Optimism on a stimulus deal remains high; the FOMC decision will be key; the dollar tends to weaken on recent FOMC decision days November retail sales will be the US data highlight; Markit reports preliminary December PMI readings; Canada reports November CPI The latest Brexit headlines are sounding optimistic; UK November CPI came in weaker than expected; eurozone December preliminary PMI provided an upside surprise; EU regulators lifted their curb on bank dividends Japan reported weak November trade and mixed preliminary December PMI readings; Australia will challenge China at the WTO Improved market sentiment continues to weigh on the dollar. DXY is down for the third straight day and four of the past five, and traded today at a new low for this cycle near

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Optimism on a stimulus deal remains high; the FOMC decision will be key; the dollar tends to weaken on recent FOMC decision days November retail sales will be the US data highlight; Markit reports preliminary December PMI readings; Canada reports November CPI

- The latest Brexit headlines are sounding optimistic; UK November CPI came in weaker than expected; eurozone December preliminary PMI provided an upside surprise; EU regulators lifted their curb on bank dividends

- Japan reported weak November trade and mixed preliminary December PMI readings; Australia will challenge China at the WTO

Improved market sentiment continues to weigh on the dollar. DXY is down for the third straight day and four of the past five, and traded today at a new low for this cycle near 90.128. We continue to target the February 2018 low near 88.253 for DXY. The euro is trading at new highs above $1.22, helped by much stronger than expected December PMI readings (see below). Sterling is also trading at new highs near $1.3550 on renewed Brexit optimism (see below), and a successful deal would likely propel it higher towards $1.40. USD/JPY continues to sink and is nearing the November low near 103.20. Break below would set up a test of the March low near 101.20.

AMERICAS

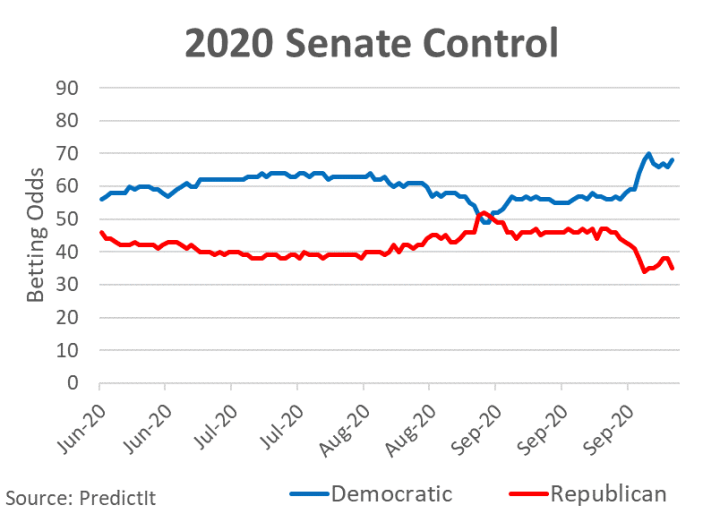

Optimism on a stimulus deal remains high. Last night, House Minority Leader McCarthy and Senate Majority Leader McConnell met with House Speaker Pelosi and Senate Minority Leader Schumer, with Treasury Secretary Mnuchin also attending for good measure. McConnell said “I’m optimistic that we’re going to be able to complete an understanding sometime soon,” which for McConnell is absolutely effusive. McCarthy said “there’s a possibility of getting it done.” On the Democratic side, there has been no word on whether the leadership will accept splitting off liability protections and state and local aid into a separate bill. This is the key question and if the Democrats agree to it, then a skinny package worth $750 bln will very likely be passed.

The two-day FOMC meeting ends today with a decision at 2 PM ET. While no action is expected, the Fed is expected to deliver a dovish hold. It may provide some clues about what plans to do in 2021 and may also pledge to do whatever is needed to keep markets functioning properly after some of its emergency programs lapse this month. Please see our preview here.

The dollar tends to weaken on recent FOMC decision days. In 2019, DXY weakened on five of the eight FOMC meeting days. Of the nine so far this year, DXY has weakened on eight of them. Stocks are a different matter this year, with the S&P falling six times and rising three times. MSCI EM has a record of six gains and three losses, while MSCI EM FX has fared slightly better with only two losses out of nine.

November retail sales will be the US data highlight for the week. Headline sales are expected to fall -0.3% m/m vs. a 0.3% gain in October, while sales ex-autos are expected to rise 0.1% m/m vs. 0.2% in October. The so-called control group used for GDP calculations is expected to rise 0.2% m/m vs. 0.1% in October. It’s clear that the economy is slowing but whatever the November readings are, we know that December will most likely be worse in light of widening lockdowns across the country. Simply put, consumption will be impossible to maintain with layoffs rising and jobless benefits waning.

