Authored by Matthew Piepenburg via GoldSwitzerland.com,

Sensationalism, like central bankers and policy makers, has many faces, views and voices.

This may explain why so many want to hold their ears, hug their knees and beg the heavens for a beacon of guiding light amidst a 24/7 fog of info-cycle pablum masquerading as information.

Facts in a Fog of Sensationalism

With so many opposing ideas, movements, policies, parties, and personalities buzzing galvanically for attention, dollars or votes (in a world rightly or wrongly brought to its pandemic-accelerated knees), it’s becoming increasingly difficult to believe anything or anyone.

And this is likely because just about everything and everyone (from defective Fed chairmen to defecting royal princes and politicized

Articles by Tyler Durden

West Virginia Gov. Personally On The Hook For $700MM In Greensill Collapse

June 1, 2021The collapse of Greensill Capital has been the biggest financial scandal of the year so far, having set off a massive public corruption scandal in the UK that has deeply embarrassed the ruling Conservative Party due to the close involvement of former PM David Cameron, who was on the Greensill payroll and was caught trying to steer relief funds meant for small businesses to Greensill to help avert its collapse.

Most recently, Credit Suisse cited Greensill as its reason for cutting off SoftBank from all future investment-banking business after the Japanese mega-conglomerate with a VC arm was caught lying about its real role in CS’s trade finance funds that were stocked with Greensill-packaged assets. Softbank was essentially using the fund to quietly bolster some of

“Everything Is On Fire”

May 20, 2021Authored by Egon von Greyerz via GoldSwitzerland.com,

“Everything is on fire” – Heraclitus (535-475 BC)

What Heraclitus meant was that the world is in a constant state of flux.

But the big problem in the next few years is that the world will experience a fire of a magnitude never seen before in history.

I have in many articles and interviews pointed out how predictable events are (and people). This is particularly true in the world economy. Empires come and go, economies boom and bust and new currencies come and without fail always go. All this happens with regularity.

A GLOBAL FIRE IS COMING

But at certain times in history, the fire will be cataclysmic. And that is where the world is now.

Explosive fires have started everywhere already. Stock markets are on

Where Europeans Get To Work From Home

May 20, 2021The social distancing measures introduced in response to the Covid-19 pandemic has forced many people to work from home and accelerated the trend of remote working.

Eurostat have released some interesting new data showing the share of employed people aged between 15 and 64 in Europe who usually do home office.

As Statista’s Miall McCarthy notes, over the past decade, that has been hovering at around five percent and the pandemic has seen it rise to 12.3 percent.

This infographic shows the situation across the continent and it also includes rates in EEA countries – Iceland, Switzerland and Norway.

UK data was not available.

You will find more infographics at Statista

With a quarter of its employed residents usually working from home, Finland now has the highest

Bitcoin Versus Gold: A Tired Debate

May 19, 2021Authored by Matthew Piepenburg via GoldSwitzerland.com,

Bias vs. Logic

We’ve written elsewhere about the ironic over-use of logic to justify otherwise illogical biases.

As Swiss-based precious metals professionals who see physical gold and silver as currency protection outside of an openly illogical (and dangerously fractured) banking system, it is more than fair for some to challenge our own “logic” (bias?) when it comes to precious metal ownership.

We understand such critiques.

Pandora’s Box

Such criticism, of course, strikes even more nerves (and claims of potential illogic) when precious metal professionals open the Pandora’s box of any conversation around Bitcoin, which has become, understandably, the sacred cow of many over-night millionaires and

UBS Reportedly Re-Starts Layoffs After “Doubling” One Time Bonuses To Some Associates

May 12, 2021On one hand, UBS seems hell bent on keep its new Gen Z employees who have recently been promoted to associate positions. After all, it was just hours ago that we wrote about how the bank was showering some newly promoted employees with one-time $40,000 bonuses.

