As governments take drastic measures to slow the spread of the Wuhan coronavirus pandemic, Wall Street – much like a plethora of other industries – has embraced the virtual workplace, according to Bloomberg. In Hong Kong, bankers have learned to win stock offerings by video chat, and Morgan Stanley is hosting a virtual meeting for a thousand-plus attendees. At Swiss giant UBS Group AG, wealth management executives have realized trips to see clients weren’t as crucial as thought. In California, an investor in hedge funds said he’s pleasantly surprised by how much faster he can confer with them remotely. –Bloomberg And according to the report, virtual finance may outlast the coronavirus – assuming a treatment is eventually found. Bloomberg notes that there are

Topics:

Tyler Durden considers the following as important: 3.) Swiss Banks, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

As governments take drastic measures to slow the spread of the Wuhan coronavirus pandemic, Wall Street – much like a plethora of other industries – has embraced the virtual workplace, according to Bloomberg.

In Hong Kong, bankers have learned to win stock offerings by video chat, and Morgan Stanley is hosting a virtual meeting for a thousand-plus attendees. At Swiss giant UBS Group AG, wealth management executives have realized trips to see clients weren’t as crucial as thought. In California, an investor in hedge funds said he’s pleasantly surprised by how much faster he can confer with them remotely. –Bloomberg

And according to the report, virtual finance may outlast the coronavirus – assuming a treatment is eventually found. Bloomberg notes that there are “early signs that some of the emergency measures Wall Street is rolling out to keep employees safe in a pandemic will become a lasting practice in an industry that’s long mythologized the handshake.”

Early reports of tele-banking success came from Asia, forcing bankers to hunker down as COVID-19 began spreading like wildfire. Many predict their colleagues in other countries will easily adapt to the changes as well – beginning with sales and trading.

“The outbreak has created the urgency to try out new ideas,” says Morgan Stanley’s head of Asia institutional equity distribution, Mehdee Reza, who oversees the firm’s annual investor summit in Hong Kong next week. After the event moved online, reservations jumped 50% – topping estimated participation by more than 400%.

Morgan has moved other events online as well, with one focusing on Indian financial companies seeing a surge in registrants.

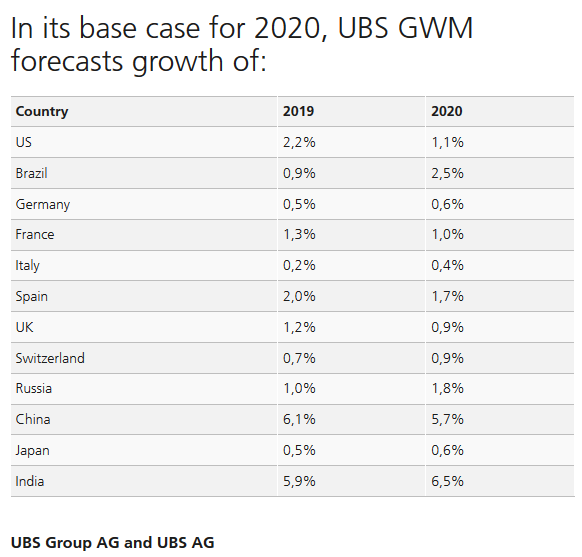

UBS, meanwhile, saw travel costs for Asia plunge 90% in February after the outbreak curtailed movement, according to one person familiar with the situation. Now, the financial firm is considering a long-term shift toward remote meetings for bankers who cover the region.

The firm’s dealmakers recently completed at least five pitch meetings on about $2 billion of stock sales with corporate clients via Skype and Zoom as they dialed in from home or from separate rooms, the people said. Citigroup Inc. bankers have been pitching via video conference on five to 10 transactions a week this year across mergers and acquisitions, equity and debt issuance, said Jan Metzger, head of Asia Pacific banking, capital markets and advisory.

“With today’s technology you can interact quicker with a client than ever before and this could be a model for the future even when this situation resolves itself,” Metzger said. –Bloomberg

At UBS’s Zurich headquarters, meanwhile, wealth management officials are considering a significant reduction in travel – though executives will still fly to meet clients who prefer it, or for types of business which must be conducted in person.

Traders and salespeople in New York and London are setting up shop in their dens and kitchens for the long haul – though some are grumbling about lack of access to the full array of resources in the office. Others are parents who have been arguing for years that it’s easy to handle transactions remotely.

LA hedge fund investor Michael Rosen says he’s enjoying the efficiency that telecommuting brings. Instead of traveling to meetings, he uses video-conferencing programs such as Zoom to hold meetings – though he does admit that lack of face-to-face interaction makes it harder to do gut-checks before handing millions of dollars to a fund manager.

“We will return, one day, to in-person meetings, but video technology is here to stay and will only grow in importance,” said Rosen. “I suspect it is now a core feature of how we will work in the future.”

It’s not just small gatherings. Manulife Financial Corp. organized a virtual town hall for 800 staff in Hong Kong and has been sharing its experience with its offices in the U.S. and Canada. Vanguard Group Inc.’s chief economist for the Asia-Pacific region has been holding webcasts for clients to discuss the outlook for the economy and markets.

Even the crucially face-to-face world of recruiting has temporarily moved virtual, according to Ilana Weinstein, the founder and chief executive officer of Wall Street headhunter IDW Group, which counts some of the world’s biggest hedge funds as clients. The market’s swings are stirring up demand for hedge fund managers who can make money in times like these, said Weinstein, who instituted a 10-foot-distance policy before taking her meetings virtual with Skype.

“As this proves efficient, it may be utilized more frequently,” she said. Still, “there’s nothing better than in-person when convincing someone to make a move. It’s about comfort with the unknown, and a layer of distance does not help.” –Bloomberg

According to Morgan Stanley co-chief CEO of Asia-Pacific and co-head of global equities, “There will be a change, there’s no question.”

“I don’t know that we’re going to go all the way back to where we were. I think we will end up somewhere in the middle.”

Tags: Featured,newsletter