A growth spurt may push us to raise our euro area GDP forecast for this year and next, although we expect some slowdown in the pace of expansion and the ECB to continue to act cautiously.While the latest euro area GDP numbers were broadly in line with expectations, at 0.6% quarter-on-quarter in Q2, net revisions to past data pushed the GDP profile higher again.Once detailed estimates are published by Eurostat—and assuming there are no significant revisions to past data—we might revise our 2017 annual growth forecast for the euro area to 2.0-2.1% from 1.9% currently. Our 2018 growth forecasts are likely to be affected as well, if only mechanically, with modest upside risks relative to our current projection of 1.6%.Almost ten years after the financial crisis, the euro area continues to

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: ECB exit policy, ECB staff forecasts, euro area growth, euro area growth forecast, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

A growth spurt may push us to raise our euro area GDP forecast for this year and next, although we expect some slowdown in the pace of expansion and the ECB to continue to act cautiously.

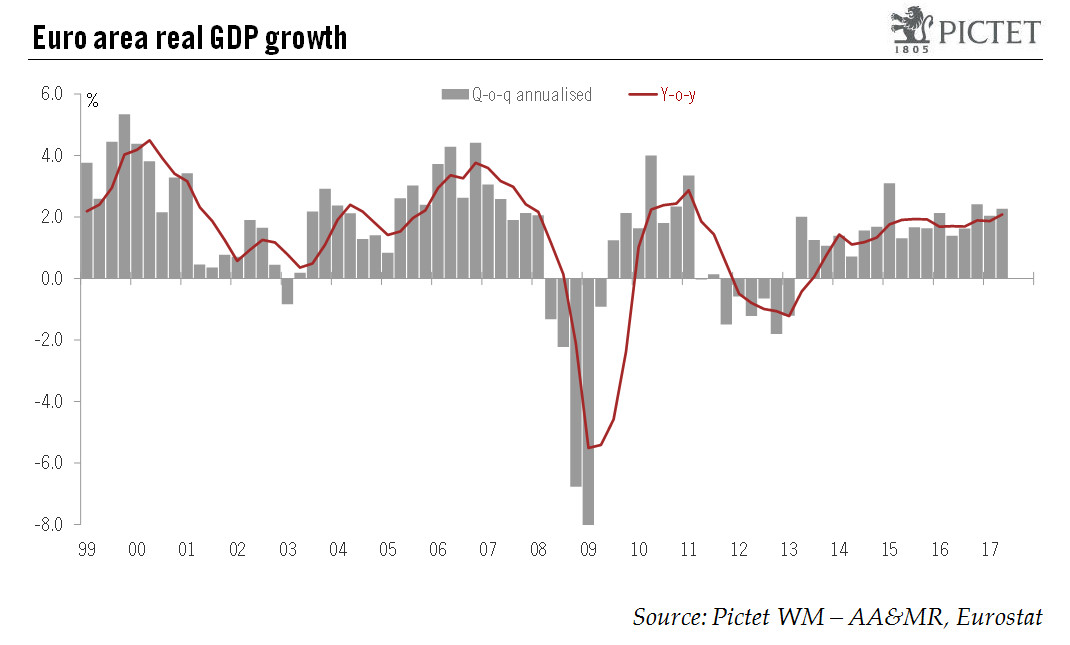

While the latest euro area GDP numbers were broadly in line with expectations, at 0.6% quarter-on-quarter in Q2, net revisions to past data pushed the GDP profile higher again.

Once detailed estimates are published by Eurostat—and assuming there are no significant revisions to past data—we might revise our 2017 annual growth forecast for the euro area to 2.0-2.1% from 1.9% currently. Our 2018 growth forecasts are likely to be affected as well, if only mechanically, with modest upside risks relative to our current projection of 1.6%.

Almost ten years after the financial crisis, the euro area continues to benefit from large pent-up demand, increasing its resilience to minor and/or idiosyncratic shocks. Meanwhile, political risks have receded considerably after the French elections. Italy remains the elephant in the room, but the prospect of a populist government pushing for an exit from the EU/EMU is looking distant for the moment.

Nevertheless, we continue to forecast a modest slowdown in GDP growth in the second half of 2017 and beyond. The July purchasing manager indices were consistent with such moderation. At the same time, the increasingly broad-based recovery means that only a large external shock (for example, a major slowdown in Chinese growth) seems likely to trigger a severe downturn, let alone a recession in the euro area. A further potential risk to the macro outlook would come from an unwarranted tightening of financial conditions (further euro strengthening and/or higher interest rates) driven by (expectations of) ECB policy normalisation.

Indeed, stronger growth numbers should make the European Central Bank (ECB) more confident that a narrowing output gap will eventually result in higher inflation. However, stronger GDP growth is unlikely to affect the short-term inflation outlook much. Regardless of upcoming exit decisions, we expect the ECB to reaffirm that a substantial degree of monetary accommodation remains necessary in order to achieve price stability over the medium term. Caution and flexibility will likely prevail at the ECB. The focus will remain on September staff projections for growth and inflation and the downside risks related to euro appreciation.