Yet on the other hand, UBS apparently isn’t as determined to hang on to certain other employees. The bank has reportedly re-started its “Reduction in Force” job cut plan this week, according to Bloomberg, who cited Inside Paradeplatz.

Inside Paradeplatz, citing unidentified people familiar with the matter, said that the bank has “started giving notice to employees” of the layoffs. The bank reportedly pointed to “planned savings” for its reasoning, without identifying further details about the planned

UBS, Desperate To Retain Talent, Now Offering $40,000 Bonuses To Newly Promoted Associates

May 11, 2021It looks like the hiring (and retention) shortage isn’t just for rank-and-file minimum wage jobs.

UBS has now said that, amidst historic competition and a “retention crisis” in the investment banking world (which we noted weeks ago), it is going to pay a one time $40,000 bonus to its global banking analysts when they are promoted. This is double what some of the bank’s competitors are offering.

It’s part of a push for lenders “to reward and retain younger employees weighed down by a surge in business and a prolonged work-from-home grind,” according to BNN Bloomberg.

The bank is planning on paying the bonus to analysts who are promoted to associates, on top of regular salary increases. It marks a bonus that is about 30% of the base pay of a newly promoted

Credit Suisse Hires Former Prime Brokerage Head To Restore Business After Archegos Blowup

May 9, 2021After firing a raft of senior employees including its head of risk, Lara Warner, Credit Suisse has been struggling to move past a series of major risk-management failures that together could cost the bank $10 billion, or more, though the final tally of losses from the Archegos blowup isn’t yet known as the bank weighs whether it should cover some client losses associated with the “low risk” trade-finance funds that collapsed earlier this year.

Following reports that the bank took in only $17.5MM in fees from servicing the trade that led to the collapse of highly-levered Archegos Capital, the hedge fund that used highly leveraged $20 billion to more than $100 billion via a string of bets with various prime brokers to amplify its bets on ViacomCBS and a host of

Read More »Gold Is Laughing At Powell

May 3, 2021Authored by Matthew Piepenburg via GoldSwitzerland.com,Recently, my colleague, Egon von Greyerz, and I had some unabashed yet blunt fun calling out the staggering levels of open hypocrisy and policy desperation unleashed by former Fed Chairman, Alan Greenspan.Poor Alan was an easy target of what I described as the “patient zero” of the reckless interest rate suppression and unbridled monetary expansion policies of the Fed which have always led to equally reckless boom and bust cycles in markets and economies.But let us be fair to comical Fed Chairmen like Greenspan, as he is not alone in making a mockery of his post at the Eccles Building.With the exception of Paul Volker and William Martin, the sad truth is that nearly every person who has sat in that lead Chair

Read More »The $3 Trillion Hidden Exposure Behind The Archegos Blowup

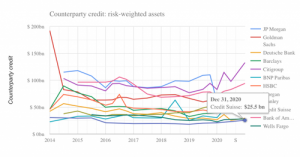

May 2, 2021Authored by Nick Dunbar of Risky FinanceWhen the family office Archegos Capital abruptly imploded in late March, prompting $50 billion in block trades and $10 billion in losses at Credit Suisse, Nomura, UBS and Morgan Stanley, many bank analysts were taken by surprise. Last week, many of these analysts sounded frustrated listening to Credit Suisse’s earnings call in which senior management skirted round without giving any real detail about the disaster.“Do you think it’s possible that this could produce a very fundamental reset in how your IRB credit risk models work?” wondered Stefan Stalmann of Autonomous Research. “I mean you have only CHF20 billion to CHF25 billion of counterparty credit risk-weighted assets on literally hundreds of billions of equity swaps

Read More »“Read My Lips…” – FedSpeak Exposed

April 30, 2021“Read my lips: No New Taxes” Bush Sr said in his acceptance speech for his nomination in 1988 when he promised no tax rises. As most politicians, he didn’t keep his word. In the 1992 campaign Clinton made a devastating attack on Bush’s pledge and the rest is history.

