Recent trends which include firmer equities and oil, weaker euro and bonds, and stronger dollar-bloc currencies are in reverse today, a turn-around Tuesday of sorts. MSCI's Emerging Market equity index is snapping a seven-day advancing streak, giving back yesterday's gains and a little more. However, Chinese shares managed to post small gains. China reported a shocking 25.4% decline in February exports (year-over-year in dollar terms). This was a much larger drop than anyone...

Read More »Swiss Consumer Price Index in February 2016: Consumer prices down 0.8% against 2015

08.03.2016 09:15 – FSO, Prices (0353-1602-40) Swiss Consumer Price Index in February 2016 Consumer prices increase by 0.2% m/m and 0.8% y/y Neuchâtel, 08.03.2016 (FSO) – The Swiss Consumer Price Index (CPI) increased by 0.2% in February 2016 compared with the previous month, reaching 99.8 points (December 2015=100 points). Inflation was -0.8% in comparison with the same month in the previous year. These are the findings of the Federal Statistical Office (FSO). You can find the complete...

Read More »Japan: Data and Flows

Early Tuesday in Tokyo, Japan will announce revisions to Q4 GDP. A downward revision to business spending risks shaving the initial estimate from a contraction of 1.4% at an annualized rate to 1.5%. Regardless, the key takeaway is that the world's third-largest economy contracted in two of the four quarters last year. Recall Initially, the consensus was for a 0.8% annualized contraction in Q4. The anticipated revision means the contraction was nearly twice as much as initially...

Read More »Great Graphic: US 2-year Premium over Germany and Japan at New Cyclical Highs

We argue that the dollar is in its third significant rally since the end of Bretton Woods in 1971. The Reagan dollar rally was driven by the policy mix of tight monetary policy and loose fiscal policy. The G7 effort to stop the dollar's appreciation at the Plaza Hotel in September 1985 marked the end of the Reagan dollar rally. After a nearly ten-year bear market for the dollar, that included the collapse of the Soviet Union, the fall of the Berlin Wall and the ERM crisis, there was a...

Read More »How you see the Stock Market determines your Profit or Loss!

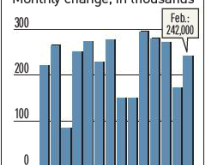

The key economic note this week was that non-farm payrolls for February was 242,000 versus Wall Street’s expectation of only 190,000; 27% above the consensus target. Wages however fell back by 0.1% from February’s gain of 0.5%. The workforce participation rate moved up to 62.9%. The excellent news on Friday was however received mutely by the market. Excellent news received muted by the market The reason was the likelihood that it will increase the probability of further interest rate rises...

Read More »Dollar and Yen Post Gains to Start the Week

The US dollar is retracing part of its pre-weekend losses against the European currencies and dollar-bloc today while falling equity prices are underpinning the yen. Brent is nearing $40 a barrel, and WTI is pushing through $36. Iron ore prices were limit up in China. US 10-year Treasury yield is three bp higher to poke through 1.90% level for the first time since February 4. European bond yields are mostly 2-3 bp lower, with notable exceptions of Portugal and Greece. The US...

Read More »Roche research: do we need treatment for Down’s syndrome?

Swiss pharmaceutical company Roche is researching medication that could help to improve the characteristic symptoms of Down's syndrome. But does everyone want it? (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »The rigmarole of naturalisation

It’s nearly four decades since Rolf Lyssy’s film ‘The Swissmakers’ poked fun at the Swiss for making it so hard to get a passport. But have things really changed that much? (RTS/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »Novartis: The making of a pharma giant

Pharmaceutical giant Novartis is celebrating its 20th birthday, and analysts say it is a big success. But the company has had its fair share of scandals, and when it was founded, many critics said it wouldn’t last. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe...

Read More »Statistics on tourist accommodation in January 2016: Marked decline in overnight stays in January

07.03.2016 09:15 - FSO, Tourism (0353-1602-30) Statistics on tourist accommodation in January 2016 Marked decline in overnight stays in January Neuchâtel, 07.03.2016 (FSO) – The Swiss hotel industry registered 2.6 million overnight stays in January 2016, which corresponds to a decrease of 6.8% (-189,000 overnight stays) compared with January 2015. Foreign demand generated 1.3 million overnight stays, i.e. a decline of 8.4% (-120,000 overnight stays). Domestic visitors registered also 1.3...

Read More » SNB & CHF

SNB & CHF