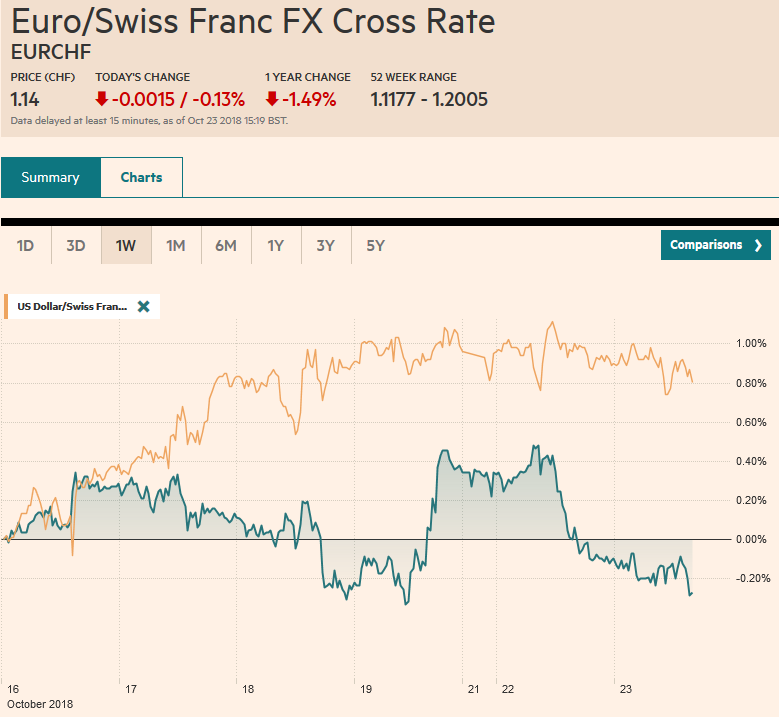

Swiss Franc The Euro has fallen by 0.13% at 1.14 EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) - Click to enlarge FX Rates Overview: There is one main story today, and that is the resumption of the slide in equities. It is having a ripple effect through the capital markets. Bond yields are tumbling. Gold is firm. The dollar is narrowly mixed, though the yen stands out with almost a 0.5% gain. Most of the large equity markets in Asia, including Japan, China, Hong Kong, Korea, and Taiwan were off mostly 2%-3%. India and some smaller bourses, like Thailand and Indonesia were of closer to 1%. In Europe, the Dow Jones Stoxx 600 gapped lower to return to levels not seen since December 2016. It

Topics:

Marc Chandler considers the following as important: $TRY, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, NZD, SPX, TLT, USD, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.13% at 1.14 |

EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) |

FX RatesOverview: There is one main story today, and that is the resumption of the slide in equities. It is having a ripple effect through the capital markets. Bond yields are tumbling. Gold is firm. The dollar is narrowly mixed, though the yen stands out with almost a 0.5% gain. Most of the large equity markets in Asia, including Japan, China, Hong Kong, Korea, and Taiwan were off mostly 2%-3%. India and some smaller bourses, like Thailand and Indonesia were of closer to 1%. In Europe, the Dow Jones Stoxx 600 gapped lower to return to levels not seen since December 2016. It has lost roughly 4% in the five-day slide, which is the longest since January-February. The S&P 500, which finished yesterday below the 200-day moving average, is also poised to gap lower. Earlier this month, the S&P 500 tested 2700, and it appears poised to retest this area. |

FX Performance, October 23 |

China: After rallying 6.6% in the past two sessions, the Shanghai Composite fell 2.25% today. It remained, though, in yesterday’s ranges. The losses come despite (or because?) officials continue to unveil efforts to support the market. The State Council (similar to the cabinet in other governments) promised support for bond financing of price sector firms. Although the PBOC is to provide funding, there were no details in terms of size, timing, or rules of accessibility. The central bank continued to provide liquidity and boosted the re-lending and re-discounting quota. Equities are one of the lynchpins in the Chinese financial system as there has been extensive use as collateral for loans. Meanwhile, as the equities have become more volatile, the yuan remains confined to narrow ranges straddling CNY6.94.