Markit reports preliminary December PMI readings. Manufacturing is expected at 55.8 vs. 56.7 in November and services is expected at 55.9 vs. 58.4 in November. Fed manufacturing surveys for December started to roll out yesterday with the Empire survey coming in at 4.9 vs. 6.3 expected and actual in November. These are the first snapshots for December and will help set the tone for other data to come. October business inventories (0.6% m/m expected) will also be reported today.

Canada reports November CPI. Headline inflation is expected to rise a tick to 0.8% y/y, while common core is expected to remain steady at 1.6% y/y. October wholesale trade sales will also be reported today and are expected to rise 0.7% m/m. At this point, inflation is simply not a concern. The Bank of Canada is taking a wait and see approach even as the Trudeau government pursues aggressively expansive fiscal policy.

EUROPE/MIDDLE EAST/AFRICA

The latest Brexit headlines are sounding optimistic. According to the BBC, the UK seems to have made material concessions on the fishing issue, which many officials on both sides are painting as the major sticking point. This is not the first time we get potentially misleading headlines, but there is no more time for any more reversals and posturing. Our bet remains that a skinny deal will be delivered withing the next week or so, even if just enough to build upon in negotiations next year. Given that sterling is trading back above $1.35, the currency markets appear to agree with us. Elsewhere, risk reversals are slightly off the most expensive levels for downside sterling protection.

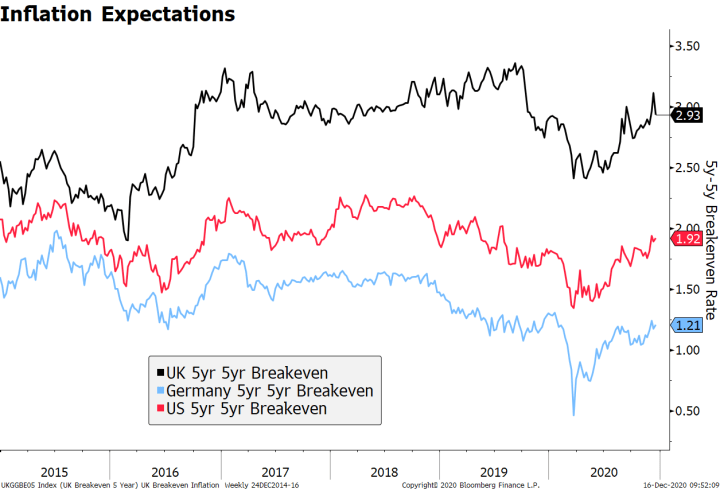

| UK November CPI came in weaker than expected. Headline CPI rose only 0.3% y/y, half the consensus and down from 0.7% in October, while CPIH rose 0.6% y/y vs. 0.8% expected. The downside surprise was mostly due to falling apparel prices, which is highly seasonal. It’s hard to make any confident forecast about the trajectory of the UK’s inflation trends without knowing if there will be a deal with the EU. Surely, a no-deal scenario would be highly inflationary given the tariff increase and pass-through from a weaker pound. Inflation expectations remain very elevated in the UK compare to Europe and the US, though this is not unusual. Tomorrow is BOE decision day but given that it just increased QE in November, no changes are expected so soon. |

