Since 2013 China continues to absorb physical gold from the rest of the world at a staggering pace. Worth noting is that gold imported into the Chinese domestic market is not allowed to be returned in the foreseeable future. Because ownership and the disposition of these volumes of gold likely will be of great importance next time around the international monetary system is under stress, it’s well worth tracking China’s progress of imports – especially because the mainstream media and most consultancy firms are in denial of these events.

Click on this link for an in-depth analysis of the structure of the Chinese gold market.

Below we’ll discuss what countries supplied gold to China in 2017, Singapore’s role not only

Articles by Koos Jansen

China Gold Import Jan-Sep 777t. Who’s Supplying?

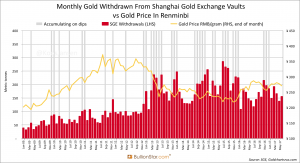

November 14, 2017While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day. The Chinese appear to be price sensitive regarding gold, as was mentioned in the most recent World Gold Council Demand Trends report, and can also be observed by Shanghai Gold Exchange (SGE) premiums – going up when the gold price goes down – and by withdrawals from the vaults of the SGE which are often increasing when the price declines. Net inflow into China accounted for an estimated 777 tonnes in the first three quarters of 2017, annualized that’s

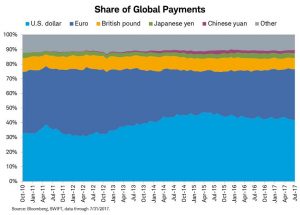

Read More »The Gold-Backed-Oil-Yuan Futures Contract Myth

October 16, 2017On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece was released ‘the story’ was widely copied in sensational analyses throughout the gold space. However, ‘the story’, as presented by Nikkei, doesn’t make sense at all. Allow me to share my 2 cents in addition to what I shared previously on the Daily Coin.

All the rumours and analyses on gold, oil and yuan

Estimated Chinese Gold Reserves Surpass 20,000t

August 2, 2017My best estimate as of June 2017 with respect to total above ground gold reserves within the Chinese domestic market is 20,193 tonnes. The majority of these reserves are held by the citizenry, an estimated 16,193 tonnes; the residual 4,000 tonnes, which is a speculative yet conservative estimate, is held by the Chinese central bank the People’s Bank of China.

I’m aware I’ve been absent from writing about the Chinese gold market for a long time, so for some of you it can be burdensome to pick up where we left a few months ago. It is not feasible for me to explain the entire structure of the Chinese gold market again; my suggestion would be to follow the links provided in the text for more background info. Most

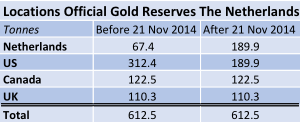

Did The Dutch Central Bank Lie About Its Gold Bar List?

July 25, 2017Head of the Financial Markets Division of the Dutch central bank, Aerdt Houben, stated in an interview for newspaper Het Financieele Dagblad published in October 2016 that releasing a bar list of the Dutch official gold reserves “would cost hundreds of thousands of euros”. In this post we’ll expose this is virtually impossible – the costs to publish the bar list should be close to zero – and speculate about the far reaching implications of this falsehood.

Recap

This story started a couple of years ago. As I am Dutch and concerned not only about my own financial wellbeing but of my country as well, I commenced inquiring my national central bank about the whereabouts and safety of our gold reserves in late 2013. One

US Mint Releases New Fort Knox “Audit Documentation” The First Critical Observations.

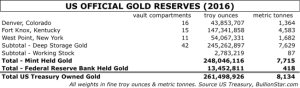

February 27, 2017In response to a FOIA request the US Mint has finally released reports drafted from 1993 through 2008 related to the physical audits of the US official gold reserves. However, the documents released are incomplete and reveal the audit procedures have not been executed proficiently. Moreover, because the Mint could not honor its promises in full the costs ($3,144.96 US dollars) of the FOIA request have been refunded.

Thanks to my readers that donated to the crowdfunding campaign I’ve been able to force the US Mint through a Freedom Of Information Act (FOIA) request to hand over documents related to the physical audits of the US official gold reserves stored at the Mint; also referred to as Deep Storage gold. Although the PDF-package digitally sent to me is redacted, incomplete, includes pages copied twice and materials I didn’t ask for, it’s the closest thing that I’ve ever seen to physical audit documentation of gold at Fort Knox and the other Mint depositories drafted in between 1993 and 2008.

What is worrying is that the reports now in my possession reveal the audit procedures have not competently been executed. Combine that with the fact the documents are incomplete and redacted, and the result is suspicion of fraud.