Italy: One might not know it by looking at the four basis point decline the yield of Italy’s 10-year benchmark bond, the most in Europe today, that the EC poised to take the unprecedented step of returning the budget proposals to Italy and formally ask the government to try again to color within the lines, so to speak. It is another step in what we expect to be a protracted struggle between Italy and the EC in the coming months. Italy would have three weeks to respond to the EC. It is really not clear that both sides are seeking a compromise. Ultimately, the problem is not that the Italian government wants to increase its budget deficit. It is that it has no plan to reduce the debt. The idea floated that if Italy’s bonds come under too much pressure, the ECB could buy them is fantasy. First, QE is winding down, and Draghi will reiterate that at his press conference in a couple of days. Second, for the ECB to support Italian bonds, Italy has to enter into a program which would likely force it to reduce its deficit and debt levels, which would entail a larger primary budget surplus.

Brexit: Prime Minister May’s latest compromise (about the backstop for the Irish border) again spurred talk of an imminent leadership challenge. May reiterated her commitment to preserving the integration of Northern Ireland in the UK, and this seemed to diffuse the situation somewhat, and a leadership challenge appears to have been put off, yet again. The problem is simply that May’s critics talk a tough game, but when push comes to shove, they fold because it is not clear that any challenger can muster the necessary votes to replace May. The 48 MP signatures needed to call a leadership challenge is not the main hurdle, it is securing the 158 votes needed to win.

Emerging Markets: The risk-off mood is seeing the MSCI Emerging Markets Equity Index reverse yesterday’s gains. It is down for the past four weeks. Indonesia’s central bank met and after raising rates five times for 150 bp since May, stood pat as 2/3 of the economists expected. Turkey’s central bank meets Thursday and is expected to refrain from changes in rate. The lira had stabilized this month through the middle of last week when it tested the 100-day moving average. It is under pressure today, with the US dollar climbing 3%. Retracement objectives are seen near TRY5.87, which has been approached today, and TRY5.95. Russia is expected to keep rates steady when it meets on Friday.

North America: The economic calendars for the US and Canada are light. The main feature is three Fed officials will speak while the markets are open: Kashkari and Bostic, which are among the dovish members, while Kaplan, who seems a centrist presently, expecting two-three more hikes that would bring the rate towards neutrality. The conviction that the Fed will raise rates again in December may be questioned in the face of the expected gap lower in US shares. We offer two caveats. First, whatever the Fed decides in December, the stock market’s performance in October is unlikely to be very salient. Second, of course at some point, the expected economic impact (through the wealth effect channel) will impact the overall economy, and it would impact the Fed’s reaction function, but given the belief that valuations were rich, it seems unreasonable to expect officials to change their tune. Coming into today’s session, the S&P is up 3% for the year. The Bank of Canada meets tomorrow, and despite the market volatility, it is expected to hike rates. If it does hike, it is not necessarily clear the impact on the Canadian dollar, but if it does not hike rates (though we think positive), the Canadian dollar would most likely get hit in disappointment.

FX: The Dollar Index briefly poked through the 96.00 cap but reversed lower. Initial support is seen near 95.50. The euro turned higher after successfully testing last week’s lows, but has been unable to resurface above $1.1500. There are about 1.3 bln euro in option struck $1.1500-$1.1520 that expire today, and given the intraday technical readings, that area may cap the euro’s upticks. Sterling approached the month’s low near $1.2920 and also recovered. Resistance is sighted a cent higher. After trading near JPY112.90 yesterday, the dollar has been sold back to JPY112.15 today. It is trying to recover in late morning turnover Europe. There is a roughly $425 mln option at JPY112.50 that could be tested. Despite the losses in the Chinese equities and the broader risk-off mood, the Australian dollar has recouped initial losses to trading firmly just below $0.7100. The New Zealand dollar reversed lower after testing the month’s high yesterday a little above $0.6600. The setback sent it toward $0.6535 before good bids re-emerged. There is a nearly N$400 mln option at $0.6550 that will be cut today. The Canadian dollar is in narrow ranges inside yesterday’s range, which was inside Friday’s range.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,$TRY,Featured,newsletter,NZD,SPX,yuan