The Federal Reserve’s models really are the most optimistic of the bunch. With the policy meeting conducted today, no surprises as far as policies go, we now know what ferbus has to say about everything that’s happened this year. Skipping the usual March projections, what with the FOMC totally occupied at the time by a complete global monetary meltdown Jay Powell now says “we saw it coming”, the central bank staff released the calculations performed by its DSGE prodigy concurrent with today’s policy meeting. According to these simulations, the US economy will contract by somewhere between 5.5% and 7.6% for all of 2020 and then rebound by hopefully 4.5% if not 6.0% in 2021. The median forecast, to make things simple, calls for -6.5% this year followed by +5.0% next

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, currencies, economy, Featured, Federal Reserve/Monetary Policy, ferbus econometric models, FOMC, jay powell, L-shaped recovery, Markets, newsletter, OECD, QE, stimulus, v shaped recovery, World Bank

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Federal Reserve’s models really are the most optimistic of the bunch. With the policy meeting conducted today, no surprises as far as policies go, we now know what ferbus has to say about everything that’s happened this year. Skipping the usual March projections, what with the FOMC totally occupied at the time by a complete global monetary meltdown Jay Powell now says “we saw it coming”, the central bank staff released the calculations performed by its DSGE prodigy concurrent with today’s policy meeting.

According to these simulations, the US economy will contract by somewhere between 5.5% and 7.6% for all of 2020 and then rebound by hopefully 4.5% if not 6.0% in 2021. The median forecast, to make things simple, calls for -6.5% this year followed by +5.0% next year.

And that places the Fed’s projections out in front of everyone else’s, not that it means anything.

Each and every one of these continues to look the same. The most optimistic forecasts, the FOMC’s, are not categorically different from the rest. The uncertainty pertains instead to estimates for just how bad off we might be by the end of next year; there’s no debating the massive economic damage already done.

This “V” everyone is talking about and hoping for keeps coming up conspicuously light on the right. Only a partial comeback which will almost certainly leave the world to deal with the fallout from years of underperformance – following more than a decade of unacknowledged and unexplained underperformance already.

