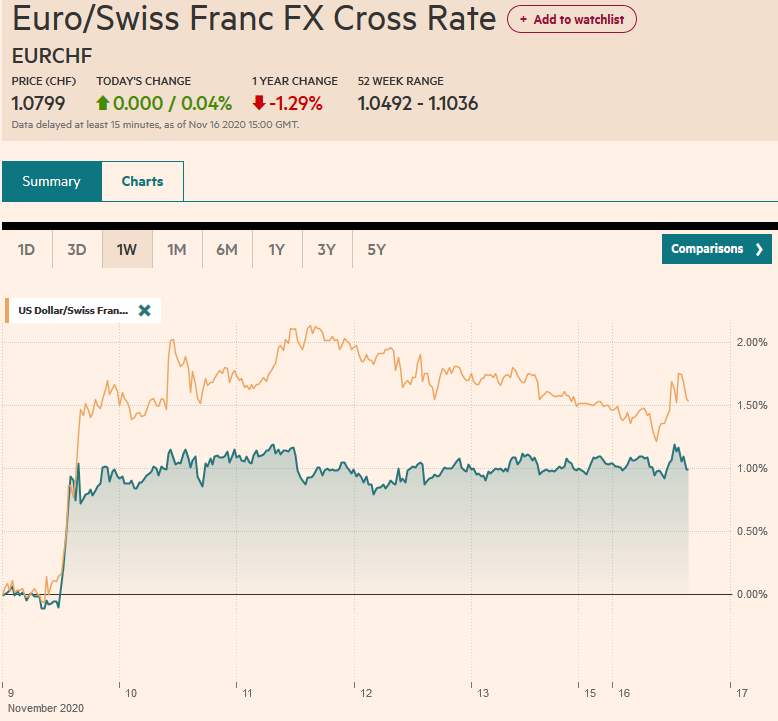

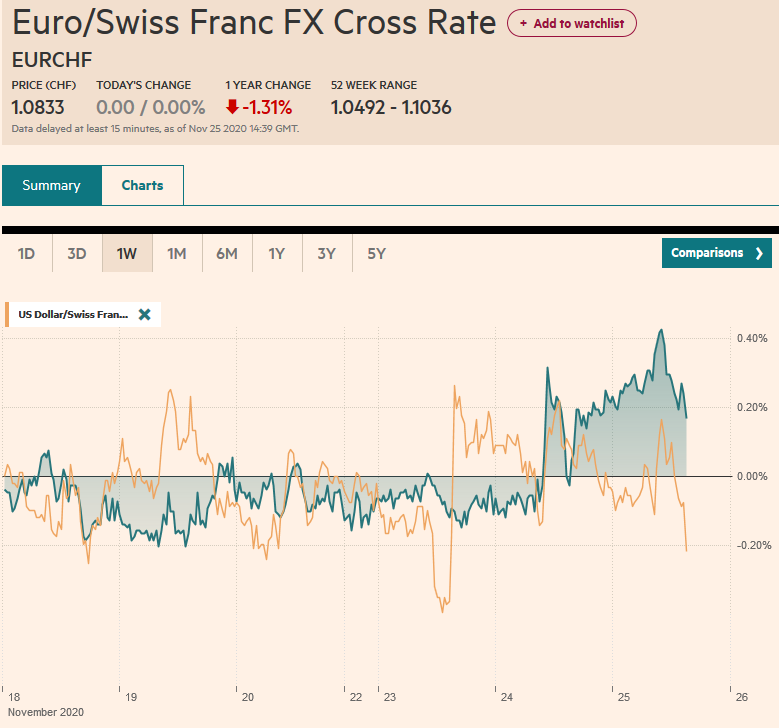

Swiss Franc The Euro is stable by 0.00% to 1.0833 EUR/CHF and USD/CHF, November 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global equity rally appears to be stalling after the US markets rallied strongly yesterday. Chinese, Taiwan, Korean, and Indian indices fell, and the MSCI Asia Pacific Index appears to have posted only its second loss this month. European shares are narrowly mixed, leaving the Dow Jones Stoxx 600 little changed. US equities are struggling to sustain upside momentum. The bond market is quiet. US and European yields are a little softer, leaving the 10-year Treasury around 0.87%. Note that Italian, Spanish, and Portuguese benchmark yields are setting new record lows today. Also,

