Swiss Franc EUR/CHF - Euro Swiss Franc, January 04(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF rates have jumped during the first official day of trading in 2017, with the pair hitting 1.2657 at today’s high. The Pound gained support this morning following positive UK Manufacturing data, which came in well above market expectation. This increased market confidence in the UK economy and the Pound has...

Read More »A Few Takeaways from the Latest IMF Reserve Figures

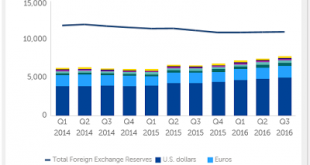

Summary: Overall reserve holdings hardly changed in Q3. China continues to bleed its reserves from unallocated to allocated. Sterling’s share of new reserves warns it may be losing some allure. The IMF is the most authoritative source for reserve holdings of central banks. It reports the data at the end of each quarter with a quarter lag. At the end of last year, the IMF published the Q3 16 reserve figures. ...

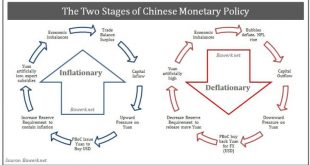

Read More »Chinese Philosopher Kings, Losing their Yuan FX Religion?

It took a while, but the world are slowly coming to grips with the simple fact that the red-suzerains in Beijing are not the infallible leaders en route to a new superior economic model as they thought they were. All the craze that emanated from the spurious work of Joshua Cooper Ramo, which eventually led to works like “How China’s Authoritarian Model Will Dominate the Twenty-First Century,” are slowly catching...

Read More »Gold Market Charts – A Month in Review

BullionStar has recently started a new series of posts highlighting charts relating to some of the most important gold markets, gold exchanges and gold trends around the world. The posts include charts of the Chinese Gold Market, the flow of gold from West to East via the London and Swiss gold markets, and the holdings of gold-backed Exchange Traded Funds (ETFs). This is the second post in the series. Please see...

Read More »European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

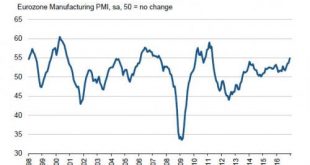

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia’s major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April...

Read More »Weekly Sight Deposits and Speculative Positions:

Headlines Week January 02, 2017 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro. The last ECB meeting showed that the ECB might be dovish for a longer...

Read More »FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

Swiss Franc Switzerland SVME PMI, December 2016(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge FX Rates The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling’s earlier losses were recouped following news that the manufacturing PMI jumped to...

Read More »Weekly Speculative Positions: Speculators go short CHF again after a brief period of Long CHF

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Weekly Speculative Positions: Speculators go short CHF again after a brief period of Long CHF

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: What You Should Know to Start the First Week of 2017

Summary: Data has already been reported. Trends reversed in the last two weeks. US jobs data may disappoint. It will take a few more weeks to lift some of the uncertainty hanging over the markets. There are four things investors should know as the New Year begins. First, it has already begun with several PMI reports already reported. Second, in the last two week of the December, the trends that dominated Q4...

Read More » SNB & CHF

SNB & CHF