Swiss Franc The Euro has fallen by 0.12% at 1.1337 EUR/CHF and USD/CHF, February 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is narrowly mixed against the major currencies, but the strongest currency today is the Chinese yuan, following reports that US wants China to keep the yuan stable and not offset US tariffs with currency depreciation. The...

Read More »Strong Trade Balance Data Supports the Franc

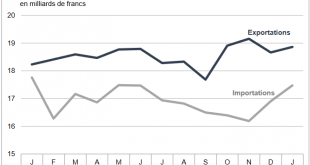

The Swiss Franc has been boosted during early morning trading as investors find the latest Trade Balance data supportive of the economy, with the Trade Balance data coming in showing a surplus of CHF3bn. The strength of the Swiss economy is its exports; in watches, chocolate and specialized industrial engineering. The franc has risen marginally and this could represent a stronger Swiss franc down the line as investors...

Read More »Credit Exhaustion Is Global

Europe is awash in credit exhaustion, and so is China. The signs are everywhere: credit exhaustion is global, and that means the global growth story is over: revenues and profits are all sliding as lending dries up and defaults pile up. What is credit exhaustion? Qualified buyers don’t want to borrow more, leaving only the unqualified or speculators seeking to save a marginal bet gone bad with one more loan (which will...

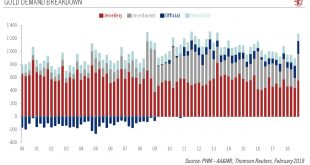

Read More »Gold to consolidate before further leg up

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better. Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018,...

Read More »Central Planning Is More than Just Friction, Report 17 February

It is easy to think of government interference into the economy like a kind of friction. If producers and traders were fully free, then they could improve our quality of life—with new technologies, better products, and lower prices—at a rate of X. But the more that the government does, the more it burdens them. So instead of X rate of progress, we get the same end result but 10% slower or 20% slower. Some would go so...

Read More »FX Daily, February 19: Investors Need Fresh Incentives

Swiss Franc The Euro has fallen by 0.08% at 1.1345 EUR/CHF and USD/CHF, February 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Activity in the global capital markets is subdued as investors await fresh developments. New wording for the Irish backstop apparently is being drafted. US-China trade talks resume. No decision has been made on US auto tariffs, but...

Read More »Swiss Trade Balance January 2019: Start of a Positive year

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »La Dépossession façon BNS. Entretien ORBIS TERRAE

Interview de Vincent Held, auteur du Crépuscule de la Banque nationale suisse, par Orbis Terrae, Bernard Antoine Rouffaer, janvier 2019 L’ouvrage de Vincent Held aborde une série de sujets brûlants : la politique d’affaiblissement du francs suisse menée par la Banque nationale suisse (BNS), l’imbrication de cette politique avec celles des banques privées suisses, la politique d’acquisition d’obligations d’Etat en...

Read More »The SNB’s Karl Brunner Distinguished Lecture Series: Raghuram Rajan announced as next speaker

The Swiss National Bank (SNB) has named Raghuram Rajan as this year’s speaker for its Karl Brunner Distinguished Lecture Series. Professor Rajan has made outstanding contributions to both economic practice and economic research on the global stage. His roles have included Governor of the Reserve Bank of India from 2013 until 2016 and Chief Economist at the IMF between 2003 and 2006. He has held a professorship at the...

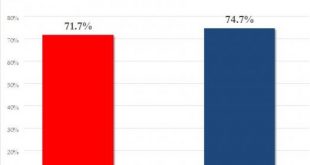

Read More »Ministers make the case for tax and pension reform package

Two ministers, two policies, one vote: Alain Berset (left) and Ueli Maurer. (© Keystone / Peter Klaunzer) The Swiss government has launched its campaign in favour of the upcoming national vote on a reform of the corporate tax and pension systems. Ministers for health and finance, Alain Berset and Ueli Maurer, presented their case at a press conference on Monday, urging citizens to vote ‘yes’ on May 19. Berset and...

Read More » SNB & CHF

SNB & CHF