China Net Imported 1,300t Of Gold In 2016

February 15, 2017For 2016 international merchandise trade statistics point out China has net imported roughly 1,300 tonnes of gold, down 17 % from 2015. The importance of measuring gold imports into the Chinese domestic gold market – which are prohibited from being exported – is to come to the best understanding on the division of above ground reserves in and outside the Chinese domestic market.

Kindly be advised to have read my posts the Mechanics Of The Chinese Domestic Gold Market. If segments in this post are unclear please click the links provided.

The last bits of data are coming in from the countries that export gold to China, with which we can compute the total the Chinese have imported in 2016. There are four main gold exporters to China, which are Hong Kong, Switzerland, the UK and Australia (it’s not publicly disclosed how much South Africa exports directly to China ). Let’s start discussing the largest gold exporter to China.

Hong Kong

Since 2011 when the gold price slowly started to decline and China embarked importing gold at large, Hong Kong has been the main conduit to the mainland. According to data by the Hong Kong Census And Statistics Department (HKCSD) the special administrative region net exported 771 tonnes of gold to China in 2016, ranking first once again.

How The West Has Been Selling Gold Into A Black Hole

January 21, 2017Kindly be advised to have read my posts The Mechanics Of The Chinese Domestic Gold Market and The Great Physical Gold Supply & Demand Illusion before continuing.

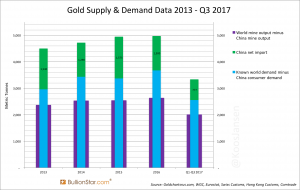

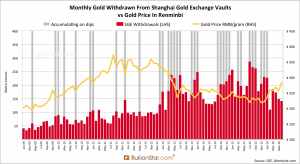

In December 2016 Chinese wholesale gold demand, measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), accounted for 196 tonnes, down 9 % from November. December was still a strong month for SGE withdrawals due to the fact the gold price trended lower before briefly spiking at the end of the month, and the Chinese prefer to buy gold when the price declines (see exhibit 1).

In total Chinese wholesale gold demand reached an astonishing 1,970 tonnes in 2016. But will these huge tonnages bought by China ever have an impact on the gold price? I think it will.

Monthly Gold Withdrawn From Shanghai Gold Exchange Vaults vs Gold PriceExhibit 1. – Click to enlarge

As in previous years, SGE withdrawals were mostly supplied through imports, in 2016 at approximately 1,300 tonnes. And as in previous years, SGE withdrawals were roughly twice the size of Chinese consumer gold demand. The latter is published by all “leading” consultancy firms, such as the World Gold Council and Thomson Reuters GFMS.

Gold In London And Hong Kong Is Used To Settle COMEX Futures

December 8, 2016Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market.

This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at the COMEX. If you’re new to this subject it’s advised to first read my previous posts.

Most gold analysts surmise COMEX 100-ounce gold futures contracts (GC) can only be physically settled through taking and making delivery. This is technically true when excluding the possibility of EFP trading in GC through the over-the-counter (OTC) market. While on Exchange trading in GC is “executed openly and competitively”, trading GC in the OTC realm (and thus the price of the gold, its form and location) is a “privately negotiated transaction” between buyer and seller. The COMEX is a subsidiary of CME Group, which offers its clients OTC trading on a platform called ClearPort.

Gold In London And Hong Kong Is Used To Settle COMEX Futures

December 8, 2016Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market.

This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at the COMEX. If you’re new to this subject it’s advised to first read my previous posts.

Most gold analysts surmise COMEX 100-ounce gold futures contracts (GC) can only be physically settled through taking and making delivery. This is technically true when excluding the possibility of EFP trading in GC through the over-the-counter (OTC) market. While on Exchange trading in GC is “executed openly and competitively”, trading GC in the OTC realm (and thus the price of the gold, its form and location) is a “privately negotiated transaction” between buyer and seller. The COMEX is a subsidiary of CME Group, which offers its clients OTC trading on a platform called ClearPort.

Q1 – Q3 2016 China Net Gold Import Hits 905 Tonnes

November 28, 2016Submitted by Koos Jansen from BullionStar.com

Withdrawals from the vaults of the Shanghai Gold Exchange, which can be used as a proxy for Chinese wholesale gold demand, reached 1,406 tonnes in the first three quarters of 2016. Supply that went through the central bourse consisted of at least 905 tonnes imported gold, roughly 335 tonnes of domestic mine output, and 166 tonnes in scrap supply and other flows recycled through the exchange.

