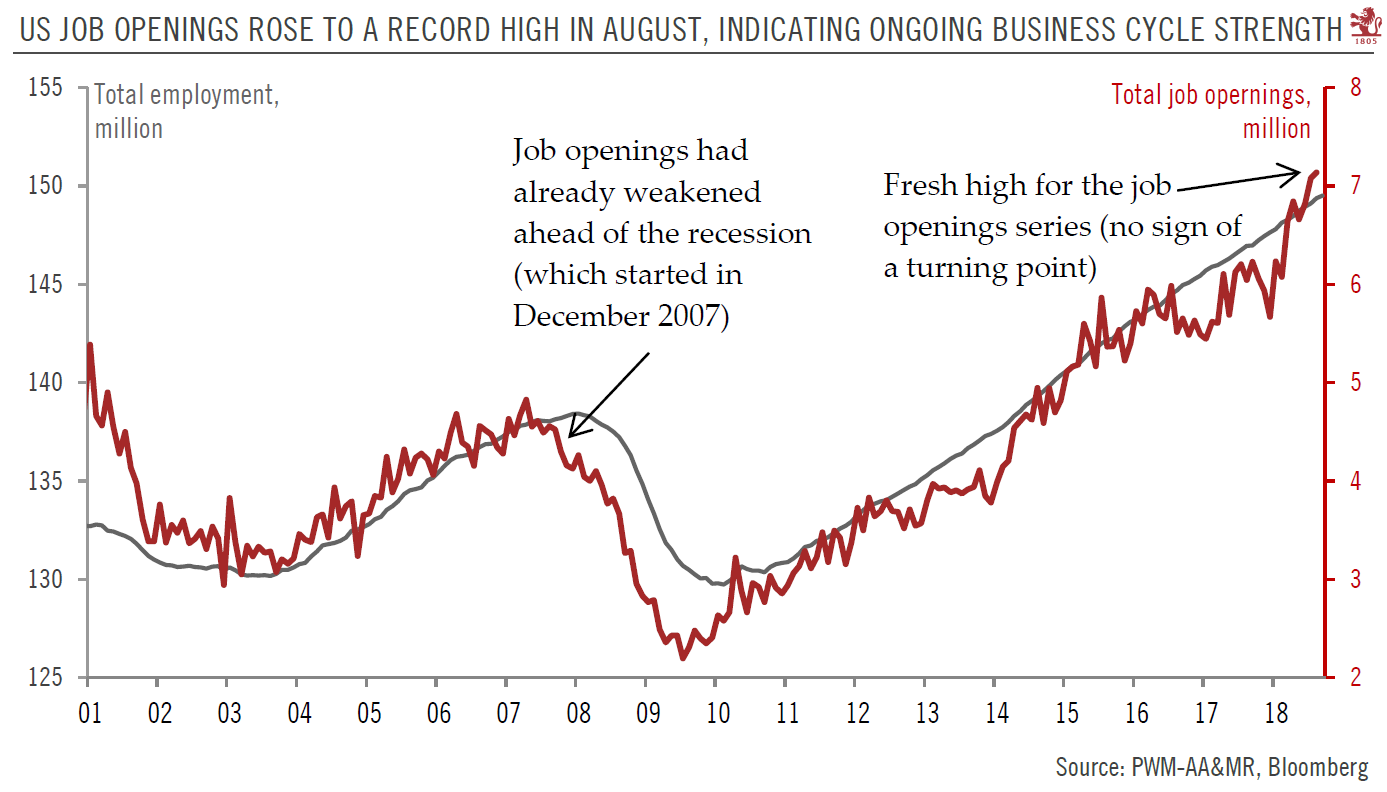

No sign of a let-up in the US business cycle as job openings continue to rise.We particularly like job openings data as an indicator for a turning point in the US macroeconomic cycle, even though this series has not much history (data start in December 2000), and in spite of its long lag to release (we just had data for August, i.e. it is more than two months old now).Still, job openings did a rather good job of indicating an inflexion point right before the global financial crisis: the US recession officially started in December 2007, but job openings had already shifted down several months ahead of that.In contrast to ongoing underlying fears among some in the markets about the end of the US business cycle, the latest job openings data – which rose to a record high in August, after

Topics:

Thomas Costerg considers the following as important: Macroview, us job creation, US job openings, US labour market

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

No sign of a let-up in the US business cycle as job openings continue to rise.

We particularly like job openings data as an indicator for a turning point in the US macroeconomic cycle, even though this series has not much history (data start in December 2000), and in spite of its long lag to release (we just had data for August, i.e. it is more than two months old now).

Still, job openings did a rather good job of indicating an inflexion point right before the global financial crisis: the US recession officially started in December 2007, but job openings had already shifted down several months ahead of that.

In contrast to ongoing underlying fears among some in the markets about the end of the US business cycle, the latest job openings data – which rose to a record high in August, after three consecutive positive months of gains – suggests that the US business cycle still has further room. This view is further supported by other data, such as initial jobless claims (another favourite US series), which remain very low (i.e. very strong).

We remain relatively upbeat about the US business cycle in general, especially as we think the mini corporate investment cycle that started a few months ago in the wake of the tax cuts, has further running room, and may continue to underpin US growth. That said, the base effect for investment becomes less favourable, and we still expect a negative hit from the Trump Administration’s trade tariffs on Chinese imports. This means that US growth, while strong, could decelerate a notch going into 2019; but there is no reason for now to expect real GDP growth to slow below potential growth (which the Federal Reserve estimates at 1.8%). That would take a genuine breakdown in relations with China affecting US business sentiment, or a severe unexpected tightening in financial conditions. These risks are worth monitoring but appear overshadowed by the strength in the domestic economy for now.

This in turn means that the Federal Reserve is likely to continue its routine of one rate increase per quarter, and a December rate uptick still looks very likely indeed.