Macroview No change in base rates, but currency intervention on the cards as franc continues to strengthen Read full report hereThe Swiss National Bank (SNB) decided to leave its monetary policy unchanged at its quarterly meeting on 16 June. The main messages were unchanged from its March meeting. The target range for the three-month Libor was kept between -1.25% and -0.25%; the interest rate on sight deposits with the SNB was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene on the foreign exchange market to deal with short-term appreciation of the Swiss franc.As a safe haven currency, the Swiss franc is experiencing some renewed upward pressure ahead of the UK referendum on EU membership, reaching a 2016 high against the euro in mid-June. Appreciation of the Swiss economy could hurt the currently feeble recovery of the economy. At this stage, foreign exchange market interventions appear the SNB’s policy tool of choice to deal with Swiss franc appreciation. An interest rate cut would be an option only if the Swiss franc appreciates substantially.Provided “Brexit” does not occur, our baseline scenario is for the interest rate on sight deposits with the SNB to remain at -0.75% until the end of the ECB’s quantitative easing (QE) programme, or at least until appreciation pressures on the Swiss franc start to fade.

Topics:

Nadia Gharbi considers the following as important: Macroview, Swiss Franc, Swiss monetary policy, Swiss National Bank

This could be interesting, too:

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes China’s Politburo Validates and Extends Pivot while the US Dollar Sees Yesterday’s Gains Pared

Marc Chandler writes Run on the Dollar Stalls after the Market Boosted Odds of another 50 bp Fed Cut

No change in base rates, but currency intervention on the cards as franc continues to strengthen

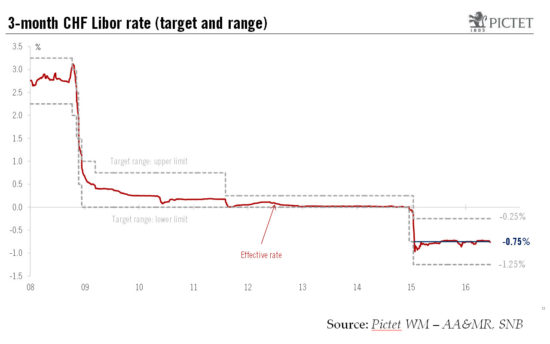

The Swiss National Bank (SNB) decided to leave its monetary policy unchanged at its quarterly meeting on 16 June. The main messages were unchanged from its March meeting. The target range for the three-month Libor was kept between -1.25% and -0.25%; the interest rate on sight deposits with the SNB was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene on the foreign exchange market to deal with short-term appreciation of the Swiss franc.

As a safe haven currency, the Swiss franc is experiencing some renewed upward pressure ahead of the UK referendum on EU membership, reaching a 2016 high against the euro in mid-June. Appreciation of the Swiss economy could hurt the currently feeble recovery of the economy. At this stage, foreign exchange market interventions appear the SNB’s policy tool of choice to deal with Swiss franc appreciation. An interest rate cut would be an option only if the Swiss franc appreciates substantially.

Provided “Brexit” does not occur, our baseline scenario is for the interest rate on sight deposits with the SNB to remain at -0.75% until the end of the ECB’s quantitative easing (QE) programme, or at least until appreciation pressures on the Swiss franc start to fade. We therefore expect the SNB to keep its policy rate unchanged at least until Q2 2017.