The simple rule is: Don’t listen to WHAT people say, but HOW they say it. Already 50 years ago the Mehrabian model concluded that words only convey 7% of a message, body language accounts for 55% and tone of voice delivers 38%. That is why you should never focus on the words of a speaker since they are the least important.

A WORLD OF QUANTS AND NEURAL SYSTEMS

Automation of investment decisions is a massive growth area. In early 2020 Goldman Sachs had 920 vacancies for engineers, including

Credit Suisse’s Archegos Exposure Was Reportedly Over $20 Billion

April 22, 2021Just minutes after the SEC is reportedly “exploring how to increase transparency for the types of derivative bets that sank Archegos,” The Wall Street Journal reports that Credit Suisse Group AG had somehow allowed a massive exposure to investments related to Archegos Capital Management or more than $20 billion.

While the bank has said that its losses on the positions amounted to $4.7 billion, WSJ, citing people familiar with the matter, reports that Archegos’ bets on a collection of stocks swelled in the lead-up to its March collapse, but parts of the investment bank hadn’t fully implemented systems to keep pace with Archegos’s fast growth.

Some inside the bank who were familiar with Archegos’s exposure had thought it was a fraction of the roughly $20 billion

Credit Suisse Slashes Bonuses After $4.7 Billion Archegos Disaster

April 13, 2021While all of the banks playing “pass the hot potato” with Archegos Capital’s now-dismantled equity book are undoubtedly still assessing the damage they incurred (or at least will report to shareholders), it looks like no one had it worse than Credit Suisse.

The banking giant has now slashed its bonus pool by “hundreds of millions of dollars” according to FT, after the firm lost $4.7 billion in the Archegos implosion. Credit Suisse is Switzerland’s second biggest lender by assets and had Archegos as a client of its prime brokerage division.

The staggering $4.7 billion loss accounts for about 18 months of net profits for the bank. As questions also continue to loom about the implosion of Greensill Capital, Credit Suisse’s compliance and risk management is under the

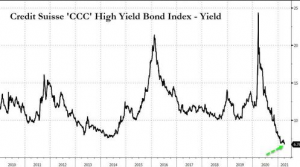

“They’re Just Chasing” – The Fed Has Put Distressed Investors Out Of Business… Again

April 10, 2021“People aren’t investing, they’re just chasing.”

That is the ominous, ponzi-like warning from Adam Cohen, Caspian Capital’s managing partner as the distressed debt investor has chosen to return some money to investors because the rewards don’t justify the high risks anymore.

He is not wrong as it’s party time for zombie companies everywhere as “high yield” is now officially “low yield.”

“People aren’t investing, they’re just chasing.”

That is the ominous, ponzi-like warning from Adam Cohen, Caspian Capital’s managing partner as the distressed debt investor has chosen to return some money to investors because the rewards don’t justify the high risks anymore.

He is not wrong as it’s party time for zombie companies everywhere as “high yield” is now officially “low

Can Credit Suisse Avoid Becoming The ‘Deutsche Bank’ Of Switzerland?

April 8, 2021“And the future is certain, give us time to work it out…”

Markets were shaken but unstirred by the collapse of Greensill and the Archegos unwind trades. Credit Suisse is the ultimate loser of the two scandals – reputationally damaged and holed below the water line. The bank is paying the price of years of flawed management, poor risk awareness. and its self-belief it was still a Tier 1 global player. Its’ challenge is to avoid becoming the Deutsche Bank of Switzerland – which it will struggle to do without a radical and unlikely shakeout.

As the global economy bounces back, markets are having a good time as indices close higher, but things aren’t so bright in Switzerland.

I started this morning by opening Credit Suisse’s Private Banking website. I was curious.

Credit Suisse Dumping Huge Archegos Blocks; Liquidating Millions In VIACS, VIPS And FTCH

April 6, 2021Literally moments ago we said that the Archegos portoflio was being sold off all day on fears of “stealth” prime broker deleveraging, as tens of millions of shares were yet to be accounted for. Then, moments after 5pm, Credit Suisse – the firm that was hammered the hardest by the Archegos implosion and which had yet to provide a detailed breakdown of its Bill Hwang-linked P&L – confirmed what we said, when it unveiled a massive secondary offering dump, including shares of VIACA, VIPS and FTCH.

