© Andrey Popov | Dreamstime.com - Click to enlarge Le Matin. After nearly ten years of European Union opposition to preferential company tax deals, Switzerland’s government agreed in 2014 to do away with such arrangements. Under current rules Swiss cantons can offer preferential tax rates to certain companies, mostly multinationals with most of their activity abroad. In Geneva, these special rates mean certain...

Read More »SMI up on post Trump rally

SMI Swiss stocks continued to rise this week, in line with other global stocks thanks to a strong performance from financials which gained as investors weighted the prospects of higher interest rates in the US. SMI Index, November 18 - Click to enlarge Economic Data Stocks in the financial sector advanced after Federal Reserve Chair Janet Yellen said the US central bank is close to lifting interest rates as the...

Read More »FX Daily, November 18: Revaluation of the Dollar Continues

Swiss Franc EUR/CHF - Euro Swiss Franc, November 18(see more posts on EUR/CHF, ). - Click to enlarge FX Rates Since the US election, the dollar has been on a tear. Pullbacks have been brief and shallow. There are powerful trends in place. The euro has fallen nearly five percent over the past ten sessions, during which it is not closed higher once. The dollar rose four days this week against the yen and four days...

Read More »China fines Swiss-based packager Tetra Pak for breaking monopoly rules

Tetra Pak crumpled - Click to enlarge According to Reuters, following an investigation, China’s State Administration for Industry and Commerce (SAIC) said, it found out that Tetra Pak violated some provisions in China’s anti-trust law and will impose a fine of 668 million yuan ($97 million) on Tetra Pak for “abuse of dominant market position”. The Shanghai Daily said, SAIC found that Tetra Pak had broken anti-monopoly...

Read More »Swisscom promises to put an end to unwanted sales calls

© Marcovarro | Dreamstime.com - Click to enlarge Swisscom’s fixed line (remember those) customers will be given the option of blocking unwanted calls from 28 November. The service will be free and can be activated by checking a box online or by calling the Swisscom hotline (0800 800 800). Sunrise and UPC are expected to follow Swisscom by mid 2017, according to 24 Heures. The new system automatically filters out...

Read More »Are Emerging Markets Still “A Thing”?

By Chris at www.CapitalistExploits.at Last week I jumped on a call with an old friend Thomas Hugger who I hadn’t spoken with in months. I recorded the call for your enjoyment but first a quick bit of background to Thomas. Thomas is a Swiss fund manager living and working in Asian frontier markets such as Vietnam, Bangladesh, and Cambodia, which is a bit like taking a Rolls Royce through the Gobi desert if you think...

Read More »You’ll Only Understand Trump and Brexit If You Understand the Failure of Globalization

[See also The Numbers Show Trump Win NOT Due to Racism and Sexism] You can only understand the victory of Donald Trump and Brexit once you understand the failure of globalization … Trump Trump made rejection of globalization a centerpiece of his campaign. In his July 21st acceptance speech as the Republican nominee, he said: Americanism, not globalism, will be our credo. The Boston Globe bannered this headline on...

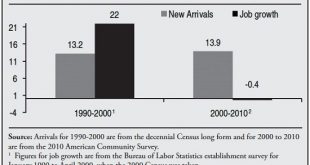

Read More »Rising Immigration but no Jobs

Perceptions may well change when the global illusions of solvency and “growth” collapse in a heap. The list of pundits jostling for air time to add their two cents to discussions of hot-button issues such as immigration is endless. The airwaves and social media are overflowing with people wanting to comment on hot-button social issues, but when it comes to the the one truly critical dynamic that will shape the...

Read More »Global Forum on Modern Direct Democracy | DAY 1

The 6th world conference on active citizenship and participatory democracy is a timely event indeed. Just days after perhaps the most suprising election result in modern history, and after a US presidential campaign full of lies, accusations and stupidities, we are gathering in this beautiful spot of the Basque Country for four days of sharing, caring and developing of modern direct democracy. Last week’s ballot box earthquake in America has sent waves of disbelief across the globe. It is...

Read More »Swiss National Bank won’t cut record low interest rate again, survey shows

© Valeriya Potapova | Dreamstime.com - Click to enlarge The Swiss National Bank, which has the lowest interest rate among the world’s major central banks, may be done cutting. SNB President Thomas Jordan and his fellow policy makers will keep the deposit rate unchanged at minus 0.75 percent until at least the end of the first quarter of 2019, according to the median forecast in Bloomberg’s monthly survey of...

Read More » SNB & CHF

SNB & CHF