Rome and Brussels reached a compromise on the Italian government’s budget plans last month. But there are plenty of reasons for thinking this will be a challenging year for Italy. After battling for more than two months over a 2019 budget plan defiantly non-compliant with the EU fiscal rules, Rome and Brussels struck a last-minute agreement in December that avoided opening an Excessive Deficit Procedure (EDP). To avoid the EDP, Italy had to backtrack on parts its initial plans for fiscal expansion to reduce the planned deficit for 2019 to 2.04% of GDP from 2.4%. For its part, the European Commission was once again forced to bend the EU fiscal framework: the new Italian budget draft now plans a zero change in the

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, Featured, Italian 2019 draft budget, Italian economic challenges, Italian economy, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Rome and Brussels reached a compromise on the Italian government’s budget plans last month. But there are plenty of reasons for thinking this will be a challenging year for Italy.

After battling for more than two months over a 2019 budget plan defiantly non-compliant with the EU fiscal rules, Rome and Brussels struck a last-minute agreement in December that avoided opening an Excessive Deficit Procedure (EDP). To avoid the EDP, Italy had to backtrack on parts its initial plans for fiscal expansion to reduce the planned deficit for 2019 to 2.04% of GDP from 2.4%. For its part, the European Commission was once again forced to bend the EU fiscal framework: the new Italian budget draft now plans a zero change in the structural deficit (the previous document expected a deterioration), far from the original requirement for Italy to improve the structural deficit in 2019 by 0.6pp of GDP.

While the Italian 2019 budget saga has quietened down for now, risks remain. The concessions made by Rome have the potential to feed tensions within the governing populist coalition.

Both coalition members that form Italy’s government will do all they can to stay in office, but talk of a snap general election may gain momentum after the European Parliament elections in May. with a decision to prop up beleaguered lender Banca Carige could also strain relations between the ruling parties as well as between Rome and the European authorities.

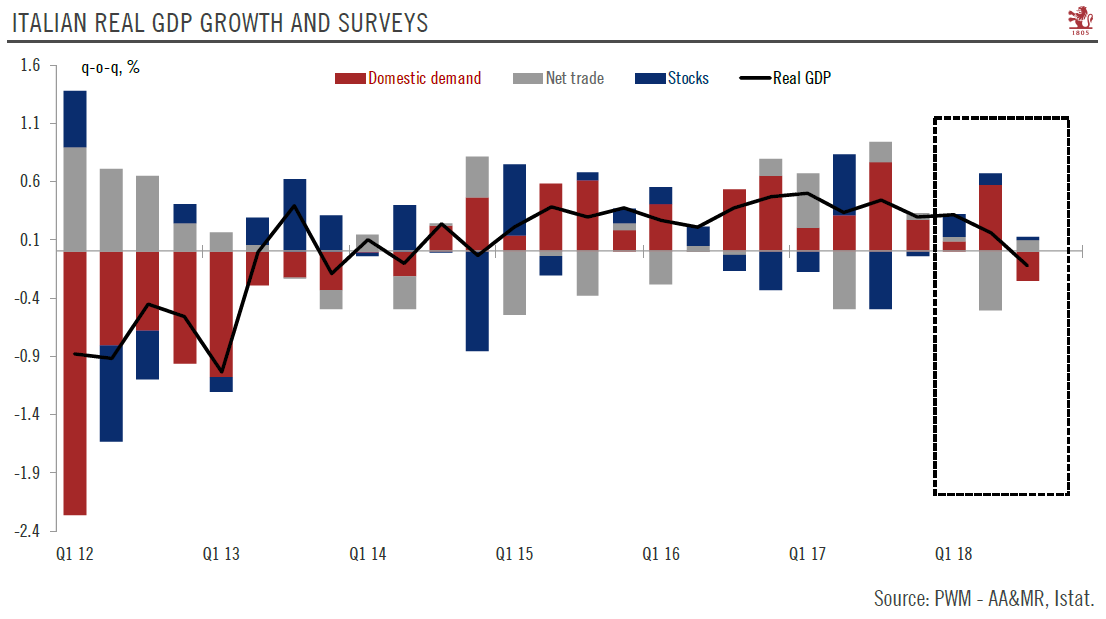

| Italy’s economic outlook is further cause for concern, as a marked cyclical deterioration could hurt investment sentiment and place additional pressure on the government. Italy may well have entered a technical recession in the second half of 2018.The risk of overshooting the 2.04% deficit target in 2019 is significant, as the government’s growth and fiscal baselines remain optimistic. To achieve 1% GDP growth this year, Italy will need to record average quarter-on-quarter growth of 0.4%, which seems ambitious. The populists in power have little appetite for the value-added taxes agreed with Brussels to help Italy meet its budget targets in 2020. This could be another flashpoint in relations with the European authorities later this year.

All in all, we remain of the view that 2019 will be a challenging year for Italy. The economic slowdown, tensions within the governing coalition and the potential for fresh confrontation with Brussels could push sovereign yields higher again after the rally of recent weeks. Finally, a large deficit without a significant rise in GDP growth will increase the vulnerability of Italy’s public finances to negative shocks. |

Italian Real GDP Growth and Surveys, Q1 2012-Q1 2018 |

Tags: Featured,Italian 2019 draft budget,Italian economic challenges,Italian economy,Macroview,newsletter