As shown in the block notice below, Credit Suisse hopes to sell its remaining holdings in VIAC at $41-$42.75; its VIPS at $28.50-$29.50 and its FTCH at $47.50-$49.25. While it is unclear what losses the Swiss bank is taking on these final unwinds, it’s safe to say that they

Another Wirecard? Invoices Backing Greensill-Issued Bonds Never Existed, Administrator Finds

April 2, 2021As the collapse of Greensill Capital threatens to ensnare former PM David Cameron in a humiliating public probe, the Financial Times on Thursday reported some disturbing new details that appear to suggest Greensill wasn’t merely reckless, but potentially guilty of a Wirecard-style fraud. According to the FT, Greensil’s administrator – who is responsible for winding down whatever assets remain and managing creditors’ claims – “has failed to verify invoices underpinning loans to Sanjeev Gupta, after companies listed on the documents denied that they had ever done business with the metals magnate.”

In other words, it would appear that some of the bonds issued by Greensill were backed by fraudulent invoices. Keep in mind, Credit Suisse went on to take these bonds and

Read More »Things That Make Me Go Hmmm: Inflation, Crypto, Command Economies, & Gold

March 29, 2021Over the years I’ve written almost ad nauseum about the crazy I see (and saw) around me as a fund manager, family office principal and individual investor.

The list includes: 1) an entire book on the grotesque central bank distortions of free market price discovery, 2) the open (and now accepted) dishonesty on everything from front-running Musk tweets and bogus inflation reporting to COMEX price fixing, 3) the insanity of 100-Year Austrian bonds or just plain negative-yielding bonds going mainstream, 4) the open death of classic capitalism and the rise of economic feudalism, 5) asset bubble hysteria seen in everything from BTC to Tesla; 5) rising social unrest, 6) the serious implications of Yield Curve Controland the gross mispricing of debt that has midwifed the

Getting Ready For Gold’s Golden Era

March 20, 2021Worried about gold sentiment? Don’t be.

The mainstream view of gold right now is an open yawn, and sentiment indicators for this precious metal are now at 3-year lows despite the gold highs of last August.

Is this cause for genuine concern?

Not at all.

In fact, quite the opposite.

Most investors are totally wrong about gold, and below we show rather than argue why they are missing the forest for the trees.

Unlike trend chasers, speculating gamblers and gold bears, sophisticated precious metal professionals and historically (as well as mathematically) conscious investors are not only calm right now, they are biding their time for what is about to become gold’s perfect backdrop and, pardon the pun, golden era.

Understanding the Current Gold Price

As for the current

Credit Suisse Claws Back Bonuses, ‘Restructures’ Asset-Management Unit As Greensill Scapegoating Continues

March 19, 2021Credit Suisse is still reeling from the collapse of Greensill Capital, a firm which it championed by helping to sell its financial products (created by ensconcing trade invoices in a complex securities wrapper). 8 months after the first reports emerged about the bank’s potential involvement in a risky “circular financing scheme” involving SoftBank and Greensill (which the bank pledged to investigate at the time), CS and its clients have been left holding the bag (after CS gated some $10 billion in funds stocked with Greensill products, claiming that, without insurance coverage, the assets had become impossible to value). And now the bank is understandably eager to scapegoat some employees, in accordance with the Wall Street scandal playbook.

According to the FT‘s

Swiss Voters Approve ‘Burqa Ban’

March 13, 2021Swiss voters have narrowly approved a proposal to ban face coverings in public spaces.

The measure comes just over a decade after citizens voted to ban the construction of minarets, the tower-like structures on mosques that are often used to call Muslims to prayer.

