Measures of cross-market implied volatility have been stable for a few weeks now Weekly jobless claims are expected at 3 mln; reports suggest House Democrats are pushing ahead with a possible vote next week on another relief package Canada reports April Ivey PMI; Peru is expected to keep rates steady; Brazil COPOM delivered a dovish surprise last night The Bank of England delivered a dovish hold; The Norges Bank surprised markets with a 25 bp cut to 0%; Czech National Bank is expected to cut rates 50 bp to 0.50% Eurozone data came in very weak; China data were mixed; Philippines Q1 GDP contracted -5.1% q/q The dollar is mixed against the majors after the BOE delivered a dovish hold. Nokkie and Aussie are outperforming, while Swissie and yen are underperforming.

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

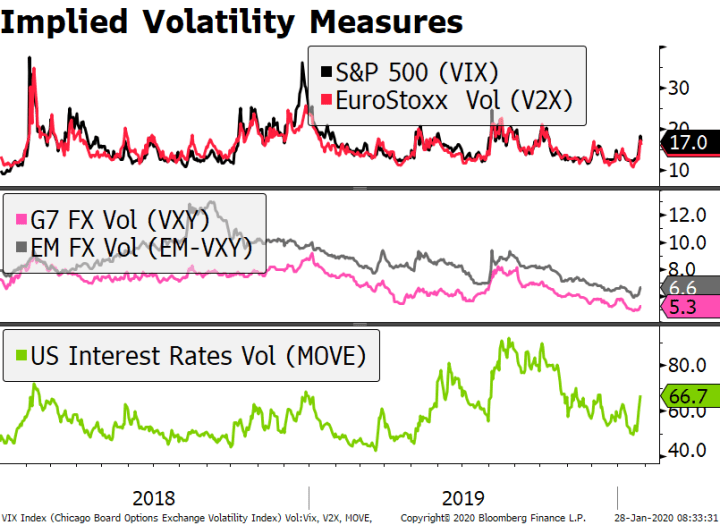

- Measures of cross-market implied volatility have been stable for a few weeks now

- Weekly jobless claims are expected at 3 mln; reports suggest House Democrats are pushing ahead with a possible vote next week on another relief package

- Canada reports April Ivey PMI; Peru is expected to keep rates steady; Brazil COPOM delivered a dovish surprise last night

- The Bank of England delivered a dovish hold; The Norges Bank surprised markets with a 25 bp cut to 0%; Czech National Bank is expected to cut rates 50 bp to 0.50%

- Eurozone data came in very weak; China data were mixed; Philippines Q1 GDP contracted -5.1% q/q

The dollar is mixed against the majors after the BOE delivered a dovish hold. Nokkie and Aussie are outperforming, while Swissie and yen are underperforming. EM currencies are also mixed. RUB and ZAR are outperforming, while KRW and TRY are underperforming. MSCI Asia Pacific was down 0.4% on the day, with the Nikkei rising 0.3% after Japan returned from the Golden Week holiday. MSCI EM is down 0.1% so far today, with the Shanghai Composite falling 0.2%. Euro Stoxx 600 is up 0.8% near midday, while US futures are pointing to a higher open. 10-year UST yields are flat at 0.71%, while the 3-month to 10-year spread is up 2 bp to stand at +62 bp. Commodity prices are mostly higher, with Brent oil up 6.3%, WTI oil up 8.8%, copper up 1.3%, and gold up 0.5%.

The dollar is mixed against the majors after the BOE delivered a dovish hold. Nokkie and Aussie are outperforming, while Swissie and yen are underperforming. EM currencies are also mixed. RUB and ZAR are outperforming, while KRW and TRY are underperforming. MSCI Asia Pacific was down 0.4% on the day, with the Nikkei rising 0.3% after Japan returned from the Golden Week holiday. MSCI EM is down 0.1% so far today, with the Shanghai Composite falling 0.2%. Euro Stoxx 600 is up 0.8% near midday, while US futures are pointing to a higher open. 10-year UST yields are flat at 0.71%, while the 3-month to 10-year spread is up 2 bp to stand at +62 bp. Commodity prices are mostly higher, with Brent oil up 6.3%, WTI oil up 8.8%, copper up 1.3%, and gold up 0.5%.

Measures of cross-market implied volatility have been stable for a few weeks now. The VIX and the EuroStoxx equivalent, V2X, have been are trading just above 30, compared to 80 in mid-March. FX implied volatility for G7 currencies have retraced about half it its pre-pandemic move and is now around 8.5, according to the VXY index. However, EM implied vol remains stubbornly high at 12. The US Treasury market implied vol index, MOVE, has ticked up in recent sessions but is still trading back near pre-pandemic levels.

The dollar continues to gain. After five straight down days, DXY is up for the fifth straight day and on track to test the April 24 high near 100.867 seems likely. The euro is trading at the lowest level since April 24 and is likely to test that day’s low near $1.0725. After some choppiness around the BOE decision, sterling remains heavy and on track to test the April 21 low near $1.2250. USD/JPY is seeing a small bounce off support at the 106 level but remains heavy. We remain constructive on the dollar.

AMERICAS

Weekly jobless claims are expected at 3 mln vs. 3.839 mln last week. If so, this would mean that over 33 mln will have become jobless over the last seven weeks, which is over 20% of the labor force. May is unlikely to bring any relief and we cannot rule out the unemployment rate rising to 30% or more. April Challenger job cuts, Q1 nonfarm productivity and unit labor costs, and March consumer credit will also be reported today.

