United States The first quarter winds down. The dollar moved lower against all the major currencies. The best performer in the first three months of the year has been the Australian dollar’s whose 5.8% rally includes last week’s 1% drop. The worst performing major currency has been the Canadian dollar. It often underperforms in a weak US dollar environment. It’s almost 0.5.% gain is less than half the appreciation of the sterling, the second worse performing major currency here in Q1. Although there are conflicting impulses, interest rate differentials continue to appear to be the single most important factor in considering currency movement presently. The question of the dollar is in good measure a question of the direction of interest rates. US rates have fallen since the Federal Reserve hiked rates in the middle of the month, as they did following last December’s rate hike. There are three considerations in the week ahead: economic data, Fed comments, and an initial assessment of the implications of the failure to repeal and replace the Affordable Care Act. Although Q4 GDP may be tweaked higher to 2%, the most important piece of economic data will be the February personal consumption figures.

Topics:

Marc Chandler considers the following as important: EUR, Featured, FX Trends, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

United StatesThe first quarter winds down. The dollar moved lower against all the major currencies. The best performer in the first three months of the year has been the Australian dollar’s whose 5.8% rally includes last week’s 1% drop. The worst performing major currency has been the Canadian dollar. It often underperforms in a weak US dollar environment. It’s almost 0.5.% gain is less than half the appreciation of the sterling, the second worse performing major currency here in Q1. Although there are conflicting impulses, interest rate differentials continue to appear to be the single most important factor in considering currency movement presently. The question of the dollar is in good measure a question of the direction of interest rates. US rates have fallen since the Federal Reserve hiked rates in the middle of the month, as they did following last December’s rate hike. There are three considerations in the week ahead: economic data, Fed comments, and an initial assessment of the implications of the failure to repeal and replace the Affordable Care Act. Although Q4 GDP may be tweaked higher to 2%, the most important piece of economic data will be the February personal consumption figures. The pullback in the consumer is weighing on Q1 growth estimates, while the rise in business investment does not appear sufficient to counter it. Although February retail sales (~40% of PCE) was soft, the January figure was revised sharply higher. This means that the February PCE report should catch these developments. The targeted core PCE deflator is expected to be unchanged at 1.7%. We note the contrasting projections by the Atlanta and New York Federal Reserve’s GDP trackers. The Atlanta Fed’s model has the US economy slowing to a 1.0% annualized pace in Q1. This would be just below the average Q1 pace beginning in 2010. However, the New York Fed’s model has the economy tracking 3.0%. The market (Bloomberg median) is smack in between. It is another busy week for Fed officials. Ten different officials speak, including Chair Yellen, Governor Powell, and NY Fed’s Dudley. Outside of Bullard, it does not appear that anyone has downplayed the possibility of a June hike, to the extent that the issue was addressed. There is no reason for the Fed to be too direct now. The decision is not imminent. The Bloomberg calculation puts the odds at 44.6%, while the CME’s interpolation is 50.7%. Like some Fed officials, many investors have made assumptions about fiscal policy in their economic forecasts and investment strategies. The inability to agree on the alternative national health care insurance raises questions about much of the administration’s economic program. The markets may have held up well in the face of the news before the weekend as some positions had already been pared and there is some hope that the next priority, tax reform, will be more successful. We are skeptical. First, on practical grounds, the savings from abolishing taxes associated with the Affordable Care Act was going to be an important source to fund tax reform. That is why it was embraced first. Second, on political grounds, the inclusion of the border adjustment tax, which is the other major source of funding for the anticipated tax cuts remains highly controversial. In fact, the same Republican group that sank the Trump/Ryan alternative, the Freedom Caucus, is opposed to the border adjustment tax. Third, there is a question of timing. Tax reform cannot be taken up meaningfully over the next couple of months This also the assessment of the chairman of the House Ways and Means Committee, which is its purvue. There are some more immediate issues that must be dealt with first. They include approving a budget for the remainder of the fiscal year. The one that President Trump first proposed which included several controversial cuts, including of substantial cut of the State Department, while funding a large increase in defense and security, including infamous Wall, will be another fight. In the coming weeks, Congress will also have to agree to extend the federal government’s spending authority. It runs out at the end of April. The Treasury is already taking measures to honor the debt ceiling, which also needs to be lifted. There is also a two-week recess in April, and what looks to be a fight (and possible Democrat filibuster) over the Supreme Court nomination. A third vacancy on the Fed’s Board of Governors will be exposed when Tarullo steps down next month. |

