It has now been 318 trading days since the S&P 500 suffered a 5% drawdown – the 4th-longest streak since 1928… So everything is awesome… [embedded content] BUT…US ‘hard’ economic data has not been this weak (and seen the biggest drop) since Feb 2009… US Data Surprise Index, 2006 - 2017 - Click to enlarge Q3 Was a Roller-Coaster… Q3 was the 8th straight quarterly gain in a row for The Dow – the longest streak...

Read More »Critical Swiss-German rail route back to normal

Commuters have been faced with long delays for weeks Commuters using a busy stretch of railway between the Swiss city of Basel and Karlsruhe in Germany will be relieved to learn that services will return to normal on Monday following long-running repairs to a German tunnel. The Rheintal (Rhine Valley) rail section is a critical south-north route in Europe, used particularly by freight trains as well as commuters. Trains...

Read More »FX Daily, October 04: Consolidative Tone in FX Continues

Swiss Franc The Euro has risen by 0.10% to 1.1443 CHF. EUR/CHF and USD/CHF, October 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has a softer tone today, and it was that way even for the European PMI. The greenback eased further after the upside momentum faded yesterday. The heavier tone in Asia seemed spurred by a hedge fund manager’s call that...

Read More »Hard Assets In An Age Of Negative Interest Rates

Time is the soul of money, the long-view – its immortality. Hard assets are forever, even when destroyed by the cataclysms of history. It is the outlook that perpetuated the most competent and powerful aristocracies in continental Europe, well up through World War I and, in certain prominent cases, beyond; it is the mindset that has sustained the most fiscally serious democratic republic in the Western world, that of...

Read More »Safe Haven Silver To Outperform Gold In Q4 And In 2018

– Safe haven silver to outperform gold in Q4 and 2018 – “Expect silver to eventually outperform gold” say Metals Focus– 2017 YTD, silver has underperformed gold, climbing by 5% versus 11%– Silver undervalued versus gold and especially stocks, bonds and many property markets– Will follow gold’s reactions to macroeconomic & geopolitical factors and should outperform gold– Special report on India shows it accounts for...

Read More »Stagnation Is Not Just the New Normal–It’s Official Policy

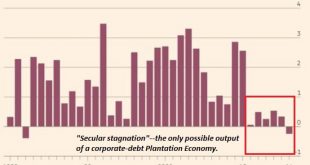

Japan is a global leader is how to gracefully manage stagnation. Although our leadership is too polite to say it out loud, they’ve embraced stagnation as the new quasi-official policy. The reason is tragi-comically obvious: any real reform would threaten the income streams gushing into untouchably powerful self-serving elites and fiefdoms. In our pay-to-play centralized form of governance, any reform that threatens the...

Read More »This Chart Defines the 21st Century Economy

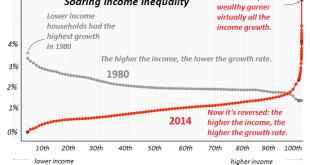

There is nothing inevitable about such vast, fast-rising income-wealth inequality; it is the only possible output of our financial and pay-to-play political system. One chart defines the 21st century economy and thus its socio-political system: the chart of soaring wealth/income inequality. This chart doesn’t show a modest widening in the gap between the super-wealthy (top 1/10th of 1%) and everyone else: there is a...

Read More »Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fat-Boy Waves The prices of the metals dropped $17 and $0.35, and the gold-silver ratio rose to 77. A look at the chart of either metal shows that a downtrend in prices (i.e. uptrend in the dollar) that began in mid-April reversed in mid-July. Then the prices began rising (i.e. dollar began falling). But that move ended...

Read More »FX Daily, October 03: Dollar Retains Firm Tone, Spanish Markets Stabilize

Swiss Franc The Euro has risen by 0.17% to 1.1452 CHF EUR/CHF and USD/CHF, October 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Firm US interest rates and a strong manufacturing ISM yesterday help support the greenback, while disappointing construction PMI in the UK weighs on sterling. The euro briefly slipped below $1.17 in Asia for the first time in six weeks. It...

Read More »Another Look at Why the Return to Capital is Low

(summary of presentation based on my book, Political Economy of Tomorrow, delivered to Bank Credit Analyst conference yesterday) Alice laughed. There is no use trying; she said, “one can’t believe impossible things.” I dare say you haven’t had much practice, said the queen. When I was younger, I always did it for half an hour a day. Why sometimes I’ve believed as many as six impossible things before breakfast. — Lewis...

Read More » SNB & CHF

SNB & CHF