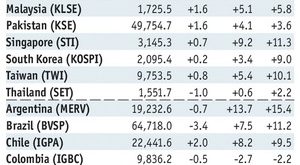

Stock Markets EM FX ended last week on a firm note despite the strong US jobs data, with the dollar succumbing to some “buy the rumor, sell the fact” price action. We think the dollar should recover as the week begins, as it seems risky to be short/underweight dollars going into the FOMC meeting. With the Fed poised to hike 3 or perhaps 4 times this year, we don’t think EM FX can continue to rally the way it has so far...

Read More »FX Weekly Review, March 06 – March 11: CHF loses against the euro

Swiss Franc Currency Index The Swiss Franc lost this week in particular against the euro, given that Mario Draghi was less dovish than expected. If the stronger euro is driven only by speculators, or also by “real money” (investments in cash, bonds, stocks) will be visible in Monday’s sight deposits release. Trade-weighted index Swiss Franc, March 11(see more posts on Swiss Franc Index, ) Source: markets.ft.com...

Read More »The Next Domino to Fall: Commercial Real Estate

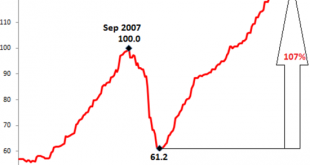

Unless the Federal Reserve intends to buy up every dead and dying mall in America, this is one crisis that the Fed can’t bail out with a few digital keystrokes. Just as generals prepare to fight the last war, central banks prepare to battle the last financial crisis–which in the present context means a big-bank liquidity meltdown like the one that nearly toppled thr global financial system in 2008-09. Planning to win...

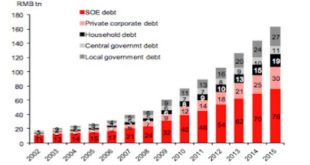

Read More »Do Record Debt And Loan Balances Matter? Not Even Slightly

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated...

Read More »[ Jeffrey Snider ] Understanding the Global US Dollar Shortage

Erik Townsend welcomes Jeffrey Snider to MacroVoices. Erik and Jeff discuss: -- Understanding the Eurodollar Money Market -- Swap Spreads and Interbank . MacroVoices Presents: Jeffrey Snider - Understanding the Global US Dollar Shortage. Thanks for watching!!! Erik Townsend welcomes Jeffrey Snider to MacroVoices. Erik and Jeff discuss: -- Understanding the Eurodollar Money Market -- Swap . Thanks for watching!!!

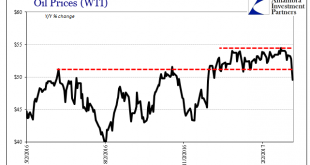

Read More »Gold & Oil – Ross Clark.Setting Up For a Crash? – Bill Bonner. PDAC – Michael Fox. Update AMY:TSX.V

Air Date: March 11, 2017 Ross Clark – Gold and Oil. email: [email protected] Bill Bonner – Will Trump Drain the Swamp? Too Much Equity in FANGS: Facebook, Apple, Netflix, Google – Setting up for a Crash Similar to the Tech Disaster of 2000? Guest's website: https://bonnerandpartners.com/ Michael Fox – Update on PDAC – Mining is Back! Guest's website: http://theprospectornews.com/ Larry Reaugh, President & CEO of American Manganese on Company Showcase...

Read More »Gold & Oil – Ross Clark.Setting Up For a Crash? – Bill Bonner. PDAC – Michael Fox. Update AMY:TSX.V

Air Date: March 11, 2017 Ross Clark – Gold and Oil. email: [email protected] Bill Bonner – Will Trump Drain the Swamp? Too Much Equity in FANGS: Facebook, Apple, Netflix, Google – Setting up for a Crash Similar to the Tech Disaster of 2000? Guest's website: https://bonnerandpartners.com/ Michael Fox – Update on PDAC – Mining is Back! Guest's website: http://theprospectornews.com/ Larry Reaugh, President & CEO of American Manganese on Company Showcase – Recycling Research Results...

Read More »Payrolls Still Slowing Into A Third Year

Today’s bland payroll report did little to suggest much of anything. All the various details were left pretty much where they were last month, and all the prior trends still standing. The headline Establishment Survey figure of 235k managed to bring the 6-month average up to 194k, almost exactly where it was in December but quite a bit less than November. In other words, despite what is mainly written as continued...

Read More »Time, The Biggest Risk

If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the...

Read More »Are Central Banks Losing Control?

Eight years after the crisis of 2008-09, central banks are still injecting $200 billion a month into the global financial system to keep it from imploding. If you want a central banker to choke on his croissant, read him this quote from socio-historian Immanuel Wallerstein: “Countries (have lost the ability) to control what happens to them in the ongoing life of the modern world-system.” Stated another way, Wallerstein...

Read More » SNB & CHF

SNB & CHF