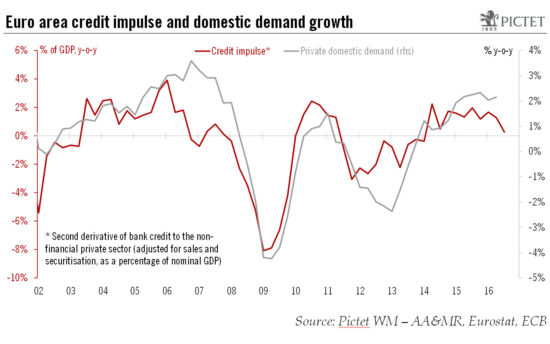

Data pose a downside risk for GDP forecast and strengthens case for additional ECB intervention.Euro area bank credit flows to non-financial corporations (NFC) were pretty disappointing in September (coming in flat after a decline of EUR 1bn in August). On a country by country basis, NFC flows were positive for the four biggest economies, but not enough to bring the 3-month average back into positive territory in Italy and Spain. On a brighter note, credit flows to euro area households rose strongly again in September, mainly driven by lending for house purchases.But the near-term outlook for bank lending remains fraught with uncertainty due to a combination of structural and cyclical headwinds, including non-performing loans, regulatory constraints, low and flat yield curves and concerns over banks’ profitability. The Bank Lending Survey (BLS) for Q3 was broadly consistent with a further pick-up in credit flows in the euro area, albeit at a gradual pace given lack of momentum in credit demand. Indeed, banks’ expectations of future demand for loans from NFC have been revised down since early 2015, pointing to a more muted rebound in actual credit.The credit impulse – the change in credit flows as a percentage of GDP – softened in the third quarter, pointing to weaker domestic demand ahead.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: bank credit, Credit demand, credit impulse, euro area credit flows, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Data pose a downside risk for GDP forecast and strengthens case for additional ECB intervention.

Euro area bank credit flows to non-financial corporations (NFC) were pretty disappointing in September (coming in flat after a decline of EUR 1bn in August). On a country by country basis, NFC flows were positive for the four biggest economies, but not enough to bring the 3-month average back into positive territory in Italy and Spain. On a brighter note, credit flows to euro area households rose strongly again in September, mainly driven by lending for house purchases.

But the near-term outlook for bank lending remains fraught with uncertainty due to a combination of structural and cyclical headwinds, including non-performing loans, regulatory constraints, low and flat yield curves and concerns over banks’ profitability. The Bank Lending Survey (BLS) for Q3 was broadly consistent with a further pick-up in credit flows in the euro area, albeit at a gradual pace given lack of momentum in credit demand. Indeed, banks’ expectations of future demand for loans from NFC have been revised down since early 2015, pointing to a more muted rebound in actual credit.

The credit impulse – the change in credit flows as a percentage of GDP – softened in the third quarter, pointing to weaker domestic demand ahead. A much stronger rebound in credit flows to enterprises will be needed for the impulse to turn positive again in the first half of 2017. The weak credit impulse poses significant downside risks to our current euro area GDP forecast of 1.3% for 2017.

The good news is that cyclical economic momentum appears to be firming, as reflected in the latest PMI indices. Still, the ECB is likely to remain focused on bank credit in the near future, thus strengthening the case for additional monetary easing.