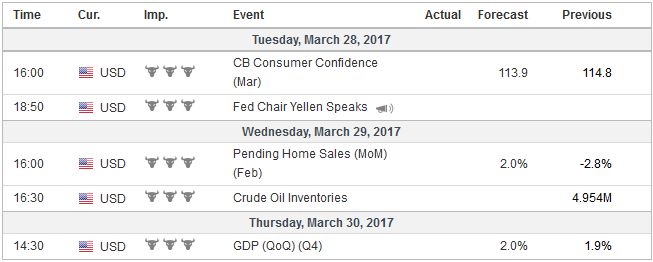

Economic Events: United States, Week March 27 |

EurozoneThere is some talk that the Republicans could force a rule change to allow a simple majority to confirm Gorsuch for the Supreme Court. Doing so, however, would make it harder to reach out to Democrats on other issues. The Republican Party, like other modern political parties, are coalitions. To be successful, Trump has to forge a majority coalition with the Republicans or find a rump of Democrats with whom to deal. It is questionable whether the requisite skills for either strategy currently exist. And even if they do, are they ten-times better? Consider that the Affordable Care Act was over a year in the making. The new plan about five-weeks-old, and changing at the last minute. A test for Democratic leadership is whether they can regain the initiative and propose their own reforms to the Affordable Care Act. One of the factors that helped the euro recover in recent weeks is speculation that the ECB could hike rates this year before ending the asset purchase operations. The speculation was fanned by comments from some officials and the steady increase in inflation. At the end of the week, investors will likely learn that the six-month rise in CPI was snapped February. The year-over-year pace may slow to 1.8% from 2.0% on softer energy prices. The core rate may have eased to 0.8% (from 0.9%) and remains stuck in the trough after having bottomed at 0.6%. |

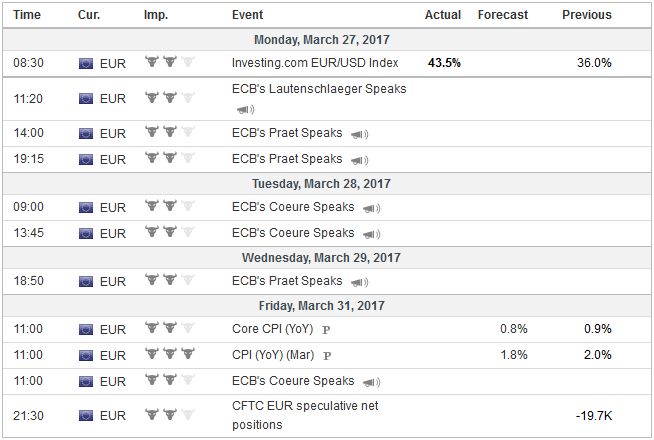

Economic Events: Eurozone, Week March 27 |

GermanyThe Saarland state election in Germany will draw attention. Merkel’s CDU has governed Saarland one of the smallest states for the past 18 years and now leads a coalition with the SPD. The rejuvenated Social Democrat Party under Schulz the former speaker of the European Parliament, not the anti-EMU and anti-immigration AfD, poses the biggest threat to the status quo. The prospect of an SPD-victory in the national elections in six months are seen as slightly euro negative. That said there are two more state elections next month. |