|

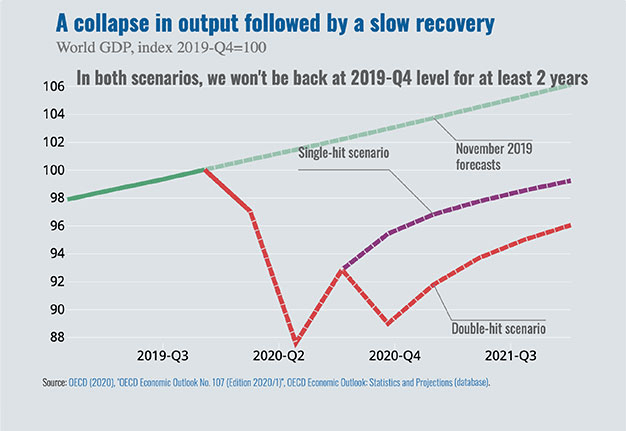

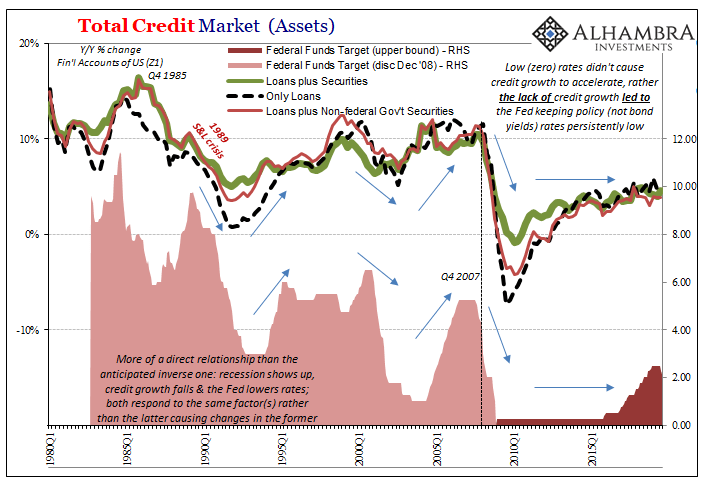

But, QE or something. These statistical simulations already assume “stimulus” is, has been, and will continue to be tremendously helpful. In addition to all their biases and unrealistic premises, as noted yesterday, underlying each and every one of these sets of projections, especially the Fed’s, is the unproven (to put it kindly; in empirical reality these are disproved ten times over across every part of the planet) assumption monetary policy is some kind of miracle drug. If only in terms of “jobs saved.” Before Jay Powell got on TV this afternoon to talk a lot about how helpful the Fed can be, and how the biggest risk in his lurid liar’s mind must be interest rates exploding higher, the OECD had already put out its own forward-looking estimates. Even though you may not have seen this particular set, you’ve already seen them many times before recently. The V’s very light on the right.Their purple line “single-hit” scenario envisions COVID-19 being a one-off, no second outbreak, and still look where it ends up; substantially, dangerously below where the economy should have been had governments properly distrusted statistical modeling in both Economics as well as epidemiology. And that purple disaster assumes, of course, how, “Policymakers have used a vast array of exceptional measures to support healthcare systems and people’s incomes, as well as to help businesses and stabilise financial markets.” These best-case scenarios are all predicated on the same fairy tale. If Jay Powell can lie to the public convincingly enough, and keep it up for long enough, then we just might avoid a second and more disruptive leg of GFC2 and keep to the disaster of the purple line as opposed to an outright catastrophe. See what I mean about “jobs saved?” In the same part of the world as the OECD, and on the same day, yet another mainstream series of modeled projections was released, this one by the World Bank which basically ends up declaring the same thing as everyone else: the world is screwed. According to these numbers, the FOMC’s figures are only slightly elevated. They call for the US economy to drop 6.1% in 2020 and then come back 4% in 2021. Only a little lighter on the right side of their “V.” While that’s not really a “V”, either, it’s much closer to one than what’s being envisioned for the rest of the developed world; Japan and Europe. The former is looking like -6.1% but then only +2.5%. The latter is projected to collapse by 9.1% this year, and only rebound by 4.5% next year. If you thought the euro was in trouble in 2011… |

Mainstream Models, Q3 2019-Q3 2021 |

| As I’ve been writing (constantly), these are not the scenarios everyone right now has in mind. Certainly not what’s propping up valuations on Wall Street. There’s this idea, priced into equities, that COVID-19 was a serious health risk that has already been surmounted and is fading into historical trivia. Once the pandemic is over, it’s over.

On the contrary, every single one of the mainstream models, predisposed to be overly optimistic, indicates the exact opposite thing. When you can’t even get DSGE on your side even though DSGE is basically made to be on that side. What we are left to argue about is just how screwed we are; not whether we are. Even the Economists at the World Bank are nervous about their purple, since they also realize the dangers in relying on “stimulus” for these more optimistic numbers (that are, again, terrible). In other words, they also know how everything has to go perfectly in order to achieve them. The world has no room left for anything more like March.