Yesterday, ADP jobs came in close to consensus at -20.236 mln. This was the final clue for the April jobs report tomorrow. Consensus sees -21.25 mln jobs, with the unemployment rate seen spiking to 16.0%. Yet we already know that things are bad from the weekly claims data and it’s going to get worse in May.

Reports suggest Hose Democrats are pushing ahead with a possible vote next week on another relief package. Speaker Pelosi has said that it will need bipartisan support, but relations with Senate Republicans have gotten tense after the last package was overwhelmingly passed. House Majority Leader Hoyer said his party is in full agreement on the need for funds to go to state and local governments. Senate Majority Leader McConnell resisted this at first but has softened his position, but other Republicans have said they do not want to be rushed into the next package.

Canada reports April Ivey PMI. It stood at 26.0 in March. Markit manufacturing PMI came in at 33.0 vs. 46.1 in March but the two measures don’t always line up. That said, markets should be prepared for further weakness in the economy. Jobs data tomorrow are expected to show -4 mln jobs. That is equivalent to a -40 mln reading in the US. CAD is trading more with risk sentiment than oil prices lately. That said, USD/CAD has had trouble staying below the 1.40 area.

Peru central bank is expected to keep rates steady at 0.25%. CPI rose 1.72% y/y in April vs. 1.82% in March. This was the lowest since September 2018 and moves into the lower half of the 1-3% target range. Yet interest rates are at the lower bound. Further easing will have to take the form of more unconventional measures and we do not think policymaker are ready to do that yet.

Brazil COPOM delivered a dovish surprise last night. It cut rates 75 bp to 3.0%. Consensus saw 50 bp. CDI market is so far pricing in a small chance of another cut at the next meeting June 17, but a lot can happen between now and then. That said, continued easing in the face of near-record BRL weakness suggests low concern about the exchange rate as there has been no inflation pass-through. The bank will likely continue to intervene to maintain orderly moves, but with the political outlook getting murkier, we remain negative on Brazil assets.

EUROPE/MIDDLE EAST/AFRICA

The Bank of England delivered a dovish hold. There was a 7-2 vote to maintain the QE program. The two dissenting members wanted an immediate increase in QE of £100 bln, which now stands at £645 bln. Officials underscored their readiness to “take further action if necessary.” On the bright side, the bank has penciled in a relatively strong return of economic activity back to trend sometime in 2021, though after contracting 30% in H1. This sets the BOE for an increase in QE if their optimistic outlook fails to materialize and will absorb rising debt issuance that could increase yields and tighten financial conditions.

We suspect the dovish hold has increased market expectations of action at the next policy meeting June 18. Yet like the Fed, the BOE is no longer constrained by the calendar and will act as it sees fit whenever the need arises. If the outlook worsens, we cannot rule out another intra-meeting move. Sterling got a little boost in choppy trade after the decision but is little changed on the day. The same goes for UK yields.

On the virus front, the UK should start the first steps towards re-opening on Monday. The premises here are raising testing capacity, the tracking mobile app, and guidance for returning employees.

The Norges Bank surprised markets with a 25 bp cut to 0%. This is an historic low and goes against its previous communications. The statement explained the move as a reaction to the abrupt decline in activity simplified by the sharp fall in oil prices, which contributed to a weakening of the exchange rate. In the past, however, the bank seemed hesitant to step into the zero bound area due to concerns over the banking system. Governor Olsen said that they “do not envisage making further policy rate cuts.” We think any further easing will take the form of QE. NOK is still 1% stronger against the dollar on the day but was as much as 2% earlier in the session.

Czech National Bank is expected to cut rates 50 bp to 0.50%. Ahead of the decision, weak March construction and industrial output data were already reported, falling -2.3% y/y and -10.8% y/y, respectively. Yesterday, Czech March retail sales fell -15.5% y/y vs. -12.0% expected.

Eurozone data came in very weak. Germany and France reported March IP. The former fell -9.2% m/m and the latter fell -16.2% m/m, both much worst than expected. As a result, the eurozone measure out next Wednesday is likely to show some downside bias. Italy will report March IP Monday. Today, it reported March retail sales at -21.3% m/m, also weaker than expected.

ASIA

China data were mixed. The trade numbers were a welcome upside surprise, as exports rose 3.5% y/y compared to forecasts for -11.0%. It’s hard to read too much into this reading, which has a lot to do with catch-up activity and a backlog of orders which is likely to fade this month. Imports contract -14.2% y/y vs. -10% expected. Caixin reported April China services and composite PMIs at 44.4 and 47.6, respectively. While both improved modestly from March, it’s clear that the economy is not recovering as fast as policymakers would like. Lastly, April foreign reserves rose to $3.091 trln rather than ease as expected to $3.056 trln from $3.060 in March.

Philippines Q1 GDP contracted -5.1% q/q. This was far worse than the expected -2.0% as the lockdown paralyses economic activity. In y/y, the economy contracted -0.2% vs. expectations of 2.9% growth. All sectors aside from government spending (+7.1%) were heavily hit. Further easing will clearly be seen. Next central bank policy meeting is June 25 but it may not wait until then to cut rates again.

Tags: Articles,Daily News,Featured,newsletter