Economic Events: Germany, Week March 27 |

JapanIn Japan, industrial output is improving with the help of better exports. Despite firm labor market, household spending remains depressed. Since August 2015, it has only risen on a year-over-year basis once (February 2016). Meanwhile, core inflation (excludes fresh food) is expected to rise to 0.2% from 0.1%. While this may not sound impressive, it would be the highest core reading since April 2015. BOJ policy is set, and the immediate interest has shifted to a scandal involving a conservative school’s ability to get a sweetheart deal and whether the Prime Minister or is wife gave a modest sum of money to it. Although support for the cabinet has fallen, it is not (yet) a significant factor that is offsetting the other economic drivers, like interest rate differentials. |

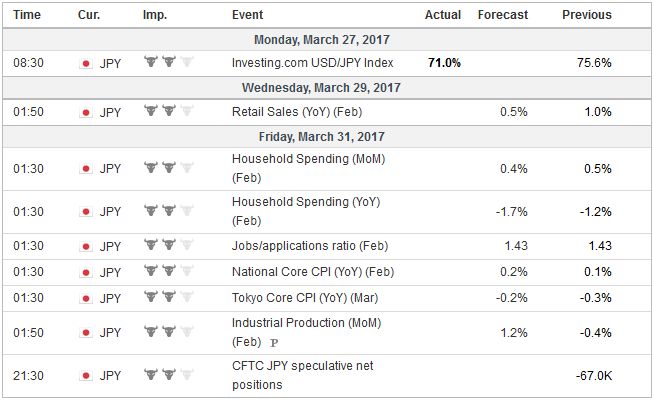

Economic Events: Japan, Week March 27 |

United KingdomIn the UK, May will trigger Article 50 of the Maastricht Treaty to begin the dissolution of its EU membership. In so doing, the UK will be subject to rules designed to discourage a country leaving. It will lose the initiative. In any event, the actual trigger is a formality for investors. The BOE’s Financial Policy Committee meets and there is an expectation for an update of the counter-cyclical capital buffer (currently set at zero) that is set to expire in June. Sterling’s correlation with the 10-year interest rate differential between the US and UK is among the strongest since the late 1990s. Lastly, we note that OPEC continues to report high compliance and the drop in prices make it increasingly likely it will continue at reduced output. That said, it seems to be relying on demand catching up to supply. US rig count and output are still increasing. Still, after declining nearly 14% this month, the downward momentum seems to be exhausted. More stable oil prices, and possibly return to $50 a barrel, also may help ease the weight on US rates. |

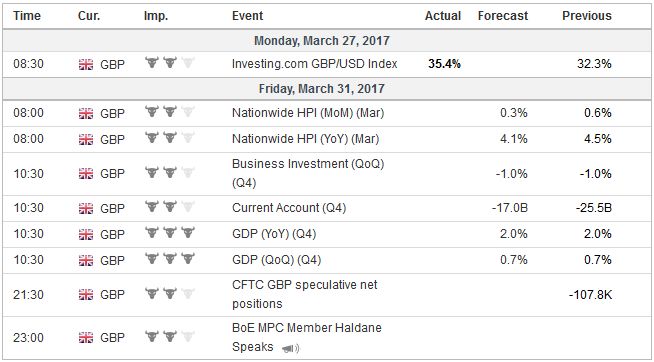

Economic Events: United Kingdom, Week March 27 |

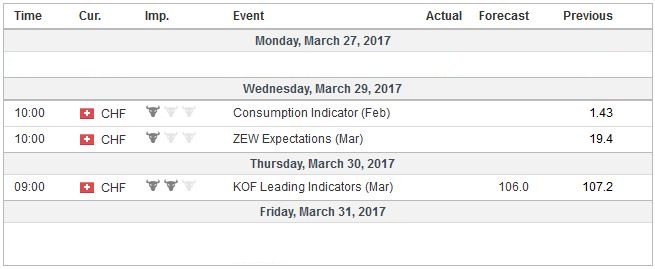

Switzerland |

Economic Events: Switzerland, Week March 27 |

Tags: #GBP,#USD,$EUR,$JPY,Featured,newsletter