The first US jobs report of 2017 saw employment beat consensus. But some details were disappointing, including wage growth.Non-farm payroll employment in the US rose by 227,000 month on month in December, above consensus expectations (180,000). The unemployment rate rose slightly further, to 4.8% in December while the broader U6 unemployment rate rebounded to 9.4%. Overall, however, the underlying picture remains one of ongoing improvement in US labour market conditions. As we highlighted in our 2017 scenario, we continue to expect a slowdown in job creation in the months ahead as the economy hovers around full employment and productivity growth remains subdued.The main surprise came from wage growth, with hourly wages up by a meagre 0.1% m-o-m in January and up by 2.5% year on year (compared with 2.8% in December), despite minimum-wage hikes. The strong growth in hourly wages recorded in December was also revised downwards.Aggregate weekly payrolls eased in January, but we continue to expect the ongoing reduction in labour market slack to support stronger wage growth and households’ income this year.We have left our US GDP and inflation forecasts unchanged in the light of recent data. Today’s job report weakened the case for a Fed move in March and strengthened our view that the Fed will hike rates twice this year, in June and in December.

Topics:

Frederik Ducrozet considers the following as important: Macroview, US forecasts, US nonfarm payrolls, US unemployment, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The first US jobs report of 2017 saw employment beat consensus. But some details were disappointing, including wage growth.

Non-farm payroll employment in the US rose by 227,000 month on month in December, above consensus expectations (180,000). The unemployment rate rose slightly further, to 4.8% in December while the broader U6 unemployment rate rebounded to 9.4%. Overall, however, the underlying picture remains one of ongoing improvement in US labour market conditions. As we highlighted in our 2017 scenario, we continue to expect a slowdown in job creation in the months ahead as the economy hovers around full employment and productivity growth remains subdued.

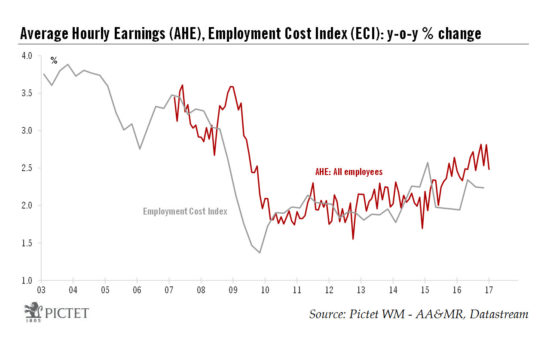

The main surprise came from wage growth, with hourly wages up by a meagre 0.1% m-o-m in January and up by 2.5% year on year (compared with 2.8% in December), despite minimum-wage hikes. The strong growth in hourly wages recorded in December was also revised downwards.

Aggregate weekly payrolls eased in January, but we continue to expect the ongoing reduction in labour market slack to support stronger wage growth and households’ income this year.

We have left our US GDP and inflation forecasts unchanged in the light of recent data. Today’s job report weakened the case for a Fed move in March and strengthened our view that the Fed will hike rates twice this year, in June and in December.