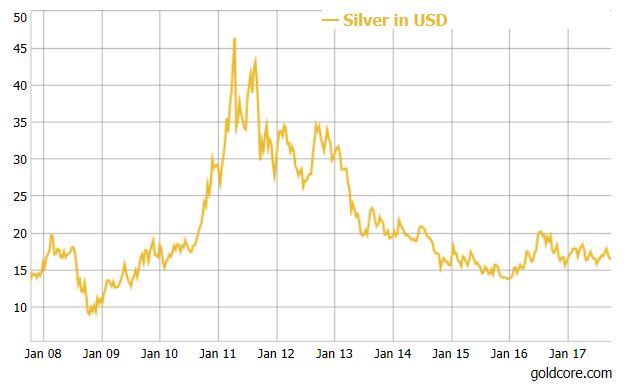

– Safe haven silver to outperform gold in Q4 and 2018 – “Expect silver to eventually outperform gold” say Metals Focus– 2017 YTD, silver has underperformed gold, climbing by 5% versus 11%– Silver undervalued versus gold and especially stocks, bonds and many property markets– Will follow gold’s reactions to macroeconomic & geopolitical factors and should outperform gold– Special report on India shows it accounts for just 16% of global silver demand – Silver a “safe haven at times during which gold failed to be” according to academic research Silver Price in USD, Jan 2008 - 2017(see more posts on silver price, ) - Click to enlarge Since the beginning of 2017 the silver price has disappointed many investors. With a

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, gold silver ratio, GoldCore, newsletter, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| – Safe haven silver to outperform gold in Q4 and 2018 – “Expect silver to eventually outperform gold” say Metals Focus – 2017 YTD, silver has underperformed gold, climbing by 5% versus 11% – Silver undervalued versus gold and especially stocks, bonds and many property markets – Will follow gold’s reactions to macroeconomic & geopolitical factors and should outperform gold – Special report on India shows it accounts for just 16% of global silver demand – Silver a “safe haven at times during which gold failed to be” according to academic research |

Silver Price in USD, Jan 2008 - 2017(see more posts on silver price, ) |

| Since the beginning of 2017 the silver price has disappointed many investors. With a 5% gain so far in 2017, it has failed to match gold’s 11% gains this year. Both precious metals have ultimately performed below expectations given the positive macroeconomic and geopolitical backdrop.

However, things are starting to look up for the industrial precious metal as industry observers believe it will outperform gold this quarter and into 2018. In a recent Metals Focus report, the precious metals consultancy concluded that ‘we do expect silver to eventually outperform gold.’ Whilst demand for silver coins in the US has been weak, there are some indicators that suggest this physical demand is beginning to pick up, alongside industrial demand. For example, there has been robust silver ETF demand and in September there was significant uptick in those taking immediate delivery on COMEX. This year has also taken many market participants by surprise as silver demand has fallen in a number of areas. One of which is India. The Metals Focus report for the Silver Institute believes that Indian demand in 2017 has not matched the decades’ unprecedented silver demand due to higher prices and a clampdown by Indian government on unbanked money in the drive to the cashless society. However, incomes and the economy and both growing which leads the report to conclude that demand will come back to the country with a bang. Gold-Silver ratio shows silver undervalued In June, silver hit a low of $15.60/oz, since then it has recovered somewhat. The gold-silver ratio is also higher than expected, given gold’s performance of late. Earlier this year it fell to as low as 68, but has recently been stuck between 74 and 80. |

Gold:Silver Ratio, Nov 2016 - Oct 2017(see more posts on gold silver ratio, ) |

| The modern historical average is around 40 to 1. The long term historical average is 15 to 1.

