Swiss Franc EUR/CHF - Euro Swiss Franc, February 10(see more posts on EUR/CHF, ) - Click to enlarge Sterling vs the Swiss Franc has been climbing recently as the Brexit talks appear to be going the right way at the moment. The talks are progressing and it has been confirmed that the government will be allowed to vote on the final agreement prior to the triggering of Article 50. The Pound is still under huge...

Read More »Cool Video: Bearish Case for Euro and Prospect of Currency Wars

Still in London as this part of the business trip is winding down. I had the privilege of going over to the Bloomberg office today and spoke with Vonnie Quinn and Mark Burton about the euro’s outlook and whether the US should have a strong or weak dollar.I sketch out my idea that the (upside) correction in the euro began in mid-December around following the Fed’s hike. Over the last couple weeks, I have been...

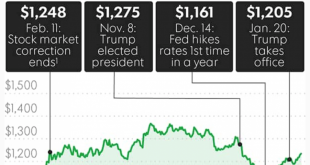

Read More »Gold Prices Up 6 percent YTD As Trump ‘Honeymoon’ Ends

Gold prices continued to shine this week reaching $1,244.70 per ounce and and has posted gains in five of the last six weeks. This week it reached a new three-month high – it’s highest since the Trump win and has climbed over 6% this year, beating the gains made in the same period in 2016. The yellow metal has climbed 4.30% in the US dollar, 3.38% in the Euro and 1.35% in the sterling, in the last 30 days. This week...

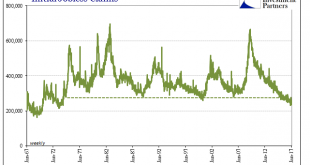

Read More »Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years. Unemployment insurance...

Read More »Switzerland Unemployment January 2017: The situation on the labor market

Unemployment Rate (not seasonally adjusted) According to the State Secretariat for Economic Affairs (SECO) surveys, 164,466 unemployed were registered at the Regional Employment Centers (RAV) at the end of January 2017, 5,094 more than in the previous month. The unemployment rate thus rose from 3.5% in December 2016 to 3.7% in the reporting month. Switzerland Unemployment Rate Not Seasonally Adjusted January...

Read More »FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

Swiss Franc EUR/CHF - Euro Swiss Franc, February 09(see more posts on EUR/CHF, ) - Click to enlarge Currency manipulation is becoming a hot topic now that Donald Trump has been inaugurated as the US President. Followers of his social media accounts will be aware of his criticism’s of a number of countries for artificially weakening their currency’s in order to remain competitive on a global scale, and recently...

Read More »Is a Strong or Weak Dollar Good for the US? The $16 trillion Question

Summary: Dollar movement helps some economic interest and hurts others. From a strategic point of view, the best thing for the US is the market-generated rate. It was an important achievement that the forex market was de-weaponized. Many observers have been crying wolf about a currency war for many years, which may have de-sensitized investors to the threat of a real one. Reports suggest that recently President...

Read More »Incrementum Advisory Board Meeting, Q1 2017 and Some Additional Reflections

Looming Currency and Liquidity Problems The quarterly meeting of the Incrementum Advisory Board was held on January 11, approximately one month ago. A download link to a PDF document containing the full transcript including charts an be found at the end of this post. As always, a broad range of topics was discussed; although some time has passed since the meeting, all these issues remain relevant. Our comments below...

Read More »Cool Video: Around the World with Katie Martin of the Financial Times

Katie Martin and Marc Chandler I am in London as part of a larger business trip. I had the chance today to talk to Katie Martin, who runs Fast FT and is often writing about foreign exchange. They show was live on Facebook. It is about a 22 minute interview and although foreign exchange is the key issue, to get to it we end up talking about many things, including US interest rates, Trump, and even cooking frogs. Often I...

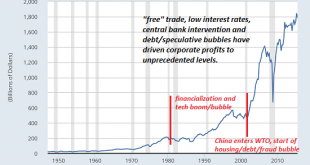

Read More »The Colonization of Local-Business Main Street by Corporate America

This is what our mode of production optimizes: ugliness, debt-serfdom, and servitude to politically dominant corporations. An insightful correspondent recently remarked on the striking transition of American neighborhoods from commercial districts dominated by locally owned businesses to streets lined with look-alike outlets of Corporate America. This transition is so obvious that few even comment on it, much less ask...

Read More » SNB & CHF

SNB & CHF