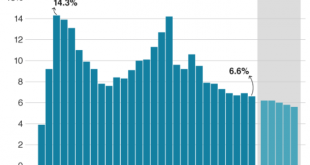

The latest numbers released by China’s statistics bureau fueled widespread concerns about the outlook of the global economy, as the Asian superpower reported its slowest growth rate since 1990. The figures showed a 6.6% growth for 2018, confirming the view that the growth engine of the world economy is running out of steam. Deep-seeded vulnerabilities, far beyond the trade war China’s weakening growth has been widely...

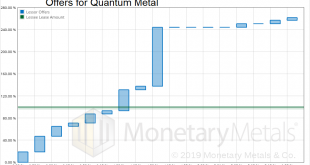

Read More »Quantum Metal Lease #1 (gold)

Monetary Metals leased gold to Quantum Metal, to support the growth of its gold distribution business through retail bank branches. The metal is held in the form of retail Perth Mint bars. For more information see Monetary Metals’ press release. Metal: Gold Commencement Date: January 31, 2019 Term: 1 year Lease Rate: 4.5% net to investors Offers for Quantum Metal - Click to enlarge...

Read More »We could see another 5% rise in the dollar: Win Thin

Win Thin, emerging markets strategy at Brown Brothers Harriman, discusses what the latest moves in the dollar mean for the overall stock market. » Subscribe to CNBC: http://cnb.cx/SubscribeCNBC About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more. Connect with CNBC News Online Get the latest news: http://www.cnbc.com/...

Read More »We could see another 5% rise in the dollar: Win Thin

Win Thin, emerging markets strategy at Brown Brothers Harriman, discusses what the latest moves in the dollar mean for the overall stock market. » Subscribe to CNBC: http://cnb.cx/SubscribeCNBC About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more. Connect with CNBC News Online Get the latest news: http://www.cnbc.com/ Find CNBC...

Read More »FX Daily, February 12: Dollar Buying Pressure Subsides

Swiss Franc The Euro has risen by 0.63% at 1.1388 EUR/CHF and USD/CHF, February 12(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Dollar Index’s eight-day advance is in jeopardy. Although the greenback recorded new highs against some major currencies, the momentum appears to be stalling. The news stream is constructive as a compromise seems to have been...

Read More »Switzerland investigating Venezuela-linked corruption

Despite its vast reserves of oil, Venezuela has to import fuel. (Keystone) Switzerland’s attorney general has opened an investigation into a corruption case involving Venezuela, according to a weekend report published by Schweiz am Wochenende. The Latin American nation is in the grips of a major political, economic and social crisis. According to the prosecutor’s statement to the weekly, proceedings were initiated at...

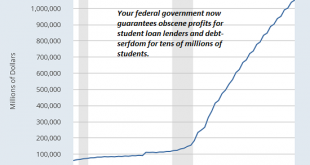

Read More »We’re Overdue for a Sell-Everything/No-Fed-Rescue Recession

We’re way overdue for a sell-everything recession, one that the Fed will only make worse by pursuing its usual policies of lowering interest rates and goosing easy money. As I noted last week, central banks, like generals, always fight the last war–until the war is lost. The global economy is careening into recession (call it a “slowdown” if you are employed by the Corporate-State Media), and while we don’t yet know...

Read More »Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen

-Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen– Growing demand from investors to relocate tangible assets out of the UK– “Zurich continues to be the most sought-after location for storage, but Dublin has already surpassed Hong Kong and will likely usurp the second spot from London” Gold bars sit across a one kilo gold bar at precious metals storage specialist GoldCore....

Read More »What They Don’t Want You to Know about Prices, Report 10 Feb

Last week, in part I of this essay, we discussed why a central planner cannot know the right interest rate. Central planner’s macroeconomic aggregate measures like GDP are blind to the problem of capital consumption, including especially capital consumption caused by the central plan itself. GDP has an intrinsic bias towards consumption, and makes no distinction between consumption of the yield on capital, and...

Read More »FX Daily, February 11: Dollar Starts New Week on Firm Note

Swiss Franc The Euro has risen by 0.05% at 1.1331 EUR/CHF and USD/CHF, February 11(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Lifted by the re-opening of Chinese markets after the week-long Lunar New Year holiday, global equities are trading firmer. Outside of Japanese markets that were closed, the large markets in Asia–China, Taiwan, South Korea, and...

Read More » SNB & CHF

SNB & CHF