The referenda reflect the determination of a majority of Swiss voters to preserve Swiss traditions and values in the face of runaway multiculturalism and the encroachment of political Islam.

Switzerland now joins Austria, Belgium, Bulgaria, Denmark, France, Germany, Italy, Latvia, the Netherlands and Sweden, all of which currently have full or partial bans on religious and non-religious face coverings.

The binding referendum, approved on March 7 by 51.2% of voters, is popularly known as the “burqa

Credit Suisse Launches Probe Into Collapsed Greensill Trade-Finance Funds

March 11, 2021Roughly a weekand a-half has passed since Credit Suisse gated funds containing $10BN in assets packaged by Greensill, the troubled financial innovator that suckered in former British PM David Cameron, SoftBank and legions of clients and investors with its stated mission to “democratize” supply-chain finance. Now that the trade finance emperor has fallen (having filed for administration earlier this week), Credit Suisse is starting the arduous process of convincing regulators and its clients that the bank is taking steps to ensure that something like this never happens again.

In keeping with its scandal-response playbook, the Swiss megabank is launching an internal investigation (kind of like it did after the corporate espionage scandal which felled its former CEO,

SocGen Slashes Banker Bonuses Amid ECB Pressure

March 4, 2021Despite banks, broadly speaking, having a banner year in 2020 as central-bank-liquidity more-than-washed over the losses due to COVID and policy restrictions, banker bonuses have come under pressure.

In Europe, the picture is more uncertain as banks’ performance has been mixed.

Credit Suisse wound up reducing its bonus pool by about 7%.

Back in December 2020, Credit Suisse CEO Thomas Gottstein blamed the cuts on social responsibility, stating that “it’s too early to say, but generally you have to expect that bonuses will be down compared to last year and this is part of our solidarity and social responsibility. This is a challenge, but it’s something the whole industry is facing.”

Deutsche Bank also had to scale back a plan to increase bonuses after the EU

Swiss To Vote In Referendum On Government’s Emergency COVID-19 Measures

February 25, 2021After mounting a national campaign, and the work of determined local organisations, Swiss campaigners have managed to trigger a referendum for ending the government’s destructive COVID regulations. If successful, this will also be a blow for the extremists at the World Economic Forum in Davos, Switzerland, who have been pushing the idea of a global economic shutdown since the beginning of the alleged ‘global pandemic.’

Among other things, the peoples’ revolt is pushing back against the government’s coercive attempt to enforce a “compulsory system with poorly tested vaccines.”

In the meantime, the government has announced that it will start to ease some national mitigation measures from March 1st.

Euro News reports…

Swiss campaigners have triggered a referendum on

The Death Of Logic

February 24, 2021Just over four years ago, as Bitcoin was making its first big moves in both price and public perception, John Hussman of Hussman Investment Trust penned a lengthy as well as seminal report entitled, “Three Delusions: Paper Wealth, a Booming Economy, and Bitcoin.”

The core themes set forth in his report (as in any well-reasoned, blunt analysis) are refreshingly evergreen in their ongoing applicability.

Rather than re-invent an already functioning wheel, I’ve opted to revisit some of Hussman’s key arguments which have not only stood the test of time, but remain even more pertinent in today’s perception-challenged markets.

The Follies of Our Predecessors

Hussman’s report opens with a quote from Charles Mackay’s work, Extraordinary Popular Delusions and the Madness of

Unhappy Endings: Deception Has Gone Global

February 16, 2021Looking Behind the Labels

Regardless of one’s politics, most would agree that extremely complex issues are typically given extremely misleading titles.

Not all those of the extreme left, for example, are all that “woke” and not everyone on the far right, to be fair, is a “domestic terrorist.”

Nevertheless, words are often misused and abused to place, as well as burry, otherwise nuanced realities behind simple phrases, as we’ve seen in everything from the “Patriot Act” to “Monetary Stimulus.”

Financial Fiction Writers

So many of the fancy words and phrases tossed about by our financial elites come in such deliberate yet pear-shaped tones of calm, authority and wisdom.

