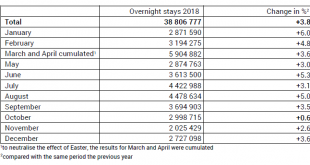

26.02.2019 – The hotel sector in Switzerland registered 38.8 million overnight stays in 2018, i.e. the best result to date. This represented a growth of 3.8% (+1.4 million) compared with 2017. Foreign demand totalled 21.4 million units, an increase of 4.5% (+921 000) and its best performance in 10 years. Swiss overnight stays increased by 2.9% (+493 000), thus reaching the record value of 17.4 million overnight stays....

Read More »No Surprise, Hysteria Wasn’t a Sound Basis For Interpretation

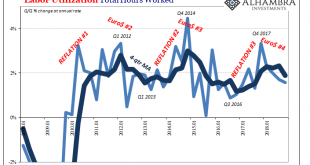

What gets them into trouble is how they just can’t help themselves. Go back one year, to early 2018. Last February it was all-but-assured (in mainstream coverage) that the US economy was going to take off. The bond market, meaning UST’s, was about to be massacred because the overheating boom would force a double shot down its throat. Not only would safety instruments like UST’s have to contend with the unemployment...

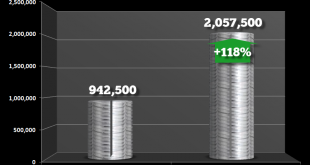

Read More »U.S. Mint Suspends Silver Bullion Coin Sales After Sales Double In February

U.S. Mint suspends silver bullion coin sales after sales double in February Silver investment demand for American Eagles (one ounce) silver bullion coins depletes West Point Mint inventories U.S. Mint suspended sales of American Eagle (1 oz) coins on Feb. 21 because it had no coins left to sell With increased investment demand, the Mint is experiencing a resurgence in steady demand with sustained purchases of the...

Read More »CNBC Clip: February 24 Brexit

We tried a CNBC hook-up in Asia via Skype on February 25. I did not think there would be a clip, but I stumbled on it looking for something else. Click here for the roughly 2.5-minute interview done from my apartment in NYC. The discussion is on Brexit and sterling. [embedded content] Related posts: Cool Video: Clip from CNBC Squawk Box FX Daily,...

Read More »FX Daily, February 27: Dollar Trades Heavily, While Prospects of a Softer and Later Brexit Send Sterling Higher

Swiss Franc The Euro has fallen by 0.21% at 1.1366 EUR/CHF and USD/CHF, February 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the North American session is about to begin, the markets await developments in the UK House of Commons where a vote is expected today on Prime Minister May’s proposal to hold votes on around March 12 on the Withdrawal Bill and no...

Read More »Uriella on television

In 1992 Swiss public television's programme 'Kassensturz' had Uriella demonstrate her practices. Here is an excerpt. (SRF, swissinfo.ch) In 1992 Swiss public television's programme 'Kassensturz' had Uriella demonstrate her practices. Here is an excerpt. (SRF, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and...

Read More »Uriella on television

In 1992 Swiss public television's programme 'Kassensturz' had Uriella demonstrate her practices. Here is an excerpt. (SRF, swissinfo.ch) In 1992 Swiss public television's programme 'Kassensturz' had Uriella demonstrate her practices. Here is an excerpt. (SRF, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and...

Read More »ECB: running out of runway – Part I

At the end of January, only a month after the official end of the QE program of the European Central Bank (ECB), its President Mario Draghi told the European Parliament’s committee that the central bank could resume its bond purchasing, in a questionable effort to assuage concerns over the impact of the policy change. As Europe’s economy flashes increasingly bright warning signs, doubts are multiplying over the...

Read More »Swiss weapons exports increase 14 percent

Building a tank at the Swiss defence contractor RUAG (Keystone) Swiss companies last year exported government-approved war materiel to 64 countries with a total value of CHF510 million ($510 million), 14% more than the previous year. Germany was the largest customer, taking deliveries worth CHF118 million, followed by Denmark, the US, Romania and Italy, the State Secretariat for Economic Affairs (SECO) said on...

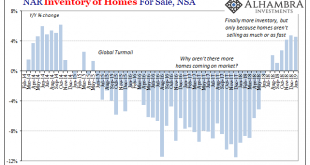

Read More »The Fate of Real Estate

For years, realtors have been waiting for more housing inventory. It had become an article of faith, what was restraining a full-blown recovery was the lack of units available. The level of resales like construction was up, but still way, way less than it was now fourteen years past the prior peak despite sufficient population growth to have absorbed the previous bubble’s overbuilding. All the way back in March 2017,...

Read More » SNB & CHF

SNB & CHF