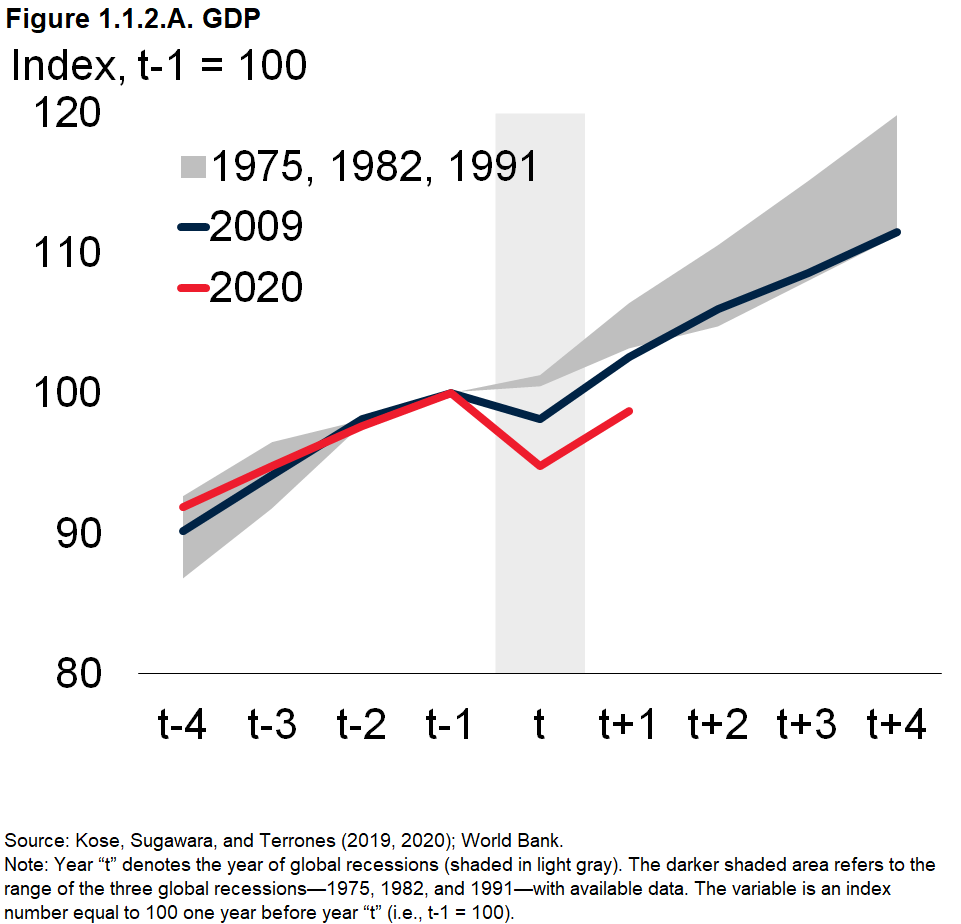

Second and third order effects, in other words. We can’t afford even a whiff of those despite signs and signals already showing up in too many key indications. And even if everything does go right, we don’t have a wave of bankruptcies or more of GFC2 frightening consumers and businesses beyond what it already has, it will be a disaster greater than the Great “Recession.” Perfect illustrating this “best” case, the World Bank supplies what should be worth far more than every $1000 stock: |

Mainstream Models World Bank, 1975-2020 |

| If you thought 2008-09 was fun, just wait until 2022! And that’s only if “stimulus” can save a multitude of jobs between now and then.

The problem with calling what’s going on right now survivor’s euphoria is that we haven’t actually survived anything – economically speaking. It was premature in the middle of 2008 after Bear, just as it is almost certainly premature right at this moment. Shock euphoria just doesn’t have the same ring to it, though, does it? But that’s all that has really happened so far; we haven’t made it past the thing, we’ve only made it past the shock which has produced the thing. A shock which was amplified by what may prove to have been only the first leg of GFC2. |

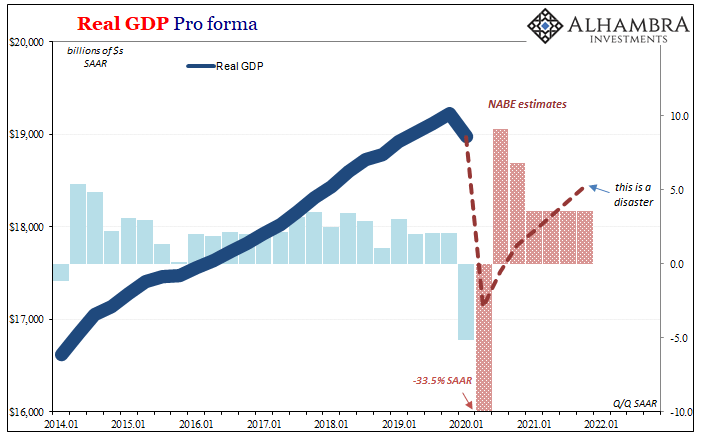

Real GDP Pro forma, 2014-2022 |

| What every single one of these highly optimistic mainstream modeled assessments shows is that this thing has only gotten started. That’s why there’s no “V.” It wasn’t nothing as people are now being led to believe, hooked by crooks.

No wonder Jay Powell learned so quickly to be a damned liar. |

|

Tags: currencies,economy,Featured,Federal Reserve/Monetary Policy,ferbus econometric models,FOMC,jay powell,L-shaped recovery,Markets,newsletter,OECD,QE,stimulus,v shaped recovery,World Bank