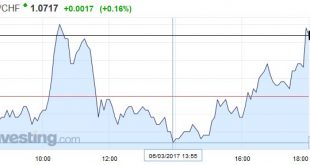

Swiss Franc EUR/CHF - Euro Swiss Franc, March 07(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound has continued to gradually slide lower against the Swiss Franc with rates for this pair falling to 1.2350. GBP CHF is particularly week on two counts: The safe haven status of the Swiss Franc and Brexit. Sterling continues to remain under a degree of pressure as the Brexit uncertainty continues to...

Read More »They’re Worried You Might Buy Bitcoin or Gold – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Bitcoin Mania The price of gold has been rising, but perhaps not enough to suit the hot money. Meanwhile, the price of Bitcoin has shot up even faster. From $412, one year ago, to $1290 on Friday, it has gained over 200% (and, unlike gold, we can say that Bitcoin went up — it’s a speculative asset that goes up and down...

Read More »Speculative Blow-Offs in Stock Markets – Part 2

Blow-Off Pattern Recognition As noted in Part 1, historically, blow-patterns in stock markets share many characteristics. One of them is a shifting monetary backdrop, which becomes more hostile just as prices begin to rise at an accelerated pace, the other is the psychological backdrop to the move, which entails growing pressure on the remaining skeptics and helps investors to rationalize their exposure to...

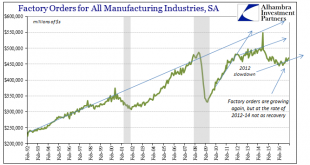

Read More »Manufacturing Back To 2014

The ISM Manufacturing PMI registered 57.7 in February 2017, the highest value since August 2014 (revised). It was just slightly less than that peak in the 2014 “reflation” cycle. Given these comparisons, economic narratives have been spun further than even the past few years where “strong” was anything but. The ISM’s gauge of orders increased to the highest level in just over three years, while an index of production...

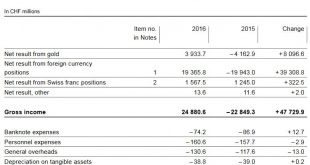

Read More »Swiss National Bank Results 2016 and Comments

The Swiss National Bank (SNB) reports a profit of CHF 24.5 billion for the year 2016 (2015: loss of CHF 23.3 billion). The profit on foreign currency positions amounted to CHF 19.4 billion. A valuation gain of CHF 3.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.6 billion. For the financial year just ended, the SNB has set the allocation to the provisions for currency reserves at CHF 4.6 billion. After taking into account the...

Read More »FX Daily, March 06: The Dollar Gives Back More Before Consolidating

Swiss Franc EUR/CHF - Euro Swiss Franc, March 06(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar’s pre-weekend pullback was extended in early European turnover but appeared to quickly run out of steam. The prospect of a constructive US employment report at the end of the week, especially given the steady decline in weekly initial jobless claims to new cyclical lows, underscores the...

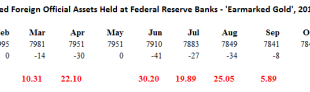

Read More »Germany’s Gold remains a Mystery as Mainstream Media cheer leads

On 9 February 2017, the Deutsche Bundesbank issued an update on its extremely long-drawn-out gold repatriation program, an update in which it claimed to have transferred 111 tonnes of gold from the Federal Reserve Bank of New York to Germany during 2016, while also transferring an additional 105 tonnes of gold from the Banque de France in Paris to Germany during the same time-period. Following these assumed gold bar...

Read More »Speculative Blow-Offs in Stock Markets – Part 1

Defying Expectations Why is the stock market seemingly so utterly oblivious to the potential dangers and in some respects quite obvious fundamental problems the global economy faces? Why in particular does this happen at a time when valuations are already extremely stretched? Questions along these lines are raised increasingly often by our correspondents lately. One could be smug about it and say “it’s all...

Read More »Weekly Sight Deposits and Speculative Positions: Each week an intervention record.

Headlines Week March 06, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Last week:The EUR/CHF remained around 1.0650, the level where the...

Read More »Weekly Speculative Position: More CHF Shorts, Less EUR Shorts this time

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More » SNB & CHF

SNB & CHF