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, Currency Movement, EUR/CHF, Featured, Mexico, newsletter, U.K., USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro is stable by 0.00% to 1.0833 |

EUR/CHF and USD/CHF, November 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

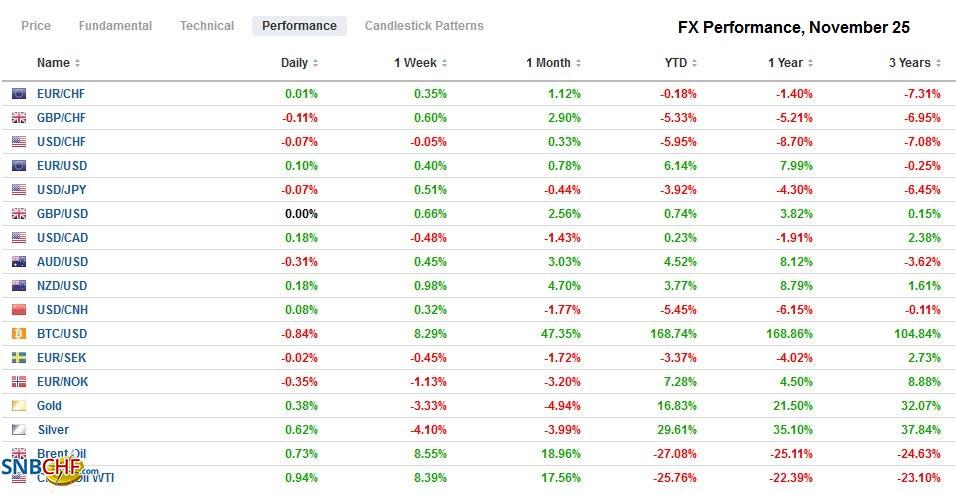

FX RatesOverview: The global equity rally appears to be stalling after the US markets rallied strongly yesterday. Chinese, Taiwan, Korean, and Indian indices fell, and the MSCI Asia Pacific Index appears to have posted only its second loss this month. European shares are narrowly mixed, leaving the Dow Jones Stoxx 600 little changed. US equities are struggling to sustain upside momentum. The bond market is quiet. US and European yields are a little softer, leaving the 10-year Treasury around 0.87%. Note that Italian, Spanish, and Portuguese benchmark yields are setting new record lows today. Also, a premium over the US is beginning to build in Australia and New Zealand. The dollar is mostly higher in the foreign exchange market. Yesterday’s losses were initially extended, with the euro climbing to $1.1930 and the Australian dollar near $0.7375 before the beleaguered greenback bounced back. The Scandis retain their strength, while the dollar-bloc and the Swiss franc see yesterday’s gains pared. Among emerging market currencies, the Turkish lira, the Korean won, and the Chinese yuan is the strongest. In contrast, eastern and central European currencies are the laggards, leaving the JP Morgan Emerging Markets Currency Index little changed on the day. Gold held above $1800 and consolidated yesterday’s sharp decline, where it came within a whisker of the 200-day moving average. Oil is extending its push higher for a fourth consecutive session. The January WTI contract pushed above $45 a barrel for the first time in eight months. |

FX Performance, November 25 |

Asia Pacific

The emergence of China is being demonstrated on two fronts. First, Sinopharm is seeking approval for its coronavirus vaccine. With the other vaccine candidates, like Pfizer’s, Moderna’s, and AstraZeneca’s, the early results have been announced. Less is known about Sinopharm’s vaccine. It illustrates the challenge. While China has achieved a certain level of technical competence, the lack of transparency limits its international recognition. China’s second achievement is unfolding. This week, it has launched a crewless rocket that will go to the moon, drill a hole in an unexplored part of the moon, and bring rocks back to earth for further study. Only the US and USSR had achieved this previously.

Meanwhile, back at home, India has banned another 43 Chinese apps, including Alibaba’s shopping service app and an assortment of dating and gaming apps. That brings it to more than 200 Chinese apps that India has banned. In the US, the ban on WeChat and TikTok is still making its way through the judicial system. Part of the excitement over a digital yuan is that it will promote internet transactions, but that in turn presupposes international use of Chinese apps. However, the fragmentation of the internet, which may still be in the early days, may work against it.

