The week ahead features the ECB meeting and the US February jobs report. The Reserve Bank of Australia meets, Europe reports industrial production, Japan reports January current account figures, and China reports its latest inflation and lending figures. We frame this week’s discussion of the drivers in terms of four sets of questions and offer some tentative answers. United States What is the significance of the price action following Yellen’s comments last Friday afternoon? The US dollar reversed lower, snapping streaks against euro, yen, and sterling. US interest rates eased. Did Yellen contradict the other Fed officials, including Governors, about the likelihood of a near-term hike? Yellen, in fact, confirmed the likelihood of a rate hike on March 15. She conditioned her statement on the US economic data to be broadly in line with the Fed’s expectations. There seems to be a not very thinly veiled reference to the February jobs data on March 10. With weekly jobless claims (and their four-week average) making new cyclical lows, the chances of a meaningful downside shock has been minimized. In addition, the average hourly earning likely recovered from January’s disappointment. If anything, Yellen may have been a little more hawkish than generally recognized.

Topics:

Marc Chandler considers the following as important: $CNY, CAD, EUR, Featured, Federal Reserve, FX Trends, JPY, newsletter, RBA, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The week ahead features the ECB meeting and the US February jobs report. The Reserve Bank of Australia meets, Europe reports industrial production, Japan reports January current account figures, and China reports its latest inflation and lending figures. We frame this week’s discussion of the drivers in terms of four sets of questions and offer some tentative answers.

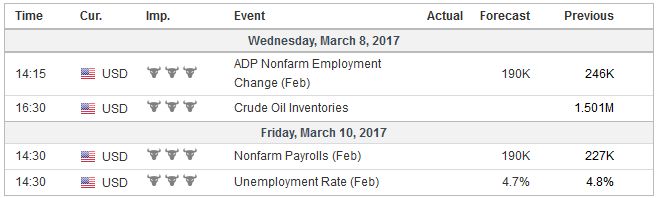

United StatesWhat is the significance of the price action following Yellen’s comments last Friday afternoon? The US dollar reversed lower, snapping streaks against euro, yen, and sterling. US interest rates eased. Did Yellen contradict the other Fed officials, including Governors, about the likelihood of a near-term hike? Yellen, in fact, confirmed the likelihood of a rate hike on March 15. She conditioned her statement on the US economic data to be broadly in line with the Fed’s expectations. There seems to be a not very thinly veiled reference to the February jobs data on March 10. With weekly jobless claims (and their four-week average) making new cyclical lows, the chances of a meaningful downside shock has been minimized. In addition, the average hourly earning likely recovered from January’s disappointment. If anything, Yellen may have been a little more hawkish than generally recognized. It describing the current monetary stance, she said it was “moderately accommodative.” Previously she said it was “modestly accommodative.” This may sound innocuous, but the Fed speaks in such nuances. Although several Fed officials, including Yellen, deny the Fed has slipped behind the curve, there seems to be a sense that there is more accommodation that needs to be removed. The market has taken the data and official comments to indicate with a high degree of confidence that Fed will hike this month. However, it has not priced the likelihood of three hikes this year. While the odds of a March move, according to Bloomberg calculations, rose from 40% to 94% chance in the past week, the odds of a third hike by year end is increased from about a one-in-four chance to a one-in-three. There was a typically buy the rumor (that Yellen would confirm what nearly all of the other Fed officials have been saying) sell the fact (when she did) activity in a relatively thinly participated Friday afternoon in North America. The dollar had moved higher for several session in a row, and the market had priced in a March hike by nearly as much as it could. The dollar was more than two standard deviations (Bollinger Bands) against several currencies, showing the stretched nature of the price action. US interest rates have also approached important levels, and based on recent data, many economists were revising down estimates of Q1 growth. The Atlanta Fed’s GDP tracker has it at 1.8% now, down from 2.5% on February 27 (though the NY Fed still sees it tracking 3.1%). The US 10-year yield rose every session last week, the first time in nearly a year. The two-year yield had risen every session last week as well, and even reached a six-year high before slipping lower ahead of the weekend. The uncertainty of the significance of the last few hours of trading last week may make for cautious and choppy trading until short-term participants get theirsea-legsback, but it is largely noise for medium and long-term investors. |

