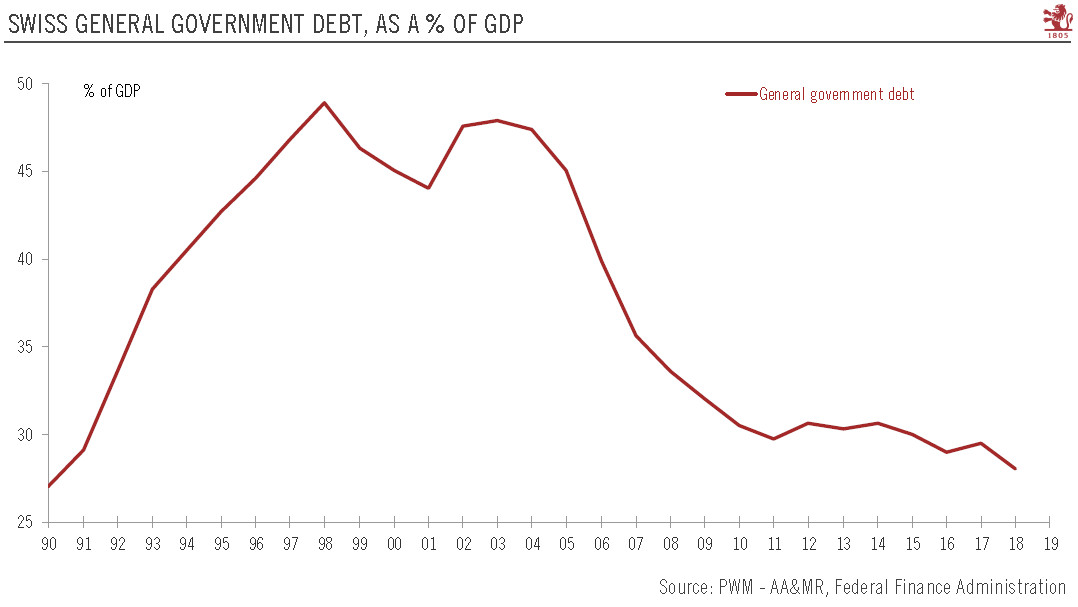

Despite a record of federal budget surpluses, don’t count on fiscal policy to relieve pressure on the SNB The Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of CHF 2.9 billion, compared with budget projections for a surplus of CHF 295 million. Over the last 10 years, the Swiss government has consistently underestimated the federal budget surplus, with 2014 being the only exception. Switzerland was lucky in the timing of the introduction of its fiscal rule,

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, Featured, Macroview, newsletter, Swiss government debt, Swiss monetary policy, Swiss National Bank

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Despite a record of federal budget surpluses, don’t count on fiscal policy to relieve pressure on the SNB

The Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of CHF 2.9 billion, compared with budget projections for a surplus of CHF 295 million. Over the last 10 years, the Swiss government has consistently underestimated the federal budget surplus, with 2014 being the only exception.

| Switzerland was lucky in the timing of the introduction of its fiscal rule, right on the cusp of an economic upswing. Nevertheless, the Swiss government’s systematic underestimation of the federal budget surplus raises some questions over the efficacy of the budget planning system. Indeed, some aspects of the debt brake rule could lead to some underspending. On this point then, something does need to be done. From an economic point of view, nothing calls for public debt to fall to zero. So why not just try to stabilise debt as it current low level? Admittedly, the country faces some medium- and long-term challenges but the country has ample fiscal space.

To a certain extent, a more expansionary fiscal policy could relieve some pressure on the SNB, which embarked on an expansionary monetary policy more than 10 years ago and is likely to remain highly accommodative, keeping its negative interest rate for the near future. However, while other countries such as the United States are in fiscal-easing mode, the bar for a more expansionary fiscal policy in Switzerland is high in our view. |

Swiss Government Debt, 1990 - 2018(see more posts on Swiss government debt, ) |

Tags: Featured,Macroview,newsletter,Swiss government debt,Swiss monetary policy,Swiss National Bank