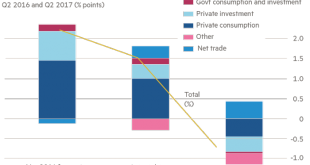

– Brexit budget – Grim outlook as UK economic forecasts downgrade – UK Chancellor uses housing market policy as smoke-screen for deteriorating economy – UK budget matters more than ever due to BREXIT risks – Policy on stamp duty will fail to aid worsening housing market – Real GDP expected to grow by just 1.5%, 40% less than projections 2 years ago – Households now face an unprecedented 17 years of stagnation in...

Read More »How Uncle Sam Inflates Away Your Life

Economic Nirvana “Inflation is always and everywhere a monetary phenomenon,” economist and Nobel Prize recipient Milton Friedman once remarked. He likely meant that inflation is the more rapid increase in the supply of money relative to the output of goods and services which money is traded for. Photo via mises.ca - Click to enlarge Famous Monetarist School representative Milton Friedman thought the US should adopt...

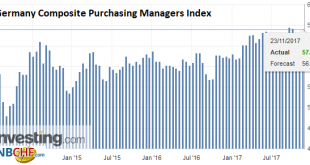

Read More »German Politics: What’s Next?

Summary: Coalition talks will resume in the coming days, and failing this a minority government is more likely than new elections. The is a general agreement among the political elites, and a hubris of small differences. The rate differentials and cross currency swaps show the incentive structure for holding dollars is increasing. Talks to forge a new coalition government in Germany passed the self-imposed...

Read More »FX Daily, November 22: Global Equity Rally Resumes, while Dollar Slips

Swiss Franc The Euro has fallen by 0.32% to 1.1599 CHF. EUR/CHF and USD/CHF, November 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equities are on the march. US indices shrugged off their first back-to-back weekly decline in three months to set new record highs yesterday. The MSCI Asia-Pacific followed suit and recorded their highest close. The Dow Jones...

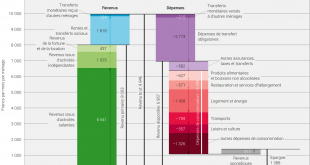

Read More »What do the Swiss spend their money on?

The Swiss had an average net household disposable income in 2015 of CHF6,957 ($7,007) a month, the Federal Statistical Office has reported. Every month, around CHF560 was spent on leisure and cultural activities – and CHF89 on cats and dogs. Average net disposable income is calculated by deducting compulsory expenditures from gross income. In 2015external link, average compulsory expenditures came to CHF2,990 a month,...

Read More »Bi-Weekly Economic Review: A Whirlwind of Data

The economic data of the last two weeks was generally better than expected, the Citigroup Economic Surprise index near the highs of the year. Still, as I’ve warned repeatedly over the last few years, better than expected should not be confused with good. We go through mini-cycles all the time, the economy ebbing and flowing through the course of a business cycle. This being a particularly long half cycle, it has had...

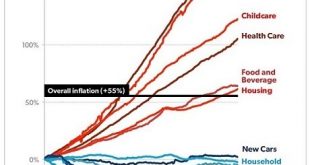

Read More »Want Widespread Prosperity? Radically Lower Costs

As long as this is business as usual, it’s impossible to slash costs and boost widespread prosperity. It’s easy to go down the wormhole of complexity when it comes to figuring out why our economy is stagnating for the bottom 80% of households. But it’s actually not that complicated: the primary driver of stagnation, decline of small business start-ups, etc. is costs are skyrocketing to the point of unaffordability. As I...

Read More »Business Cycles and Inflation, Part II

Early Warning Signals in a Fragile System [ed note: here is Part 1; if you have missed it, best go there and start reading from the beginning] We recently received the following charts via email with a query whether they should worry stock market investors. They show two short term interest rates, namely the 2-year t-note yield and 3 month t-bill discount rate. Evidently the moves in short term rates over the past ~18...

Read More »Weekly Technical Analysis: 20/11/2017 – USDJPY, EURUSD, GBPUSD, GBPAUD

USD/CHF The USDCHF pair broke 0.9892 level and settles below it now, which supports the continuation of our correctional bearish trend efficiently in the upcoming period, and the way is open to head towards 0.9800 level that represents our next main target. The EMA50 supports the negative overview, which will remain valid and active unless breaching 0.9930 followed by 0.9970 levels and holding above them. Expected...

Read More »Second class-action law suit lodged against Tezos

Investors piled their crypto assets into the Tezos ICO in the summer (Reuters) - Click to enlarge A second class-action lawsuit has been lodged in the United States against the founders of the tokenised blockchain project Tezos, and the Swiss-based foundation that houses hundreds of millions of dollars of investors’ money. The law firm Silver Miller Law presented its complaintexternal link in Florida this...

Read More » SNB & CHF

SNB & CHF