Core Supply & Demand Data Chinese Gold Market Q1-Q3 2016

Chinese gold demand is still going strong this year, albeit less than in 2015. The most likely reason for somewhat lower demand has been the strength in the price of gold in the first three quarters of this year, to which the Chinese reacted by subduing purchases. From 1 January until 30 September 2016, the gold price went up 24 % in US dollars per troy ounce, from $1,061.5 to $1,318.1; measured in renminbi the price went up 28 % over the same period.

Now I have proven the gold on Chinese commercial bank balance sheets has little to do with physical gold ownership of these banks, but mainly reflects back-to back leases and swaps, we can be positive that data on withdrawals from the vaults of the Shanghai Gold Exchange (SGE) roughly equals Chinese wholesale demand.

Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Report

October 27, 2016Submitted by Koos Jansen from BullionStar.com

After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes?

After the Germans had activated a program to repatriate 150 tonnes of their official gold reserves in 2012, which was revised in 2013 to have 50 % of their gold on German soil by 2020, and the Dutch repatriated 123 tonnes in 2014, the Austrians have likely been inspired by these initiatives – if European official gold policy is not adroitly aligned among national central banks behind the scenes. In 2015 the Austrian central bank, the Oesterreichische Nationalbank (OeNB), revealed it would repatriate a significant share of its yellow metal from the UK, where they were storing 80 % (224 tonnes) of their total reserves (280 tonnes) at the Bank Of England (BOE). The Austrians decided to eventually have 50 % of their gold on own soil by 2020 – just like the Germans.

Have a look below at the repatriation schedule of the OeNB for the period from 2015 until 2020.

The Great Physical Gold Supply & Demand Illusion

October 21, 2016Submitted by Koos Jansen from Bullionstar.com

Gold supply and demand data published by all primary consultancy firms is incomplete and misleading. The data falsely presents gold to be more of a commodity than a currency, having caused deep misconceptions with respect to the metal’s trading characteristics and price formation.

Numerous consultancy firms around the world, for example Thomson Reuters GFMS, Metals Focus, the World Gold Council and CPM Group, provide physical gold supply and demand statistics, accompanied by an analysis of these statistics in relation to the price of gold. As part of their analysis the firms present supply and demand balances that show how much gold is sold and bought globally, subdivided in several categories. It’s widely assumed these balances cover total physical supply and demand, which is incorrect as the most important category is excluded. The firms though, prefer not to share the subtle truth or their business models would be severely damaged.

The supply and demand balances by the firms portray gold to be more of a commodity than a currency, as the gist of the balances reflect how much metal is produced versus consumed – put differently, the firms mainly focus on how much gold is mined versus how much is sold in newly fabricated products.

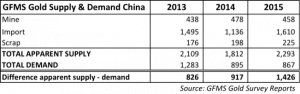

Spectacular Chinese Gold Demand Fully Denied By GFMS And Mainstream Media

August 18, 2016Submitted by Koos Jansen of BullionStar

In the Gold Survey 2016 report by GFMS that covers the global gold market for calendar year 2015 Chinese gold consumption was assessed at 867 tonnes. As Chinese wholesale demand, measured by withdrawals from Shanghai Gold Exchange designated vaults, accounted for 2,596 tonnes in 2015 the difference reached an extraordinary peak for the year. In an attempt to explain the 1,729 tonne gap GFMS presents three brand new (misleading) arguments in the Gold Survey 2016 and reused one old argument, while it abandoned five arguments previously put forward in Gold Survey reports and by GFMS employees at forums. Very few of all these arguments have ever proven to be valid, illustrated by the fact that GFMS perpetually keeps making up new ones, and thus gold investors around the world continue to be fooled about Chinese gold demand. For some reason GFMS is restrained in disclosing that any individual or institution in China can directly buy and withdraw gold at the Shanghai Gold Exchange, which is the most significant reason for the discrepancy in question.

According to my estimates true Chinese gold demand in 2015 must have been north of 2,250 tonnes.

Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

July 8, 2016Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year.

Although Chinese gold demand year to date at 973 tonnes is slightly down from its record year in 2015 – when China in total net imported over 1,550 tonnes and an astonishing 2,596 tonnes were withdrawn from SGE designated vaults – appetite from the mainland is still the greatest of all single nations worldwide. At the same time the mainstream consultancy firms (World Gold Council, GFMS, Metals Focus) continue portraying Chinese gold demand to be roughly half of SGE withdrawals, as these firms measure “gold demand” merely at retail level which excludes any direct purchases at the SGE by institutional and individual investors. But to reassure you, Chinese wholesale gold demand still equals SGE withdrawals.

In the month of June (2016) SGE withdrawals accounted for a robust 139 tonnes, although this was down 29 % from June last year.