Economic Events: United States, Week March 06 |

EurozoneWhat is happening in Europe?Is it all about European politics? Given solid PMI readings evidence that price pressures are rising, will the ECB adjust its policy initiatives accordingly? Anxiety over European politics remains elevated, but it has eased by nearly any metric one chooses.The interest rate premium investors demand for holding French paper over German narrowed last week at both the two- and 10-year sectors. The French 10-year premium has narrowed nearly 20 bp from its peak, while the two-year premium has been by around 13 bp. There is scope for one major twist in the drama. The beleaguered Fillon could pull out of the race and could be replaced by Juppe who could catapult toward the top of the polls. Meanwhile, Le Pen has her own legal difficulties. In the Netherlands, the latest polls suggest the populist-nationalist have also slipped recently. More generally throughout the EMU, premiums narrowed, and importantly, the narrowing occurred in a rising interest rate environment, Often the spreads have been more sensitive to the overall direction of interest rates. The rising rates should also be kept in perspective. Not just Germany, but France, the Netherlands, Italy, Spain, Portugal, and Ireland can all borrow for two years at negative interest rates. Indeed, it appears that nearly all EMU members, save Greece, are paid to borrow for two years. ECB policy is on hold, probably through the Q3. Draghi will likely be encouraged by the recent PMIs, which suggest that the region’s economy may even be accelerating a bit. The staff will update its forecast, and there is scope to lift growth and inflation projections a little. That said, the January industrial production reports may be softer than the PMIs implied. Draghi is likely to be disappointed that his calls for structural reforms continue to find few takers. Questions about the ECB’s inflation credibility will be rebuffed. The increase in headline inflation is largely a function of higher energy costs, and secondarily seasonal foods (weather-related). Many on the ECB want to look through this temporary impact. Instead, they are focusing on the core rate, which remains in the trough near 0.9% (having bottomed at 0.6%). We also think that relatively higher German inflation within the EMU is not an urgent problem. It is not the most desirable way for other countries to gain competitiveness over Germany, but it is one way. A month ago, it looked as if UK Prime Minister would formally trigger Article 50 on March 8-9. However, that time frame is unlikely now that the House of Lords passed an amendment to the bill (seeking to protect the rights of EU citizens in the UK). It seems procedurally more significant than substance, as some government officials were sympathetic with the sentiment. It may delay the actually triggering by a week or so. |

Economic Events: Eurozone, Week March 06 |

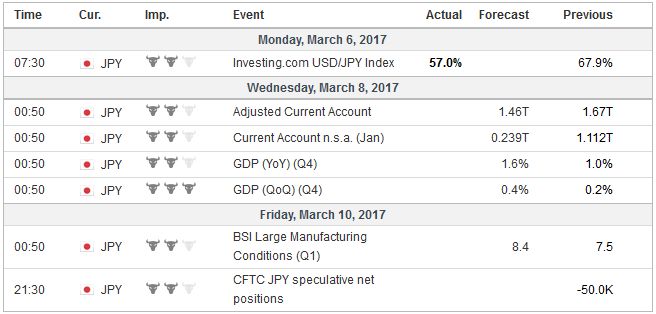

JapanWith the focus on the Fed and European politics, Japan and China may have slipped off radar screens.What is happening there and what should we expect from this week’s data? Japan’s Prime Minister Abe may be disappointed by the US withdrawal from TPP negotiations, but is probably happier with the Trump’s Administration plans for increased military spending on top of the increase that had already been planned, and its tough line toward China. The Japanese economy is being lifted by capex, industrial output, exports, and fiscal support. After the recent capex report, many expect Japan’s Q4 GDP will be revised from 0.2% to 0.4% (from 1.0% on an annualized basis to 1.6%). Japan will also report its January current account. Seasonal factors are dominant. The current account and the trade balance always (without fail for 20 years) deteriorate in January compared with December (and always improves in February). Remember, unlike Germany, Japan’s trade balance does not drive the current account. Investment income is typically larger than the trade surplus. Japanese shares have underperformed at the start of 2017. The Nikkei is up 1.8% and the Topix 2.6%. The Nikkei trails other G7 markets this year, while the Topix edges ahead of Italy and Canada. The 10-year bond yield has been above zero since the middle of last November. It has been confined mostly to a three to 10-basis point range, with the BOJ deterring moves above the range. After being challenged late last year, the BOJ has regained the upper hand. The dollar-yen exchange rate remains strongly correlated to 10-year interest rate differentials. The correlation is among the highest for the past 20 years. With Japan’s side of the spread fairly stable, the movement of the US 10-year yields drives the differential. The correlation with between dollar-yen and the two-year interest rate differential is not as strong as the 10-year, at 0.65, has hardly been surpassed over the past two decades. |

Economic Events: Japan, Week March 06 |

ChinaChina’s economy appears to have stabilized with the help of an explosion of credit.After weakening in January, the dollar traded sideways against the yuan between CNY6.85-CNY6.90 since late January. The dollar threatened to break higher but is likely to move back into the range after the weekend. The yuan is up about 0.7% against the dollar so far this year. The offshore yuan is up 1.15%, helped by a rate squeeze and possible intervention by Chinese officials. The Shanghai Composite in underperforming the region (The MSCI Emerging Markets equity index is up 8%, and MSCI Asia Pacific index is up 6.5%, while the Shanghai Composite is up 3.7%). The economic data will be skewed by the Lunar New Year holiday. The direction of the data may be more important than the exact magnitudes. Reserves likely fell as capital outflows appear to be more than offsetting the current account surplus and capital account inflows. The trade balance will likely to fall sharply, though imports and exports likely continue accelerating (due to the base effect). Aggregate lending also likely fell sharply from elevated levels. Producer prices are surging, but consumer price is set to moderate. The Bloomberg consensus is for a 1.8% year-over-year pace in February after a 2.5% clip in January. |