Inflation Expectations, 2015-2019 |

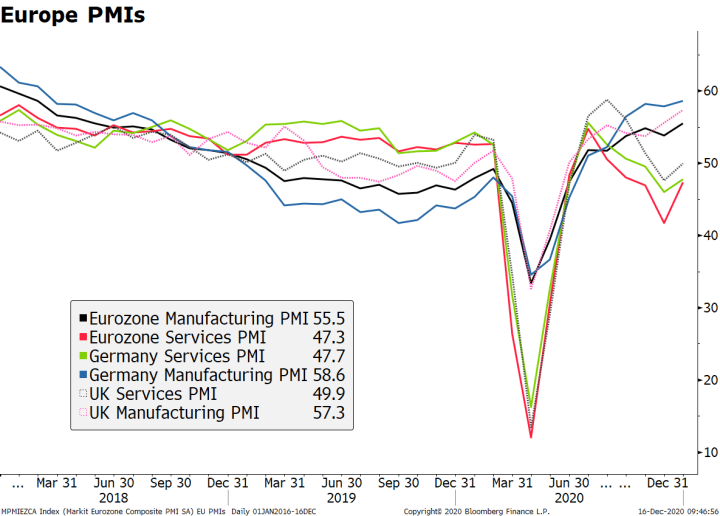

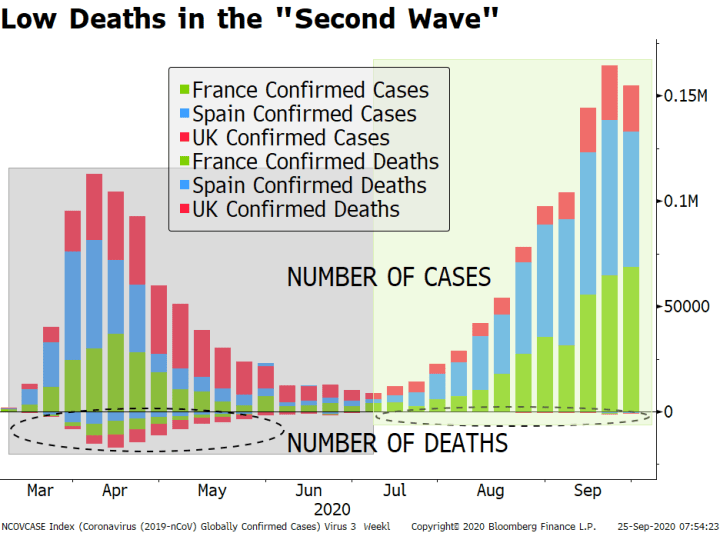

| Eurozone December preliminary PMI provided an upside surprise. The headline manufacturing reading came in at 55.5 vs. 53.0 expected and 53.8 in November, services came in at 47.3 vs. 42.0 expected and 41.7 in November, and the composite ended up almost in expansionary territory at 49.8 vs. 45.7 expected and 45.3 in November. France in particular outperformed, with its composite PMI jumping to 49.6 from 40.6 in November, while Germany’s composite climbed to 52.5 from 51.7 in November. The data clearly show that the eurozone so far has coped very well with the “first stage of the second wave,” so to speak. Still, it remains to be seen how the economy will react to the next stage, which we are going through now, including the harder lockdowns in German, Netherlands and many other countries. Elsewhere, UK December preliminary PMI readings were firmer. The manufacturing component surprised on the upside at 57.3 vs. 55.6 in November, but the services was lower than expected at 49.9 but was still up from 47.6 in November. The UK composite reading came in at 50.7 vs. 51.5 expected and 49.0 in November. |

Europe PMIs, 2018-2020 |

In a welcome sign of normalization, EU regulators lifted their curb on bank dividends. However, there were strict limits on payouts. The European Central Bank said that regional banks should keep dividends and share repurchases to less than 15% of profit for 2019 and 2020, or 0.2% of their key capital ratio, whichever is lower. That’s a slightly more conservative payout than what the Bank of England announced last week. The ECB’s supervisory arm noted “We are moving slowly back to normal, although we are not in normality yet,” noting that while the economic trajectory is clearer, there’s “not a lot of visibility on the asset quality trajectory” for banks. As a result, the ECB views these limits as an effort to help banks maintain their financial strength as the pandemic continues to unfold.

ASIA

Japan reported weak November trade and mixed preliminary December PMI readings. Exports fell -4.2% y/y vs. +0.4% expected and -0.2% in October, while imports fell -11.1% y/y vs. -9.5% expected and -13.3% in October. For exports, this was the first deterioration since May and is especially troubling since shipments were on the cusp of posting y/y growth for the first time since November 2018. Other region exporters are already seeing y/y growth. PMI readings were mixed. Headline manufacturing came in at 49.7 vs. 49.0 in November, services came in at 47.2 vs. 47.8 in November, and the composite came in at 48.0 vs. 48.1 in November. All in all, the data support our view that the economy continues to underperform even as deflation risks intensify.

Bank of Japan wraps up its two-day meeting Friday. Reports suggest the bank will extend its emergency lending and liquidity programs whilst keeping rates and asset purchases unchanged. In light of growing downside risks, the bulk of stimulus will fall on fiscal policy and the BOJ will simply maintain its supportive policies for the time being.

Australia will challenge China at the WTO. Trade Minister Birmingham said that the government had advised its counterparts in Beijing of its intention “to request formal consultations with China.” This has been brewing for quite some time and frankly, we are surprised it took so long. While the action is aimed at China’s 80% tariffs on its barley exports, we suspect Australia is sending a signal not to widen the conflict any further. Reports emerged earlier this week more than 50 ships carrying Australian coal have been stranded off China after ports were instructed in October not to offload these shipments. Elsewhere, Australia reported preliminary December PMI readings. Headline manufacturing came in at 56.0 vs. 55.8 in November, services came in at 57.4 vs. 55.1 in November, and the composite came in at 57.0 vs. 54.9 in November.

Tags: Articles,Daily News,Featured,newsletter