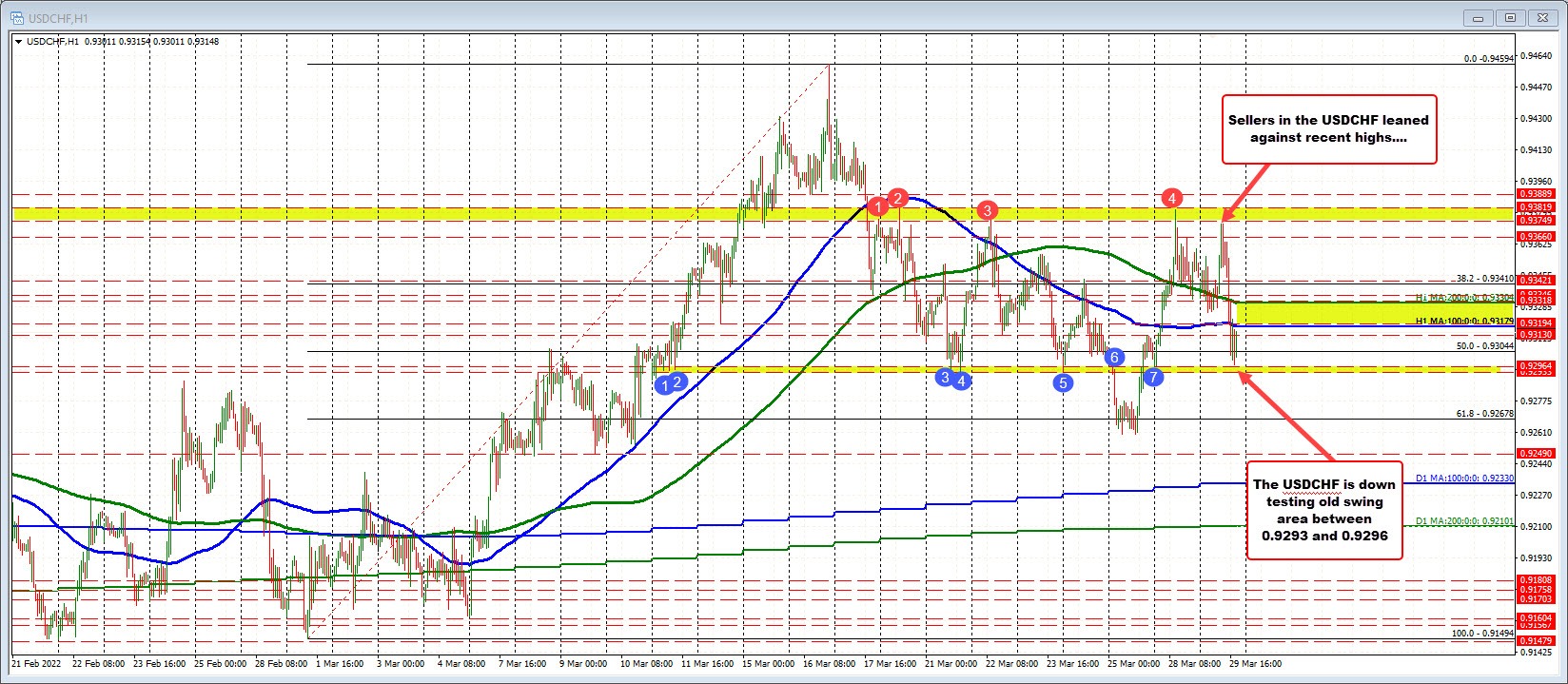

Vulnerabilities have increased and Swiss real estate market Swiss apartments overvalued by 10% to 35% SNB continues to monitor developments in real estate market It is not roll of monetary policy to curb risk to financial system The USDCHF is trading back below its 100 hour moving average at 0.93129 and its 200 hour moving average at 0.93304. However at the low today, the pair did find support against what has been a swing area between 0.9293 and 0.92964. The price did move below that swing area last Friday, but rebounded and closed back above the level. On Monday, the low price stalled against the level and pushed higher reestablishing the area as support. The high price today did find resistance against another swing area this time at the highs between

Topics:

Greg Michalowski considers the following as important: 1.) Forex Live Based CHF SNB, 1) SNB and CHF, 4) FX Trends, Central Banks, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The USDCHF is trading back below its 100 hour moving average at 0.93129 and its 200 hour moving average at 0.93304. However at the low today, the pair did find support against what has been a swing area between 0.9293 and 0.92964. The price did move below that swing area last Friday, but rebounded and closed back above the level. On Monday, the low price stalled against the level and pushed higher reestablishing the area as support. The high price today did find resistance against another swing area this time at the highs between 0.93749 and 0.93819. |

Tags: central-banks,Featured,newsletter