The number of work permits issued for non-EU workers has been a source of contention in recent years. (Keystone) Switzerland will issue 8,500 work visas to non-EU citizens next year – the same number as in 2019. The Swiss government also confirmed an earlier decision that 3,500 British workers will be welcomed in the event of a no-deal Brexit situation. Next year Swiss companies will be able to draw on 4,500 B-permitsexternal link for so-called “third country”...

Read More »We Can Only Choose One: Our National Economy or Globalization

The servitude of society to a globalized economy is generating extremes of insecurity, powerlessness and inequality. Does our economy serve our society, or does our society serve our economy, and by extension, those few who extract most of the economic benefits? It’s a question worth asking, as beneath the political churn around the globe, the issues raised by this question are driving the frustration and anger that’s manifesting in social and political disorder. A...

Read More »Capital Accumulation, Not Government, Is the Key To Technological Innovation

According to Mariana Mazzucato, the RM Phillips Professor in the Economics of Innovation at the University of Sussex, government is an important factor in the promotion of innovation and thus economic growth. In particular, she challenges the popular view that innovation happens in the private sector, with governments playing a limited role. Many commentators regard her as a revolutionary thinker that challenges the accepted dogma regarding the role of government in...

Read More »Charles Hugh Smith on why Eastern Europe may be the Go To Place

Charles Hugh Smith on why Eastern Europe may be the Go To Place Click here for the full transcript: http://financialrepressionauthority.com/2019/11/27/the-roundtable-insight-charles-hugh-smith-on-why-eastern-europe-may-be-the-go-to-place/

Read More »Charles Hugh Smith on why Eastern Europe may be the Go To Place

Charles Hugh Smith on why Eastern Europe may be the Go To Place Click here for the full transcript: http://financialrepressionauthority.com/2019/11/27/the-roundtable-insight-charles-hugh-smith-on-why-eastern-europe-may-be-the-go-to-place/

Read More »FX Daily, November 27: In Search of New Incentives

Swiss Franc The Euro has risen by 0.01% to 1.0985 EUR/CHF and USD/CHF, November 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are subdued. There have been few developments to induce activity. Even President Trump’s claims that the talks with China are in the “final throes” failed to excite. Equities are extending their advance. Bonds are little changed, and the dollar is mostly...

Read More »USD/CHF holds on to recovery gains ahead of Swiss ZEW numbers

USD/CHF takes the bids around monthly high. Optimism surrounding the US-China trade deal, global economy confront nearness to data. The US data, trade/political headlines could drive markets afterward. USD/CHF respects the previous day’s Doji formation, coupled with upbeat fundamentals, while taking the bids to 0.9980 ahead of Wednesday’s European session. Comments from the United States (US) President Donald Trump have mostly done the job of spreading market...

Read More »Internet-shunning shoppers are almost extinct

‘Online shopping creates freedom,’ said the authors of the survey (Keystone) Only 3% of adult internet users buy nothing online, with the elderly most likely to stick to bricks-and-mortar shops, according to a survey. Online comparison service Comparis.ch said on Tuesday that whereas 6% of those aged 56-74 were yet to place an order online, the number of abstainers among 18- to 35-year-olds was less than 1%. By contrast, almost one surfer in two (48%) orders...

Read More »Lugano Airport gets financial lifeline

Lugano Airport in southern Switzerland is located 80km north of Milan in Italy. Lugano authorities have approved a series of loans to help save Lugano Airport in southern Switzerland, allowing it to operate for at least one more year. The regional airport has struggled since the bankruptcy of Darwin Airline and collapse of Adria Airways in September. On Monday, Lugano parliament followed the local government by voting in favour of three loans, totalling CHF5.7...

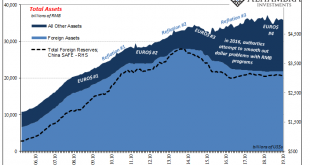

Read More »China’s Financial Stability: A Squeeze and a Strangle

I do get a big kick out of the way Communists over in China announce how they are dealing with their enormous problems especially as they may be getting worse. Each month, for example, the country’s National Bureau of Statistics (NBS) will publish figures on retail sales or industrial production at record lows but in the opening paragraphs the text will be full of praise for how the economy is being handled. If you thought the Western media was liberal with the...

Read More » SNB & CHF

SNB & CHF