Cuban president Fidel Castro flew to Geneva in 1998 for a world summit and while there wished to initiate ties with US president Bill Clinton. While his hopes were dashed, the Cuban leader did leave a lasting impression on the international community. In 1998, for the 50th anniversary of the WHO and GATT (now WTO), government leaders and officials from all over the world flocked to Geneva. Among them were Castro and then US president Bill Clinton. Following the dissolution of the Soviet...

Read More »Swiss Consumer Price Index in July 2021: +0.7 percent YoY, -0.1 percent MoM

02.08.2021 – The consumer price index (CPI) fell by 0.1% in July 2021 compared with the previous month, reaching 101.0 points (December 2015 = 100). Inflation was +0.7% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The decrease of 0.1% compared with the previous month is due to several factors including falling prices for clothing and footwear due to seasonal sales. The prices for air transport also...

Read More »Rising numbers of hikers and bikers boost Swiss economy

Almost 8% of Swiss residents over the age of 15 rode mountain bikes. Keystone / Laurent Gillieron Numbers engaging in outdoor activities like walking, cycling or mountain biking continued to rise in Switzerland in 2019, the Federal Office for Roads (ASTRA) has reported. This is also good news for the economy. Some 57% of Swiss residents labelled themselves as walkers in 2019, going on an average of 15 walks per year for an average of three hours each, ASTRA said in a...

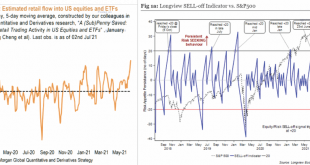

Read More »Technically Speaking: Hedge Funds Ramp Up Exposure

The “Fear Of Missing Out” has infected retail and hedge funds alike as they ramp up exposure to chase performance. We have previously discussed the near “mania” of retail investors taking on exceptional risk in various manners. From increasing leverage, engaging in speculative options trading, and taking out personal loans to invest, it’s all evidence of overconfident investors. However, that “risk appetite” is not relegated to retail investors alone. Professional...

Read More »Modern Monetary Theory

Recorded at the Mises Institute in Auburn, Alabama, on 21 July 2021. [embedded content] You Might Also Like SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros 2021-08-04 Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars. Government Land Ownership and Management 2021-08-03...

Read More »When Should Governments Ban Bitcoin?

When Should Governments Ban Bitcoin? When should governments ban new technologies? Watch on Rumble ““When Should Governments Ban Bitcoin?” [embedded content] You Might Also Like SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros 2021-08-04 Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars....

Read More »Eine „gute“ Inflation gibt es nicht, aber es gibt „gute“ Preissteigerungen

Eine „gute“ Inflation gibt es nicht, aber es gibt „gute“ Preissteigerungen 19.07.2021 – Tot ist die Inflation nie, allenfalls nur scheintot – Wann Preissteigerungen Inflation sind – Inflation durch übermäßiges Ausweiten der Geldmenge – Nicht alle Preisanstiege sind Inflation – Alle Preise vermitteln Informationen, zumal wenn sie steigen – Eine „gute“ Inflation gibt es nicht, aber es gibt „gute“ Preissteigerungen – Die gute Inflation ist Humbug von Klaus Peter...

Read More »Government Land Ownership and Management

Download the slides from this lecture at Mises.org/MU21_PPT_20. Recorded at the Mises Institute in Auburn, Alabama, on July 21, 2021. [embedded content] You Might Also Like SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros 2021-08-04 Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars....

Read More »Wieviel Geld sollte man mit 30, 40 oder 50 Jahren eigentlich gespart haben? ???

In diesem Beitrag soll es darum gehen, wie viel Vermögen du in welchem Alter haben solltest. Die Zahlen, die ich dir vorstelle, gelten spezifisch für Deutschland. In einem weiteren Beitrag soll es dabei auch um die Schweiz gehen. Kommen wir aber erst einmal auf Deutschland zurück, ich habe hier eine sehr gute Grafik für dich vorbereitet, welche es auf der Seite von finanzfluss.de zu finden gibt. Deshalb auch hier einmal ein Danke an Thomas von Finanzfluss....

Read More »Biden’s Rescue Act Targets Americans’ Freedoms

Since the 1800s, surly Americans have derided politicians for spending tax dollars “like drunken sailors.” Until recently, that was considered a grave character fault. But Joe Biden’s American Rescue Plan Act shows that inebriated spending is now the path to national salvation. It was a common saying in America in the 1930s that “we cannot squander our way to prosperity.” But that was before the latest “best and brightest” crop took the helm of the federal...

Read More » SNB & CHF

SNB & CHF