Even the title, “Federal Reserve,” is one loaded with irony for what is otherwise a private bank…

Goldman Lists The Three Things That Could Go “Really Wrong” In 2021

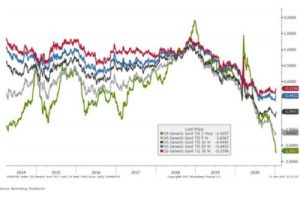

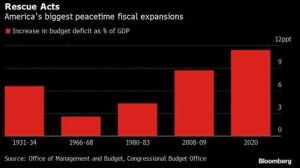

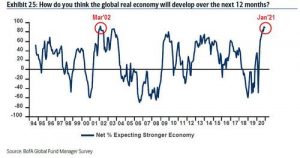

January 25, 2021On Saturday, we showed why according to observations from Credit Suisse and BofA, the “US Economy Is Set To Overheat As Households Are Flooded With $2 Trillion In Excess Savings.” Then, in a note this morning from Morgan Stanley asking “What To Do About All This Optimism” the bank said that “in November, December and now January, no question or concern has come up more often than ‘everyone is optimistic’.” Finally, the latest Fund Managers Survey showed that investors’ global growth expectations rose by 1% to a net 90%, the 3rd highest growth expectations ever (#1 in March 2002, #2 in November 2020).

Global Real Economy, 1994-2020 – Click to enlarge

This unbridled optimism prompted Goldman to boost its full year US GDP forecast to 6.6%, nearly 50% higher than

Insanity: As The US Enters A Depression, Stocks Are Now The Most Overvalued Ever

April 12, 2020Two days ago, when a platoon of clueless CNBC hacks said that stocks were extremely undervalued, and must be bought (on their fundamentals, not because the Fed was about to nationalize the entire bond market and is set to start buying equity ETFs in the next crash), we showed just how “undervalued” the market was.

That’s when Credit Suisse chief equity strategist Jonathan Golub – usually one of the most bullish Wall Streeters – published a chart showing that any “temporary” cheapness in stocks hit in late March was long gone for the simple reason that forward earnings have plunged. As a result, as of noon on March 7, when the S&P 500 had risen as much as 22% from March 23 lows, forward stock multiples had surged right back 19.0x.

Why is this notable? Because as

As COVID-19 Drives People Into Isolation, Wall Street’s New ‘Virtual Workplace’ May Become The Norm

March 24, 2020As governments take drastic measures to slow the spread of the Wuhan coronavirus pandemic, Wall Street – much like a plethora of other industries – has embraced the virtual workplace, according to Bloomberg.

In Hong Kong, bankers have learned to win stock offerings by video chat, and Morgan Stanley is hosting a virtual meeting for a thousand-plus attendees. At Swiss giant UBS Group AG, wealth management executives have realized trips to see clients weren’t as crucial as thought. In California, an investor in hedge funds said he’s pleasantly surprised by how much faster he can confer with them remotely. –Bloomberg

And according to the report, virtual finance may outlast the coronavirus – assuming a treatment is eventually found. Bloomberg notes that there are

Jim Bianco: “This Is One Of The Biggest Moments Of Truth In Financial Market History”

March 18, 2020Authored by Christoph Gisiger via TheMarket.ch,

To contain the economic and financial ramifications of the coronavirus pandemic, Central Banks are going all in.

Jim Bianco, founder and chief strategist of Bianco Research, warns that this time, monetary policy might be unable to stop financial markets from collapsing.

The Federal Reserve brings out the bazooka: It cuts the federal funds rate down to zero and will buy $700 billion in Treasuries and mortgage-backed securities. Additionally, in a coordinated effort with five other major central banks, including the Swiss National Bank, the Fed opens swap lines to smooth out disruptions in overseas Dollar markets.

Still, financial markets seem unimpressed. Futures contracts on the S&P 500 dropped 5%, reaching a «limit