The dollar is in a narrow quarter yen range above JPY104.35. It remains within yesterday’s ranges in quiet turnover. There is an option for about $375 mln at JPY104.60 that expires today but has likely been neutralized. Yesterday’s range, roughly JPY104.20 to JPY104.80, may be sufficient to contain the greenback tomorrow too. After rising 1% yesterday, the Australian dollar made a marginal new high earlier today (almost $0.7375) before the momentum faded. It pulled back about half a cent before consolidating in the European morning around $0.7345-$0.7360. A break of $0.7300 would weaken the technical tone. The PBOC set the dollar’s reference rate at CNY6.5749, in line with expectations. The US dollar rose against the yuan for the past two sessions but is a little heavier today. It has begun consolidating and remains in the range established earlier this week (~CNY6.5535-CNY6.5930). The expansion of China-Hong Kong currency swap lines to CNY500 bln from CNY400 bln is a technical adjustment and has no currency impact. A rash of defaults by state-owned enterprises in China is unsettling investors.

Europe

The UK Chancellor of the Exchequer will provide his spending review shortly. The focus will be on protecting jobs and incomes, and around GBP4.3 bln will be earmarked, according to reports. The UK may issue GBP100 bln more in Gilts in the December to March period, which would lift the issuance to around GBP480 bln this fiscal year. Meanwhile, talks with the EU continue, but perhaps, Gove’s comment that the EU still has to move suggests that 5% of the agreement that is said not to have been concluded remains unresolved. The Bank of England Governor Bailey warned that the failure to reach an agreement would be a bigger shock to the UK economy than the pandemic. Covid has not caused structural shocks to the UK economy the way a return to the WTO agreement would. The EU accounts for over half of the UK’s trade, while the UK accounts for around 15-18% of the EU’s trade.

According to reports, if bank balance sheets are strong enough, they will be allowed to resume dividend payments next year by the ECB. Separately, while the EU is negotiating with the UK on its exit from this year’s standstill agreement, it is continuing to look for a way around Poland and Hungary’s veto of the seven-year budget that also contained the much-acclaimed Recovery Fund. It is also preparing new sanctions against Turkey for its actions in the Mediterranean and Cyprus. It may come to a head at the EU Summit (December 10-11).

The euro rose to $1.1930 in Asia, its highest level since September 1 when it set the two-year high near $1.2010. However, the upward momentum has not been sustained. The Commitment of Traders from the futures market shows that speculative longs have cut positions over the last few weeks and may have re-entered the fray. However, there is still a sense of cautiousness ahead of next month when the ECB has all but promised to ease policy. The excess liquidity now is already driving funding costs down, with some measures below the minus 50 bp deposit rate. A break of $1.1850 would confirm that this attempt to break out of the range has failed. Sterling set this week’s high on Monday, just shy of $1.34. It pushed marginally above yesterday’s high of around $1.3380 in Asia but has come back offered in Europe. It has recorded the session lows near $1.3300 in the European morning. Watch an option struck at $1.3275 (for GBP210 mln) that expires today possibly comes back into play. The euro is trading higher against sterling. It bottomed on Monday near GBP0.8865 and is near GBP0.8935 in the European morning. Nearby resistance is seen in the GBP0.8955-GBP0.8965 area.

