.2016 (FSO) – Turnover in the retail sector fell by 1.3% in nominal terms in January 2016 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.5% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales...

Read More »January Retail Sales: Real YoY +0.2, Nominal -1.3% YoY

01.03.2016 09:15 – FSO, Economic Surveys (0353-1602-20) Retail trade turnover in January 2016 Swiss retail trade turnover falls by 1.3% in nominal term, +0.2% yoy in retail Neuchâtel, 01.03.2016 (FSO) – Turnover in the retail sector fell by 1.3% in nominal terms in January 2016 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.5% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the...

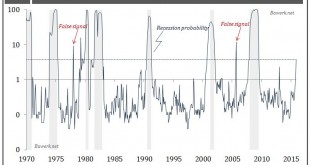

Read More »Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beginning of a recession is not deflationary but the exact opposite. As can be seen from the chart, consumer prices do indeed move higher into recessions as represented by the shaded areas. Why? The most obvious explanation is simply that the...

Read More »Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beginning of a recession is not deflationary but the exact opposite. As can be seen from the chart, consumer prices do indeed move higher into recessions as represented by the shaded areas. Why? The most obvious explanation is simply that the...

Read More »FAQ: UK’s Referendum on EU Membership

What is the issue? The UK has long had a strained relationship with the EU and has never been comfortable with the ever increasing drive for greater integration and harmonization of rules and regulations coming from Brussels. As the EU has grown, more decisions are made by a qualified majority. Previously decision required unanimity. The shift weakens the power of a UK veto. The UK Prime Minister has called for a national referendum on continued UK membership of the EU. When...

Read More »FAQ: UK’s Referendum on EU Membership

What is the issue? The UK has long had a strained relationship with the EU and has never been comfortable with the ever increasing drive for greater integration and harmonization of rules and regulations coming from Brussels. As the EU has grown, more decisions are made by a qualified majority. Previously decision required unanimity. The shift weakens the power of a UK veto. The UK Prime Minister has called for a national referendum on continued UK membership of the EU. When...

Read More » SNB & CHF

SNB & CHF