Bank Bail-Ins are coming and people need to prepare by owning bullion outside the banking system. They will be counterproductive and could lead to financial collapse. "Unfortunately, we don't learn the lessons of history to our own downfall!". For more information http://www.GoldCore.com

Read More »Rotten to the Core

Poison Money BALTIMORE – We live in a world of sin and sorrow, infected by a fraudulent democracy, Facebook, and a corrupt money system. Wheezing, weak, and weary from the exertion of trying to appear “normal,” the economy staggers on. Staggering on…. Image credit: David Sidmond Last week, we gained some insight into the ailment. Something in the diagnosis has puzzled us for years: How is it possible for the most advanced economy in the history of the world to make such a mess of its...

Read More »Max Keiser Interview Mark O’Byrne of GoldCore.com re gold and silver bullion

Max Keiser interviews Mark O’Byrne about the gold and silver bullion markets, cryptobullion, the confetti masters on Wall Street and the Federal Reserve which is not federal and has no reserves.

Read More »Talk of Secret Shanghai Agreement is a Distraction

(I have been sick with pneumonia but am just about back. I expect to resume my commentary tomorrow. Here is my overdue monthly column for a Chinese paper. Thanks to everyone for their support.)Conspiracy theories have run amok. After several years of claiming countries were engaged in currency wars, or attempts to drive their currencies down to achieve export advantage, many reporters and analysts announced a volte-face. At the late February G20 meeting in Shanghai, a secret...

Read More »Rejected asylum seekers who go into hiding

Sometimes asylum seekers go underground, as they have no hope of getting official refugee status. They’re known as “sans papiers” (without papers). (SRF/swissinfo.ch) Asylum is only granted to those who face persecution or imprisonment in their country of origin for reasons of race, religion or nationality or because of their political views. Most asylum seekers arriving in Switzerland do not meet these criteria – they are economic refugees. In 2015, roughly half of all asylum seekers...

Read More »Plane fans turn jumbo cockpit into a simulator

At Dübendorf airfield, aviation enthusiasts are converting an old jumbo jet cockpit into a flight simulator: an adventurous project with many obstacles.(SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch...

Read More »Living in a church

Many churches are listed buildings, so pulling them down is not an option. A number of parishes now want to revive empty churches by converting them into homes. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »Aircraft wreckage discovered 70 years later

Divers have found a historic aircraft in Lake Lucerne, which crashed in 1941 and was deemed lost – until today. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »The Gold – Money Supply Correlation Report

A Spot of Irrational Exuberance There were some fireworks last week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on Tuesday to drive this move down in the dollar? (We always use italics when referring to gold going up or down, because it is really the dollar going down or up). A bit of verbal puppeteering…. Janet Yellen...

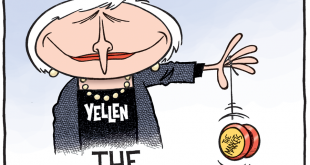

Read More »A Tribute to the Jackass Money System

A Witless Tool of the Deep State? Finance or politics? We don’t know which is jollier. The Republican presidential primary and Fed monetary policies seem to compete for headlines. Which can be most absurd? Which can be most outrageous? Which can get more page views? Politics, led by Donald J. Trump, was clearly in the lead… until Wednesday. Then, the money world, with Janet L. Yellen wearing the yellow jersey, spurted ahead in the Hilarity Run. A coo-coo for the stock market…...

Read More » SNB & CHF

SNB & CHF