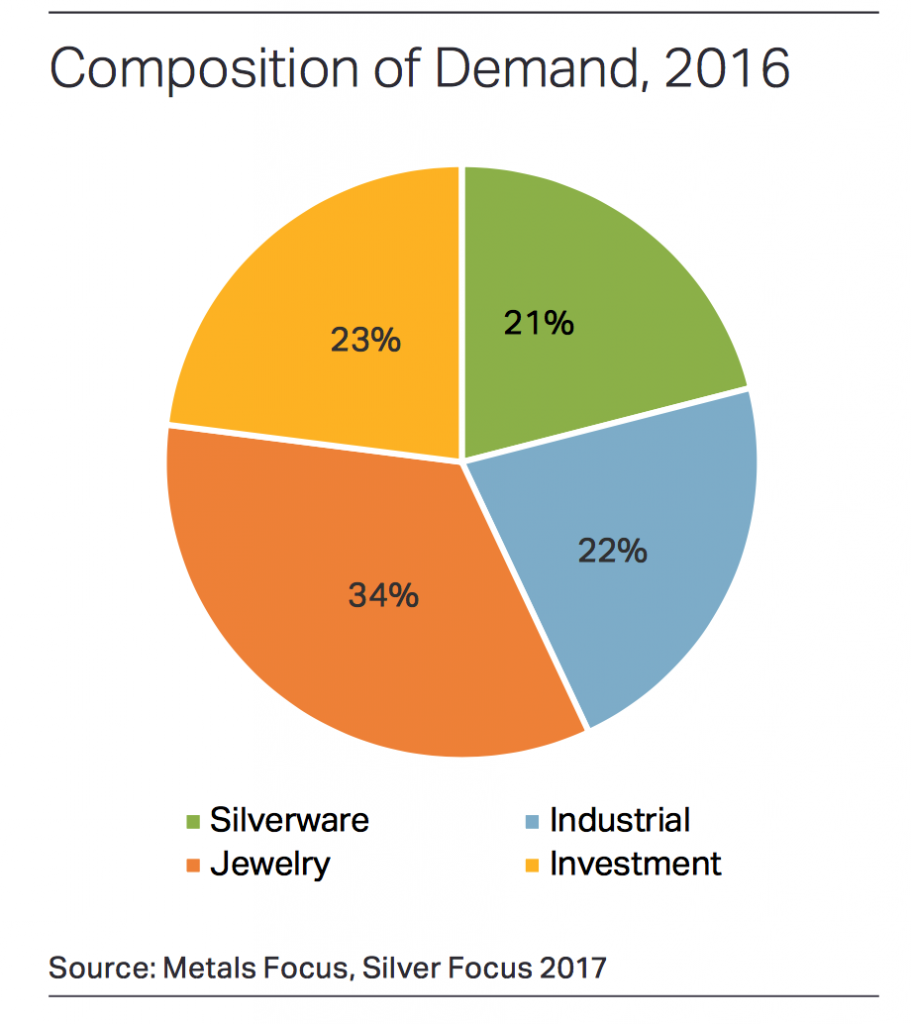

Not only is silver undervalued relative to gold but also to increasingly over valued stocks, bonds and property markets. Given silver’s industrial role and the fact that geologically there are just 15 particles of silver to every one particle of gold, it is likely that the gold/silver ratio will gradually return to below the 100 year average of 40 to 1. At the current depressed gold price this would put silver at nearly $32/oz. India’s love for silver Love for gold in the world’s seventh largest economy is well-documented but few are aware of it’s feelings towards silver. In 2016 India’s demand for silver accounted for just 16% of global demand. The report summarises the all important context for this: India is one of the world’s largest silver markets, with a very traditional core in a diverse market. To put this into perspective, India consumed 160.6Moz (4,996t) last year, which accounted for a noteworthy 16% of global silver demand. It is not only the scale of Indian demand that matters; the country’s dependence on imported metal means that changes in Indian offtake can impact those countries that supply bullion to India. The sheer scale of the Indian silver market resonates across much of the country, from physical investment, through to day-to-day activities. It is also integral to India’s cultural and belief systems. It is therefore not surprising that silver is an important part of Indian festivities and weddings. For example, it is considered auspicious to gift silver during weddings or for the birth of a child. All this means that silver’s appeal extends across most income groups. Even so, the silver market in recent years has evolved considerably in line with the growth in the Indian economy and the rise in Regarding demand, jewellery, silverware and physical investment account for around 75% of total Indian silver demand. With jewellery and silverware accounting for more than 50% of total silver demand. Investment demand is increasing from a very low base. |

Composition of Demand, 2016 |

In 2010 the two markets combined accounted for 1,200t. By the end of the decade the Silver Institute believes ‘the market will expand further to around 109Moz (3,400t), driven largely by healthy economic growth.’

Industrial demand accounts for just 22% of Indian demand and, like investment silver, it has struggled in recent years. The report explains, that this was due to an economic slowdown:

‘This saw Indian demand fall from 45.7Moz (1,421t) in 2010 to 35.9Moz (1,115t) in 2015. However, with the economy improving over the last two years (GDP growth is back over 7%), we expect industrial demand to continue to rise in the coming years.’

Outlook has a silver lining

World Gold Council data-provider Metals Focus’ conclusion will bring some hope to silver investors:

“the case for further price gains, for both silver and gold still appears strong. Together with negative interest rates (in real or nominal terms) in several key currencies, expectations for Fed rate increases have also been pushed further out. This should make the case for a weaker dollar going forward. Along with heightened geopolitical concerns, investment demand should strengthen. While gold will be the main beneficiary, silver prices should also improve.”

Overall, silver will not only step back up to the plate but it will excel the lacklustre performance of this year.

“Given silver’s much smaller market (compared with gold) it should experience greater price volatility. This in turn should see silver prices eventually outperform gold, both later this year and into 2018”

A buying opportunity

We can sit and ponder where we think the price may or may not go in the last three months of the year. We can also sit and hypothesise as to why both gold and silver haven’t performed better this year. Neither of these scenarios help our portfolios.

Instead we have to focus on what we do know – silver is currently relatively cheap when considered against a backdrop of heightened geopolitical concerns, rising inflation and ever-prominent and increasing debt risks.

History tells us that very little currently at the forefront of both economic and political concerns are going to be dealt with without negative consequences. History also tells us that silver has a key role to play as a safe haven in your portfolio.

Academic research echoes this sentiment.

Should you believe the politicians both here and across the pond that the economy is improving, this is a further reason to hold silver as part of your portfolio. In 2012 Belousova and Dorfleitner concluded that

‘Adding silver or platinum to a portfolio [of stocks, sovereign bond and the money market instruments] during bull markets reduces volatility and enhances return.’

When looking at all four precious metals’ role as a safe haven between 1989 and 2013, against the S&P 500 and US 10 year bonds, Lucey and Li (2015) found that ‘silver was a safe haven at times during which gold failed to be’, but also during far more quarters than both platinum and palladium.’

Tags: Daily Market Update,Featured,gold silver ratio,newsletter,silver price