Summary: Balance of power in China between “princleling and youth league may be at risk. Foreigners have stopped up their purchases of onshore CNY bonds. Tensions are rising between China and Japan and China and South Korea. This is the period in the monthly cycle that China releases most of its high frequency data. The process is well under way. Over the weekend, China reported its reserve figures that...

Read More »US Economy – Something is not Right

Another Strong Payrolls Report – is it Meaningful? This morning the punters in the casino were cheered up by yet another strong payrolls report, the second in a row. Leaving aside the fact that it will be revised out of all recognition when all is said and done, does it actually mean the economy is strong? As we usually point out at this juncture: apart from the problem that US labor force participation has collapsed...

Read More »Swiss Consumer Price Index -0.4 percent MoM, -0.2 percent YoY

08.08.2016 09:15 – FSO, Prices (0353-1607-40) Swiss Consumer Price Index in July 2016 Consumer prices fall by 0.4% Neuchâtel, 08.08.2016 (FSO) – The Swiss Consumer Price Index (CPI) fell by 0.4% in July 2016 compared with the previous month, reaching 100.3 points (December 2015=100). Inflation was -0.2% in comparison with the same month in the previous year. These are the findings of the Federal Statistical Office...

Read More »States Must Help Restore Sound Money in America

Control the money, and you control the people. Over the last hundred years, the federal government and the Federal Reserve, a privately owned bank cartel conceived of in secret, have waged a war on sound money in America. They’ve ended the free circulation of gold (and, for a time, criminalized its ownership), while imposing taxes on those who trade with it. They’ve replaced gold and silver coins and the promise of...

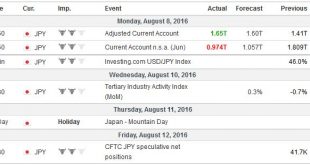

Read More »FX Weekly Preview: Light Economic Calendar Week Allows New Thinking on Macro

Summary: Policy outlook is clear: ECB and BOJ review next month, FOMC still looking for opportunity. Inventory cycle making quarterly US GDP forecasting difficult, but it looks like re-acceleration still the more likely scenario than recessions. Why didn’t European bank stress tests results have more impact? The drip-feed of high frequency economic data from the major economies slows in the week ahead. The data...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended last week on a firm note, despite the stronger than expected July jobs report. As we suspected, one strong US data point is not yet enough to derail the dovish Fed outlook. With the RBA and BOE cutting last week and the RBNZ expected to cut this week, the global liquidity backdrop remains supportive for EM and risk. Looking at individual country risk, we note that investors must remain discerning. We...

Read More »Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Negative Consumer Financing Rates in Germany Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one’s means. Curiously, it was just a month ago when an...

Read More »FX Weekly Review, August 01 – August 05: Does the Jobs Report Give the Greenback Legs?

Swiss Franc Currency Index Our weekly comparison with the dollar index: The positive performance of the Swiss franc index was reversed on Friday. Finally the dollar index had a better week than the Swiss Franc index. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three years interval, the Swiss Franc had a...

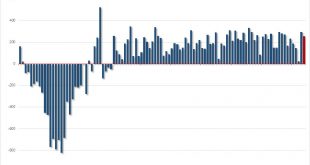

Read More »Weekly Speculative Positions: Record Sterling Shorts, Net Short in Swiss Francs

For a period that included a BOJ and FOMC meeting and the US GDP, speculators in the currency futures were unusually quiet. Summer holidays with family may be more important. Of the 16 gross currency futures speculative positions we track, 12 of them were less than 5k contracts. There was only one gross position adjustment more than 10kcontracts. Euro bears covered 13.2k gross short euro contracts,...

Read More »US Jobs Surprise, Canada Disappoints

Summary: Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged. United States Nonfarm payrolls The market’s angst over the underlying trend in the US labor market eases with the help of the second consecutive robust report. The 255k rise in non-farm payrolls was well above expectations, and...

Read More » SNB & CHF

SNB & CHF