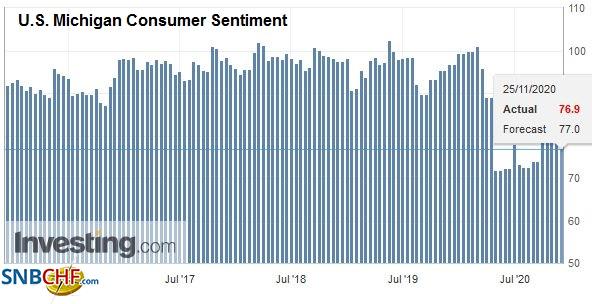

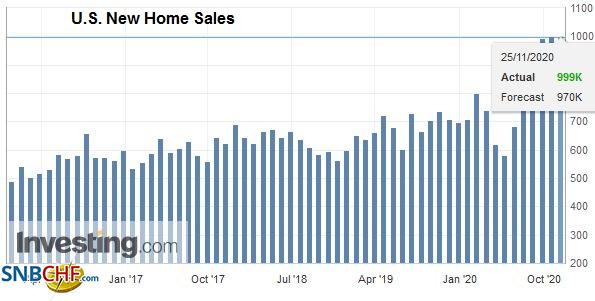

AmericaThe US sees a flurry of economic reports today. The weekly initial jobless claims, a nearly real-time look at the labor market, will be released a day early due to tomorrow’s holiday. The unexpected increase in last week’s report will likely be unwound. October trade, personal income, consumption figures, and durable goods orders will allow economists to update Q4 GDP forecasts. Growth appears to be in the 3-4% area, which offers a stark contrast with Europe, where many countries may be contracting. |

U.S. Gross Domestic Product (GDP) QoQ, Q3 2020(see more posts on U.S. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

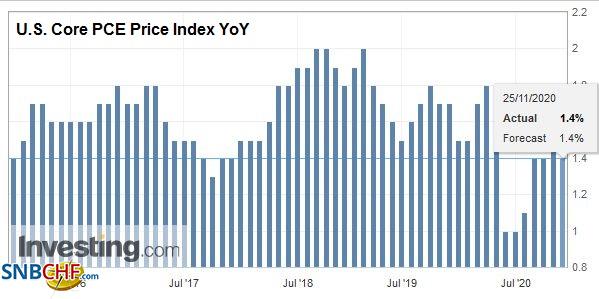

| Amid a number of reports in the leading business publications about the risk of inflation, the October PCE deflator will show little evidence. The headline and core rates are expected to tick down to 1.2% and 1.4%, respectively. Ironically, the least interesting for investors will be the revisions of Q3 GDP. Later in the day, the FOMC minutes from its recent meeting will be scrutinized for clues into next month’s meeting. In particular, investors will be keen to see confirmation that the Fed will focus its Treasury buying at the long-end of the curve. |

U.S. Core PCE Price Index YoY, October 2020(see more posts on U.S. Core PCE Price Index, ) Source: investing.com - Click to enlarge |

| The US Congress has reached an agreement on the broad outline of an appropriations bill that is needed to avoid a government shutdown next month (December 11 deadline). The next step is to work out specific spending, but several controversial issues remain, and the petulant outgoing administration may yet frustrate attempts. Trump opposes the omnibus approach, and funding for the controversial wall has not been agreed upon yet. |

U.S. Michigan Consumer Sentiment, November 2020(see more posts on U.S. Michigan Consumer Sentiment, ) Source: investing.com - Click to enlarge |

| Separately, news that Treasury Secretary Mnuchin will put the unused CARES Act funds, including those returned by the Federal Reserve, into a general fund that puts it beyond the discretion of the next Treasury Secretary is at best a minor inconvenience. These tactics seemingly designed to limit and frustrate the new administration but will be part of Trump’s legacy. |

U.S. New Home Sales, October 2020(see more posts on U.S. New Home Sales, ) Source: investing.com - Click to enlarge |

Mexico reports September retail sales and Q3 current account figures. Retail sales are expected to have risen by more than 2% for the fourth consecutive month. The peso’s recovery since the shellacking February-April has been fueled by the rising external surplus, strong worker remittances, and its relatively high yield. Inflation has been pushing above the 2-4% target range and the 3% goal. This led Banxico to hold a policy last month. The biweekly inflation earlier this week slipped back below 4%, but many economists link it to early year-end sales. Today’s central bank inflation report may offer clues into the outlook for policy.

The US dollar slipped below CAD1.30 yesterday and today, but bids emerged that have allowed it to recover. Resistance is seen in the CAD1.3040-CAD1.3060 area. Tempered risk appetites may offset the gains in commodities, and especially oil prices, and encourage consolidation. Similarly, the greenback traded below MXN20.00 for the third time in as many sessions, but it held the week’s low today is and is staging a bit of a recovery. The upside risk extends toward the MXN20.15-MXN20.18 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,Currency Movement,EUR/CHF,Featured,Mexico,newsletter,U.K.,USD/CHF