Summary:

If you have decided to buy gold bullion or to buy silver coins in the last few months then you may have been delighted with how last night’s Fed press conference went. If you’re still wondering if or how to invest in gold then it might be worth paying attention to what central banks are doing in the coming weeks. After all, how do central banks make their decisions when it comes to monetary policy? In years before it might have been quite straightforward to answer that question – they look at inflation rates, they look at market indicators, they look at data from statistical agencies and then they decide what to do with interest rates. But, yesterday US Fed Chair Jerome Powell seemed intent on adding some cloak and dagger to the situation and in doing so

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Central Bank, Commentary, Economics, Featured, Federal Reserve, FOMC, Gold, gold price, gold price prediction, gold price today, inflation, Interest rates, Jerome Powell, News, newsletter, Precious Metals, silver price, stock market, stocks, the fed

This could be interesting, too:

If you have decided to buy gold bullion or to buy silver coins in the last few months then you may have been delighted with how last night’s Fed press conference went. If you’re still wondering if or how to invest in gold then it might be worth paying attention to what central banks are doing in the coming weeks. After all, how do central banks make their decisions when it comes to monetary policy? In years before it might have been quite straightforward to answer that question – they look at inflation rates, they look at market indicators, they look at data from statistical agencies and then they decide what to do with interest rates. But, yesterday US Fed Chair Jerome Powell seemed intent on adding some cloak and dagger to the situation and in doing so

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Central Bank, Commentary, Economics, Featured, Federal Reserve, FOMC, Gold, gold price, gold price prediction, gold price today, inflation, Interest rates, Jerome Powell, News, newsletter, Precious Metals, silver price, stock market, stocks, the fed

This could be interesting, too:

finews.ch writes Geplante Regulierung für Zürcher Bankenverband unverhältnismässig

finews.ch writes Der meist unterschätzte Erfolgsfaktor

finews.ch writes Ras Al Khaimah: Hotel-Boom dank Spiellizenz

finews.ch writes US-Banklizenz: UBS nimmt erste Hürde

A Conference full of Flaws

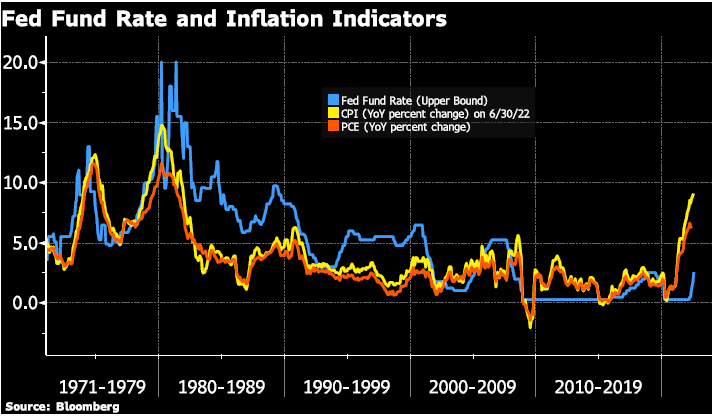

Asking about the negative GDP data in Q1 and that data and models (including the Atlanta Fed’s GDP model) are suggesting Q2 could also be negative, Chair Powell said that GDP data can’t be trusted! If the data from other U.S. government statistical agencies can’t be trusted, then what is the Fed basing its forecasts and policy decisions on? Maybe he decided to follow President Biden’s declaration. Which is there is no recession happening now and there won’t be one in the U.S. If GDP data calculated and released by the U.S. Bureau of Economic Analysis (BEA) can’t be trusted, then how can the Fed’s preferred measure of inflation? The PCE Index (Personal Consumption Expenditures), which is calculated by the same agency be trusted? This press conference had so many flaws of logic that maybe, just maybe, the mainstream media will begin to doubt the Fed and its central banking friends are infallible! Chair Powell stated several times that the Fed focuses on bringing inflation down to 2% measured by the PCE index. The Fed has little control over the supply side of the equation. Also, the shortages are caused by supply problems from China, the Russia/Ukraine war, etc. The Fed aims to achieve lower inflation by stifling demand through tighter monetary policy. Did he really mean to say that Russia’s war affected supply chains therefore interest rates must go up to shrink the economy? Even if he did not mean it, that is what he said. Did Russia just become the de facto controller of the US economy? (side-note: Check out episode two of The M3 Report for more on this) It seems that the Fed has lost its ability to focus on more than one specific indicator at a time. Remember last year when inflation was rising quickly, they stuck to the stance that inflation was “transitory”, and they didn’t need to react? Yet now they are raising rates at a quick clip to try and combat that inflation. Even though other indicators are already showing an economic slowdown. Furthermore, inflation data is a lagging indicator. The latest PCE index numbers are for May and the latest CPI data is from June. The decline in commodity prices and the already indicated slowdown in economic activity (which leads to less spending) will filter through the economy and compound the Fed’s tightening.The Fed to Tackle Inflation with Rate Increase?

Last summer the message from the Fed was that inflation was transitory, and they did not react to any of the indicators that showed otherwise. Now the Fed is frantically trying to catch up on that error. This summer the message from the Fed is that the U.S. is not in a recession. Also, its focus is solely on bringing inflation down to its 2% goal. (We remind readers a 2% goal was set on a fluke. See Did Central Banks Arrive at their Target Inflation Rate by Mere Fluke? The one glimpse of forward guidance that Chair Powell did provide was: Now that we’re at neutral, as the process goes on, at some point, it will be appropriate to slow down. And we haven’t made a decision when that point is, but intuitively that makes sense. We’ve been front-end loading these very large rate increases. Now we’re getting closer to where we need to be. Chair Powell was very ambiguous on the question of whether the risk of raising rates too much was the bigger risk for the economy at the current time. Our view is that the giant risk is that the Fed will do too much tightening. This means next summer the Fed will cut rates because the economy is too weak. The rally in gold and silver prices during the press conference, along with the declining longer-term bond yields tell us that those markets agree!Tags: Central Bank,Commentary,Economics,Featured,Federal Reserve,federal-reserve,FOMC,Gold,gold price,gold price prediction,gold price today,inflation,Interest rates,Jerome Powell,News,newsletter,Precious Metals,silver price,stock market,stocks,the fed