Economic Events: China, Week March 06 |

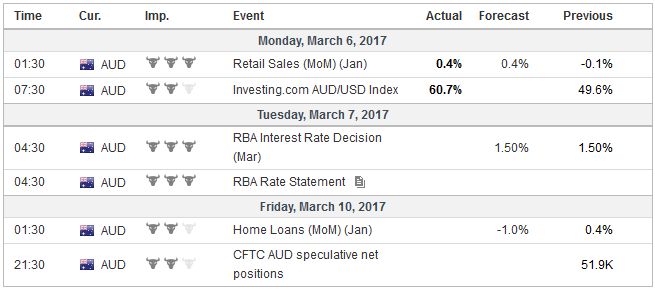

AustraliaWhat is the Reserve Bank of Australia going to do when it meets? The Australian dollar is the strongest major currency this year, with a 5.4% rise. What is the outlook? The Canadian dollar is the worst performing major currency (+0.4%), after the British pound, which has fallen 0.4% against the dollar so far this year. What is its outlook? The Reserve Bank of Australia will likely hew a neutral line. It recently updated its macroeconomic forecasts. There is little new that may be added. The stabilization of the Chinese economy, the stable to stronger US and European economies have lifted the global outlook. With a surge in iron ore, coal and copper prices, Australia enjoyed a sharp improvement in terms of trade. This in unlikely to be repeated, and instead, some deterioration is now likely. The Australian dollar repeatedly tried to break above $0.7700, but ultimately failed and was sold through $0.7600. It recovered in late Friday turnover, but speculators who have built their largest net long position in the futures market may be looking for an opportunity to cut back on exposure. Rate differentials are also moving against Australia (smaller carry). |

Economic Events: Australia, Week March 06 |

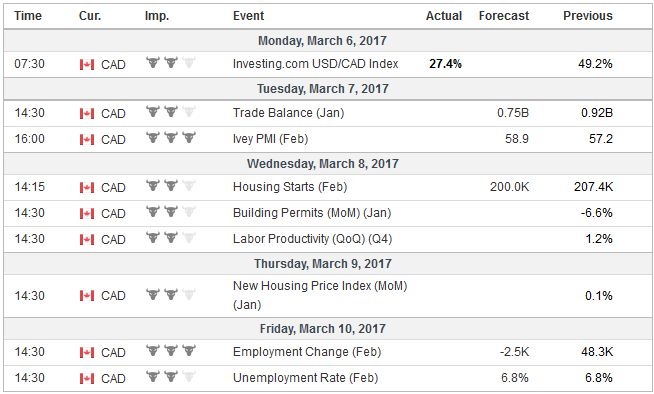

CanadaThe Canadian dollar lost nearly 2.2% against the US dollar last week. Bank of Canada Governor Poloz insisted on seeing the glass has half empty, while US central bank officials were talking about the need to consider lifting rates against, the second hike in four months. The two-year yield spread jump 14 bp to finish the week at 54 bp, the highest since early last year. The US premium has steadily increased and has fallen only twice in the past 11 sessions. Canada’s merchandise trade surplus surged in Q14 2016, but it will be difficult to sustained at the start of 2017. Investors may also pay close attention to the performance of non-energy exports, which have been disappointing. Canada’s job creation in Q4 16 (~30.2k) was the strongest quarterly growth in four years.January continued the streak with a 48.3k increase. Look for payback in February where the Bloomberg median expectation is for a loss of 2.5k jobs. Canada created 15.8k full-time jobs in January and an average of 12.1k in Q4 16 and 6.1k on average in 2016. Speculators have their largest net long Canadian dollar position on in the futures market in four years. The Canadian dollar may not benefit as much as other currencies if the US dollar begins weakening, but does seem to be vulnerable in a stronger US dollar environment. |

Economic Events: Canada, Week March 06 |

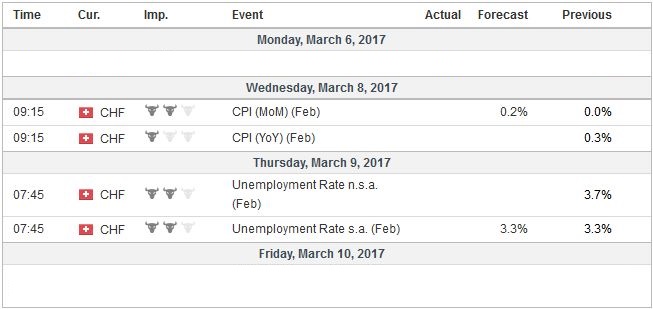

Switzerland |

Economic Events: Switzerland, Week March 06 |

Tags: #USD,$CAD,$CNY,$EUR,$JPY,Featured,Federal Reserve,newsletter,RBA